AngloGold Ashanti Limited (AU): Price and Financial Metrics

AU Price/Volume Stats

| Current price | $27.11 | 52-week high | $30.09 |

| Prev. close | $27.10 | 52-week low | $14.91 |

| Day low | $27.07 | Volume | 1,020,777 |

| Day high | $27.52 | Avg. volume | 1,958,681 |

| 50-day MA | $25.54 | Dividend yield | 0.78% |

| 200-day MA | $21.09 | Market Cap | 11.35B |

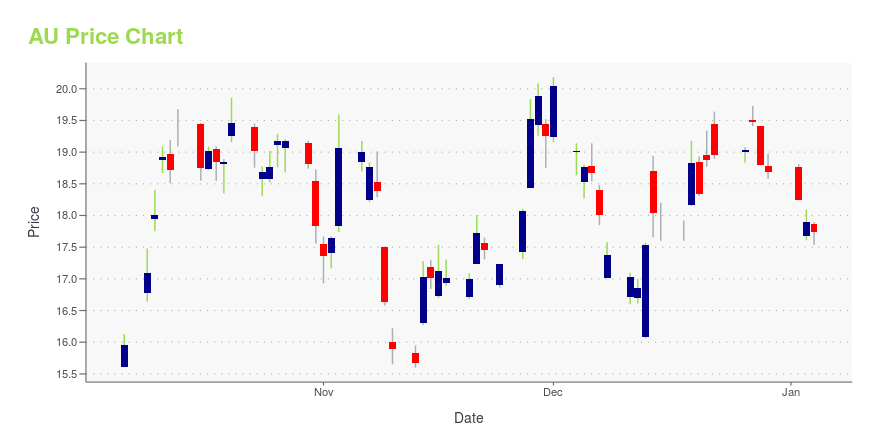

AU Stock Price Chart Interactive Chart >

AngloGold Ashanti Limited (AU) Company Bio

AngloGold operates as a gold mining and exploration company in South Africa, Continental Africa, Australasia, and the Americas. The company was founded in 1944 and is based in Johannesburg, South Africa.

Latest AU News From Around the Web

Below are the latest news stories about ANGLOGOLD ASHANTI (PTY) LTD that investors may wish to consider to help them evaluate AU as an investment opportunity.

AngloGold Ashanti (AU) to Boost Portfolio by Investing in G2AngloGold Ashanti (AU) to subscribe to G2 shares as part of its growth initiatives. |

AngloGold Ashanti to Make a Strategic Investment in G2 Goldfields Inc.DENVER, December 19, 2023--AngloGold Ashanti plc ("AGA" or the "Company") is pleased to announce that it intends, subject to execution of definitive documentation and satisfaction of customary conditions, to subscribe (the "Subscription") for 24,500,000 common shares (the "Shares") in G2 Goldfields Inc. ("G2") at C$0.90 per share for total consideration of C$22,050,000. |

AngloGold Ashanti shares gain following post-Fed spike in gold pricesInvesting.com -- U.S.-listed shares in AngloGold Ashanti (NYSE:AU) surged in premarket trading in New York on Thursday, fueled by a spike in gold prices which stemmed from indications that the Federal Reserve is open to interest rates cuts next year. |

Regis CEO Open to Joining Gold-Mining Deal Fray After Closing Hedge BookRegis Resources’ chief executive is looking forward to the miner enjoying a cash-building phase following a period of heavy investment, but isn’t ruling out a return to the deal table. |

AngloGold Ashanti Looks Like Another Gold Name That Is Ready to ShineAngloGold Ashanti is a global mining company with a diverse portfolio of gold, silver and copper operations and projects. Do the charts match the positive story on its website? We've recently discussed several other other precious metals stocks, both large and small, so let's check out the technical indicators to see where AngloGold may go from here. |

AU Price Returns

| 1-mo | 10.25% |

| 3-mo | 13.67% |

| 6-mo | 56.30% |

| 1-year | 27.07% |

| 3-year | 42.46% |

| 5-year | 56.79% |

| YTD | 46.27% |

| 2023 | -2.89% |

| 2022 | -5.51% |

| 2021 | -5.33% |

| 2020 | 1.69% |

| 2019 | 78.71% |

AU Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AU

Want to see what other sources are saying about Anglogold Ashanti Ltd's financials and stock price? Try the links below:Anglogold Ashanti Ltd (AU) Stock Price | Nasdaq

Anglogold Ashanti Ltd (AU) Stock Quote, History and News - Yahoo Finance

Anglogold Ashanti Ltd (AU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...