Avid Technology, Inc. (AVID): Price and Financial Metrics

AVID Price/Volume Stats

| Current price | $27.04 | 52-week high | $33.41 |

| Prev. close | $27.04 | 52-week low | $19.78 |

| Day low | $27.03 | Volume | 628,900 |

| Day high | $27.05 | Avg. volume | 483,812 |

| 50-day MA | $26.87 | Dividend yield | N/A |

| 200-day MA | $27.16 | Market Cap | 1.19B |

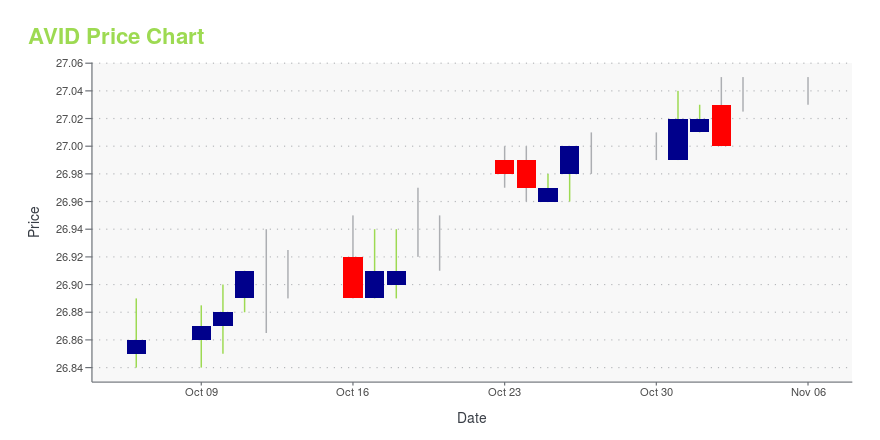

AVID Stock Price Chart Interactive Chart >

Avid Technology, Inc. (AVID) Company Bio

Avid Technology develops, markets, sells, and supports software and hardware for digital media content production, management, and distribution in the United States, the other Americas, Europe, the Middle East, Africa, and the Asia-Pacific. The company was founded in 1987 and is based in Burlington, Massachusetts.

Latest AVID News From Around the Web

Below are the latest news stories about AVID TECHNOLOGY INC that investors may wish to consider to help them evaluate AVID as an investment opportunity.

Brazil’s Record TV Upgrades Studios with Avid Audio Solutions to Power Top TV BroadcastsBrazilian TV Broadcaster Modernizes with Pro Tools | Carbon, Pro Tools | HDX and Pro Tools | MTRX Studio Record TV Record TV BURLINGTON, Mass., Oct. 26, 2023 (GLOBE NEWSWIRE) -- Avid® (NASDAQ: AVID) today announced that Record TV, one of Brazil’s leading TV broadcasters, has refitted its audio post-production studios with the Pro Tools | HDX™ and MTRX Studio™ interfaces to edit and mix its most demanding productions. Headquartered in Sao Paulo, Record TV also upgraded eight production studios wi |

Avid Joins Roybal School of Film and Television Production MagnetMedia tech leader brings technologies and services to teach essential post production skills to underrepresented L.A. kids aspiring to creative vocations Avid and Roybal Avid and Roybal BURLINGTON, Mass., Oct. 12, 2023 (GLOBE NEWSWIRE) -- Avid® (Nasdaq: AVID) is continuing its mission to help more people gain skills for successful careers in the entertainment industry as the first technology Founding Partner of the Roybal School of Film and Television Production Fund, which was established by Ge |

Avid Unveils Pro Tools Sketch for Modern Music Creators and to Expand Pro Tools WorkflowsNew iPad app and added capability to Pro Tools desktop software enables musicians to quickly capture new ideas and experiment with arrangements anywhere Avid Unveils Pro Tools Sketch for Modern Music Creators and to Expand Pro Tools Workflows New iPad app and added capability to Pro Tools desktop software enables musicians to quickly capture new ideas BURLINGTON, Mass., Sept. 22, 2023 (GLOBE NEWSWIRE) -- Avid® (Nasdaq: AVID) today announced Pro Tools Sketch™, a new non-linear, clip-based creatio |

ITV Studios’ International Production Arm Extends Partnership with Avid to Standardize and Streamline Post-Production WorkflowsInternational production labels across 11 countries and part of ITV PLC, which includes the UK’s biggest commercial broadcaster, sign new subscription deal to upgrade editing and storage workflows ITV Studios ITV Studios BURLINGTON, Mass., Sept. 18, 2023 (GLOBE NEWSWIRE) -- ITV Studios, the production and distribution arm of ITV PLC, which includes the UK’s biggest commercial broadcaster, has signed a new subscription deal with Avid® (Nasdaq: AVID) to standardize its media storage and ways of wo |

ITV Partners with Avid to Upgrade Its National and Regional News Production SystemsUK’s biggest commercial broadcaster signs subscription deal to modernize news editing, storage and management workflows Avid broadcast TV production environment Avid broadcast TV production environment BURLINGTON, Mass., Sept. 13, 2023 (GLOBE NEWSWIRE) -- ITV has partnered with Avid® (Nasdaq: AVID) to deliver leading edge functionality in its news editing, storage and publishing systems for both ITV Regional News and ITV National News, through a new subscription deal. ITV News is the largest com |

AVID Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 16.10% |

| 3-year | -21.65% |

| 5-year | 169.86% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -18.36% |

| 2021 | 105.23% |

| 2020 | 84.97% |

| 2019 | 80.63% |

Continue Researching AVID

Want to do more research on Avid Technology Inc's stock and its price? Try the links below:Avid Technology Inc (AVID) Stock Price | Nasdaq

Avid Technology Inc (AVID) Stock Quote, History and News - Yahoo Finance

Avid Technology Inc (AVID) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...