Aterian Inc. (ATER): Price and Financial Metrics

ATER Price/Volume Stats

| Current price | $1.37 | 52-week high | $3.84 |

| Prev. close | $1.35 | 52-week low | $1.22 |

| Day low | $1.34 | Volume | 64,400 |

| Day high | $1.41 | Avg. volume | 516,552 |

| 50-day MA | $1.57 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 13.61M |

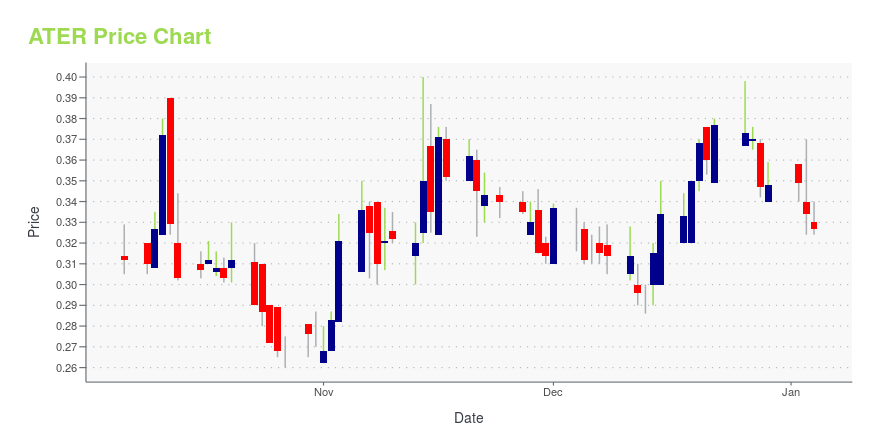

ATER Stock Price Chart Interactive Chart >

Aterian Inc. (ATER) Company Bio

Aterian, Inc. is a technology enabled consumer products company. The company's brands include hOme, Vremi, Xtava and RIF6. Its product categories include home and kitchen appliances, kitchenware, environmental appliances, beauty related products and consumer electronics. The company was founded by Yaniv Sarig Zion in 2014 and is headquartered in New York, NY.

ATER Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -53.08% |

| 3-year | -95.77% |

| 5-year | -98.06% |

| YTD | -42.92% |

| 2024 | -42.61% |

| 2023 | -54.76% |

| 2022 | -81.26% |

| 2021 | -76.12% |

| 2020 | 192.19% |

Loading social stream, please wait...