Axalta Coating Systems Ltd. (AXTA): Price and Financial Metrics

AXTA Price/Volume Stats

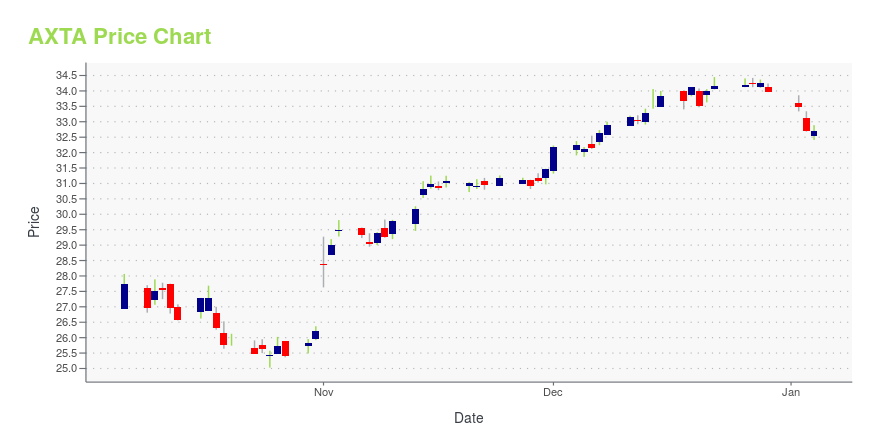

| Current price | $34.87 | 52-week high | $36.98 |

| Prev. close | $34.50 | 52-week low | $25.03 |

| Day low | $34.66 | Volume | 1,837,200 |

| Day high | $35.13 | Avg. volume | 2,053,546 |

| 50-day MA | $35.03 | Dividend yield | N/A |

| 200-day MA | $32.66 | Market Cap | 7.69B |

AXTA Stock Price Chart Interactive Chart >

Axalta Coating Systems Ltd. (AXTA) Company Bio

Axalta Coating Systems specializes in coatings used in light OEM vehicles, commercial vehicles and refinish applications to electric motors, buildings and pipelines. The company was founded in 1866 and is based in Philadelphia, Pennsylvania.

Latest AXTA News From Around the Web

Below are the latest news stories about AXALTA COATING SYSTEMS LTD that investors may wish to consider to help them evaluate AXTA as an investment opportunity.

Hawkins (HWKN) Up 51% in 6 Months: What's Driving the Stock?Hawkins (HWKN) benefits from the robust Water Treatment segment, strategic acquisitions and a prudent pricing strategy. |

Universal Stainless (USAP) Hits 52-Week High: What's Driving it?Universal Stainless' (USAP) rally reflects a robust third-quarter performance on the back of record aerospace sales. |

Is American Resources (AREC) Outperforming Other Basic Materials Stocks This Year?Here is how American Resources Corporation (AREC) and Axalta Coating Systems (AXTA) have performed compared to their sector so far this year. |

Energy Fuels (UUUU), Astorn Sign MOU to Develop Donald ProjectEnergy Fuels (UUUU) inks MOU with Astorn to co-develop the Donald Project in Australia. |

Chemours (CC), DuPont & Corteva Back U.S. Water System DealChemours (CC), DuPont & Corteva do not intend to exercise the opt-out option and extend support to PFAS Deal with the U.S. Water System. |

AXTA Price Returns

| 1-mo | 2.56% |

| 3-mo | 11.69% |

| 6-mo | 7.16% |

| 1-year | 8.87% |

| 3-year | 15.31% |

| 5-year | 12.96% |

| YTD | 2.65% |

| 2023 | 33.37% |

| 2022 | -23.10% |

| 2021 | 16.01% |

| 2020 | -6.09% |

| 2019 | 29.80% |

Continue Researching AXTA

Want to see what other sources are saying about Axalta Coating Systems Ltd's financials and stock price? Try the links below:Axalta Coating Systems Ltd (AXTA) Stock Price | Nasdaq

Axalta Coating Systems Ltd (AXTA) Stock Quote, History and News - Yahoo Finance

Axalta Coating Systems Ltd (AXTA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...