Axcella Health Inc. (AXLA): Price and Financial Metrics

AXLA Price/Volume Stats

| Current price | $0.40 | 52-week high | $41.25 |

| Prev. close | $0.44 | 52-week low | $0.34 |

| Day low | $0.36 | Volume | 6,700 |

| Day high | $0.51 | Avg. volume | 267,009 |

| 50-day MA | $3.38 | Dividend yield | N/A |

| 200-day MA | $7.54 | Market Cap | 1.18M |

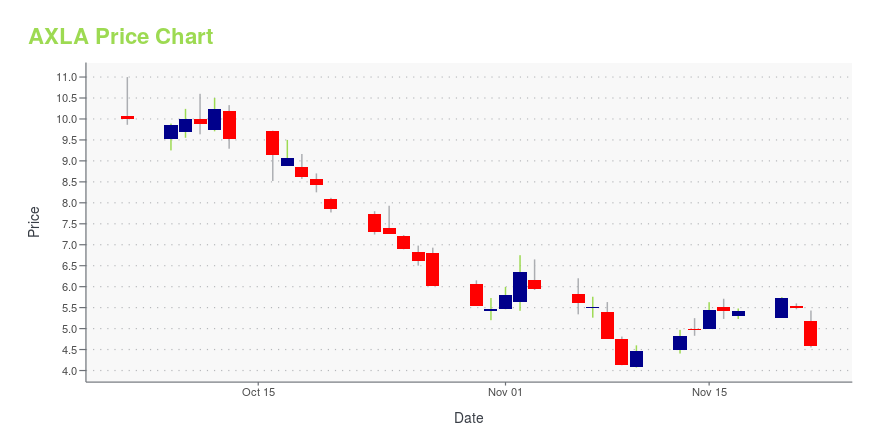

AXLA Stock Price Chart Interactive Chart >

Axcella Health Inc. (AXLA) Company Bio

Axcella Health Inc., a biotechnology company, researches and develops novel multifactorial interventions to support health and address dysregulated metabolism in the United States. The company develops its products based on its AXA Development Platform. It offers AXA1665 for use in treating hepatic encephalopathy; AXA1125 and AXA1957 to treat non-alcoholic fatty liver disease; AXA2678 for use in treating immobilization-induced acute muscle atrophy; and AXA4010 to target multiple biological pathways.

Latest AXLA News From Around the Web

Below are the latest news stories about AXCELLA HEALTH INC that investors may wish to consider to help them evaluate AXLA as an investment opportunity.

12 Best Stocks For Day TradingIn this piece, we will take a look at the 12 Best Stocks For Day Trading. If you want to skip our introduction to trading indicators and the economic climate, then check out 5 Best Stocks For Day Trading. The modern day stock market is significantly different from the one of the early 1900s. These […] |

3 Pharma Stocks to Dump Before the Damage Is DoneThere's never a shortage of pharma stocks to sell due to the nature of the sector, especially when compounded by current fears. |

Beware! 3 Biotech Stocks Waving Massive Red Flags Right NowThere are always many biotech stocks to avoid and these firms are among the clearest choices currently to steer clear of. |

NKLA Stock Alert: Nikola Announces Canadian Expansion of Dealer NetworkNikola (NKLA) stock is a hot topic among traders on Friday as they go over the details of a new dealership expansion in Canada. |

NVS Stock Alert: Novartis Shareholders Approve Sandoz SpinoffNovartis (NVS) stock is rising higher on Friday after the company announced approval for the spinoff of its generic drugs business Sandoz. |

AXLA Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -91.58% |

| 3-year | -99.52% |

| 5-year | -99.80% |

| YTD | -0.22% |

| 2023 | -95.10% |

| 2022 | -84.33% |

| 2021 | -59.73% |

| 2020 | 29.43% |

| 2019 | N/A |

Loading social stream, please wait...