Sendas Distribuidora S.A. ADR (ASAI): Price and Financial Metrics

ASAI Price/Volume Stats

| Current price | $8.82 | 52-week high | $15.25 |

| Prev. close | $8.83 | 52-week low | $8.55 |

| Day low | $8.55 | Volume | 556,630 |

| Day high | $8.84 | Avg. volume | 301,036 |

| 50-day MA | $10.80 | Dividend yield | N/A |

| 200-day MA | $12.74 | Market Cap | 2.38B |

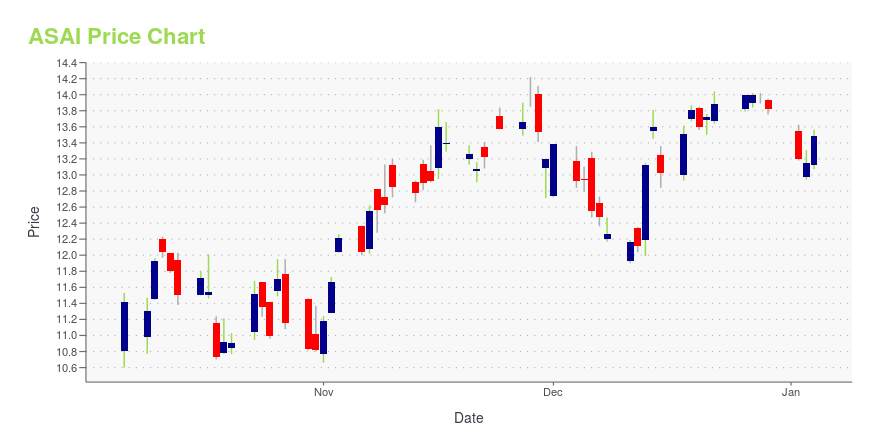

ASAI Stock Price Chart Interactive Chart >

Sendas Distribuidora S.A. ADR (ASAI) Company Bio

Sendas Distribuidora S.A. engages in the retail and wholesale sale of food products, bazaar items, and other products in Brazil. As of April 22, 2021, the company operated 185 stores under the Assaà banner, as well as 10 distribution centers. It serves restaurants, pizzerias, snack bars, schools, small businesses, religious institutions, hospitals, hotels, grocery stores, neighborhood supermarkets, and individuals. The company sells its products through brick-and-mortar stores, as well as through telesales. Sendas Distribuidora S.A. was founded in 1974 and is headquartered in Rio de Janeiro, Brazil.

Latest ASAI News From Around the Web

Below are the latest news stories about SENDAS DISTRIBUTOR SA that investors may wish to consider to help them evaluate ASAI as an investment opportunity.

Sendas Files Annual Report on Form 20-F with the SECSendas Distribuidora S.A. (NYSE: ASAI; B3: ASAI3) (the "Company") announces that its Annual Report on Form 20-F for the fiscal year ended December 31, 2021, which includes its audited financial statements for the year ended December 31, 2021, was filed with the United States Securities and Exchange Commission ("SEC") on May 02, 2022. The report can be directly accessed at the SEC's website (www.sec.gov) or on the Company's website (ri.assai.com.br). |

ASAI Price Returns

| 1-mo | -9.45% |

| 3-mo | -32.26% |

| 6-mo | -37.18% |

| 1-year | -37.54% |

| 3-year | -47.74% |

| 5-year | N/A |

| YTD | -36.18% |

| 2023 | -24.20% |

| 2022 | 56.01% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...