Ardmore Shipping Corporation (ASC): Price and Financial Metrics

ASC Price/Volume Stats

| Current price | $20.53 | 52-week high | $23.44 |

| Prev. close | $20.81 | 52-week low | $11.78 |

| Day low | $20.33 | Volume | 540,427 |

| Day high | $20.98 | Avg. volume | 680,702 |

| 50-day MA | $21.74 | Dividend yield | 5.82% |

| 200-day MA | $16.92 | Market Cap | 834.07M |

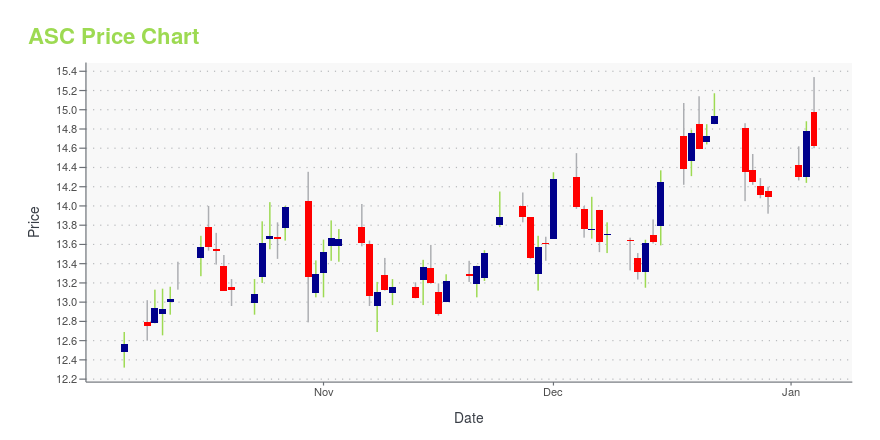

ASC Stock Price Chart Interactive Chart >

Ardmore Shipping Corporation (ASC) Company Bio

Ardmore Shipping Corporation provides seaborne transportation of petroleum products and chemicals worldwide to oil majors, national oil companies, oil and chemical traders, and chemical companies, with its modern, fuel-efficient fleet of tankers. The company was founded in 2010 and is based in Hamilton, Bermuda.

Latest ASC News From Around the Web

Below are the latest news stories about ARDMORE SHIPPING CORP that investors may wish to consider to help them evaluate ASC as an investment opportunity.

Ardmore Shipping (ASC) Stock Declines While Market Improves: Some Information for InvestorsIn the most recent trading session, Ardmore Shipping (ASC) closed at $14.25, indicating a -0.7% shift from the previous trading day. |

Ardmore Shipping Corporation (ASC) is Attracting Investor Attention: Here is What You Should KnowRecently, Zacks.com users have been paying close attention to Ardmore Shipping (ASC). This makes it worthwhile to examine what the stock has in store. |

Ardmore Shipping (ASC) Stock Moves -1.15%: What You Should KnowArdmore Shipping (ASC) concluded the recent trading session at $14.59, signifying a -1.15% move from its prior day's close. |

4 Must-Own Transportation Growth Stocks for 2024 to Buy NowHere, we present four transportation stocks, LPG, ASC, TNK and ACDVF, which you can add to your portfolio in 2024. |

Is Ardmore Shipping (ASC) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

ASC Price Returns

| 1-mo | -9.56% |

| 3-mo | 23.21% |

| 6-mo | 29.35% |

| 1-year | 63.83% |

| 3-year | 579.08% |

| 5-year | 199.94% |

| YTD | 49.64% |

| 2023 | 5.81% |

| 2022 | 326.33% |

| 2021 | 3.36% |

| 2020 | -63.57% |

| 2019 | 93.79% |

ASC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ASC

Want to do more research on Ardmore Shipping Corp's stock and its price? Try the links below:Ardmore Shipping Corp (ASC) Stock Price | Nasdaq

Ardmore Shipping Corp (ASC) Stock Quote, History and News - Yahoo Finance

Ardmore Shipping Corp (ASC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...