Aware, Inc. (AWRE): Price and Financial Metrics

AWRE Price/Volume Stats

| Current price | $1.97 | 52-week high | $2.20 |

| Prev. close | $1.92 | 52-week low | $1.05 |

| Day low | $1.93 | Volume | 16,800 |

| Day high | $2.00 | Avg. volume | 44,829 |

| 50-day MA | $1.89 | Dividend yield | N/A |

| 200-day MA | $1.73 | Market Cap | 41.54M |

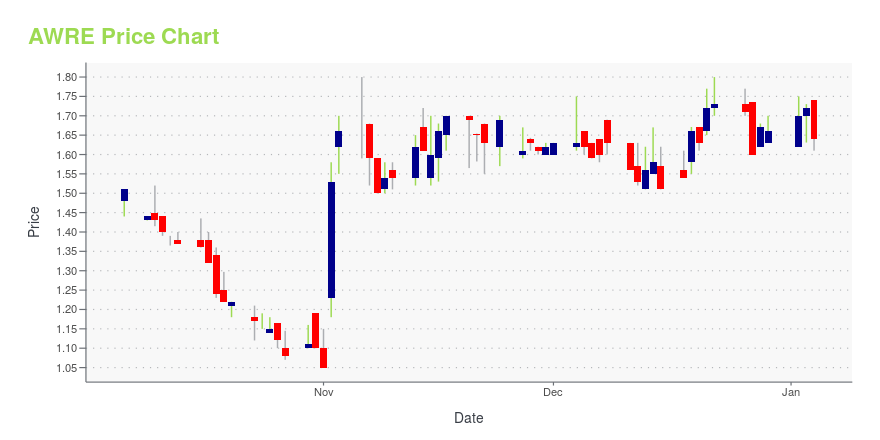

AWRE Stock Price Chart Interactive Chart >

Aware, Inc. (AWRE) Company Bio

Aware, Inc. provides software and services for the biometrics industry. The companys software products are used in government and commercial biometrics systems to identify or authenticate people. The company was founded in 1986 and is based in Bedford, Massachusetts.

Latest AWRE News From Around the Web

Below are the latest news stories about AWARE INC that investors may wish to consider to help them evaluate AWRE as an investment opportunity.

Aware and Serban Group Team Up To Create Biometric Authentication Powerhouse Serving Latin American and European MarketsCollaboration to Deliver Biometric Authentication Solutions Across Key Global RegionsBURLINGTON, Mass., Nov. 15, 2023 (GLOBE NEWSWIRE) -- Latin America (LATAM) and Europe are two of the most culturally rich and diverse regions of the world. This heterogeneity is matched only by the diversity of these regions’ identity credentials – and, increasingly, the corresponding opportunities for fraud. Fortunately, these regions - LATAM and LATAM financial services in particular – have become significant |

Aware, Inc. (NASDAQ:AWRE) Q3 2023 Earnings Call TranscriptAware, Inc. (NASDAQ:AWRE) Q3 2023 Earnings Call Transcript November 1, 2023 Matt Glover: Good afternoon and welcome to Aware’s Third Quarter 2023 Conference Call. [Operator Instructions] Before we begin today’s call, I would like to remind everyone that the presentation today contains forward-looking statements that are based on the current expectations of Aware’s management and […] |

Aware Inc (AWRE) Q3 2023 Earnings: Revenue Soars by 112% to $6.4 MillionNet income for the third quarter of 2023 totaled $1.1 million, a significant improvement from the previous year |

Aware® Reports Third Quarter and Nine Month 2023 Financial ResultsQuarterly Total Revenue Increased 112% from prior year quarter to $6.4 Million Generated $2.5 million in Operating Cashflow in Q3 2023, the Highest Quarterly Level Since Q4 2018 BURLINGTON, Mass., Nov. 01, 2023 (GLOBE NEWSWIRE) -- Aware, Inc. (NASDAQ: AWRE), a global biometric platform company that uses data science, machine learning, and artificial intelligence to tackle everyday business and identity challenges through biometrics, today reported financial results for the third quarter ended Se |

Aware and PeopleCert Align to Prevent Proxy TestingFirst-of-its-Kind Biometrics Application in Examination and Accreditation Market Promises to Eliminate Fraud, Guarantee Test ValidityBURLINGTON, Mass., Oct. 25, 2023 (GLOBE NEWSWIRE) -- In 2019, the infamous Varsity Blues conspiracy implicated several well-known business people and celebrity actors in an elite college admissions scandal. Part of this scheme involved expert test-takers standing in to take college entrance exams in place of students using fake IDs.Amid ongoing sentences for key pa |

AWRE Price Returns

| 1-mo | 0.00% |

| 3-mo | 15.20% |

| 6-mo | 27.10% |

| 1-year | 20.12% |

| 3-year | -46.47% |

| 5-year | -36.86% |

| YTD | 18.67% |

| 2023 | -2.92% |

| 2022 | -45.71% |

| 2021 | -10.00% |

| 2020 | 4.17% |

| 2019 | -6.93% |

Continue Researching AWRE

Here are a few links from around the web to help you further your research on Aware Inc's stock as an investment opportunity:Aware Inc (AWRE) Stock Price | Nasdaq

Aware Inc (AWRE) Stock Quote, History and News - Yahoo Finance

Aware Inc (AWRE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...