ARYA Sciences Acquisition Corp IV (ARYD): Price and Financial Metrics

ARYD Price/Volume Stats

| Current price | $6.64 | 52-week high | $11.57 |

| Prev. close | $8.96 | 52-week low | $6.25 |

| Day low | $6.25 | Volume | 94,400 |

| Day high | $8.75 | Avg. volume | 40,002 |

| 50-day MA | $11.21 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 50.04M |

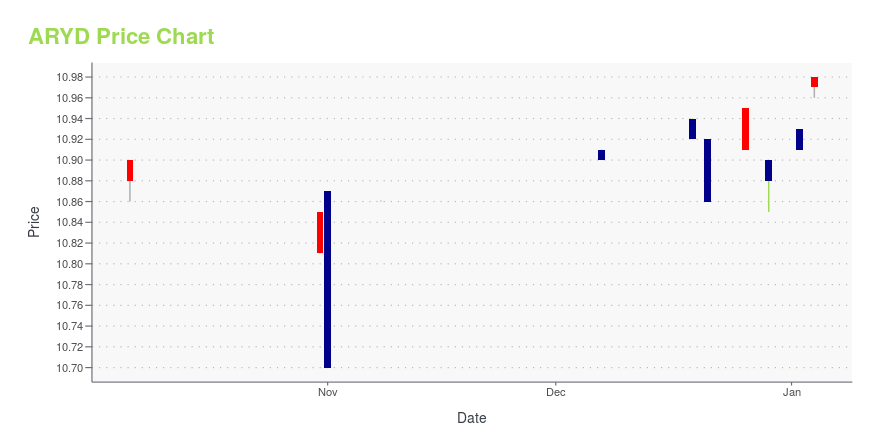

ARYD Stock Price Chart Interactive Chart >

ARYA Sciences Acquisition Corp IV (ARYD) Company Bio

ARYA Sciences Acquisition Corp IV focuses on effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company was founded in 2020 and is based in New York, New York.

ARYD Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -42.61% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | 7.92% |

| 2022 | 1.87% |

| 2021 | N/A |

| 2020 | N/A |

Loading social stream, please wait...