ATIF Holdings Limited - Ordinary Shares (ATIF): Price and Financial Metrics

ATIF Price/Volume Stats

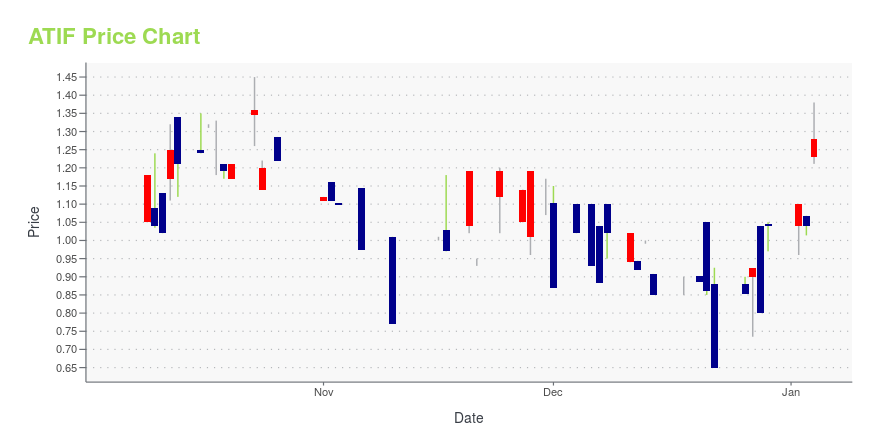

| Current price | $0.64 | 52-week high | $1.50 |

| Prev. close | $0.69 | 52-week low | $0.58 |

| Day low | $0.60 | Volume | 110,400 |

| Day high | $0.67 | Avg. volume | 59,730 |

| 50-day MA | $0.77 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 7.63M |

ATIF Stock Price Chart Interactive Chart >

ATIF Holdings Limited - Ordinary Shares (ATIF) Company Bio

ATIF Holdings Limited operates as a holding company. The Company, through its subsidiaries, provides financial planning and investment advisory services to small and medium-sized enterprises. ATIF Holdings offers asset allocation, financial management, training, capital restructuring, and training services.

ATIF Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -33.79% |

| 3-year | -64.04% |

| 5-year | -65.78% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -53.35% |

| 2022 | -30.43% |

| 2021 | 246.24% |

| 2020 | -52.31% |

Loading social stream, please wait...