AXT Inc (AXTI): Price and Financial Metrics

AXTI Price/Volume Stats

| Current price | $3.25 | 52-week high | $5.64 |

| Prev. close | $3.29 | 52-week low | $1.89 |

| Day low | $3.21 | Volume | 292,216 |

| Day high | $3.38 | Avg. volume | 1,391,349 |

| 50-day MA | $3.54 | Dividend yield | N/A |

| 200-day MA | $3.10 | Market Cap | 144.30M |

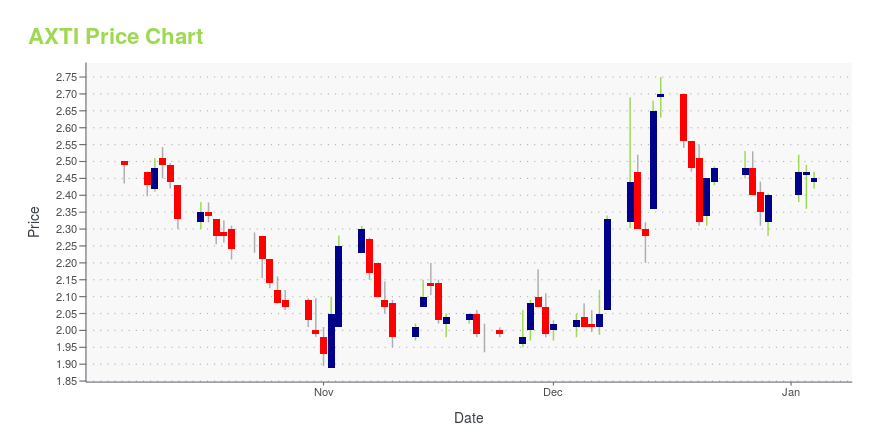

AXTI Stock Price Chart Interactive Chart >

AXT Inc (AXTI) Company Bio

AXT, Inc. designs, develops, manufactures, and distributes compound and single element semiconductor substrates. The company manufactures its semiconductor substrates using its proprietary vertical gradient freeze technology. It offers semi-insulating substrates made from gallium with arsenic (GaAs), which are used for applications in power amplifiers and radio frequency integrated circuits for wireless handsets; direct broadcast televisions; transistors; and satellite communications. The company was founded in 1986 and is based in Fremont, California.

Latest AXTI News From Around the Web

Below are the latest news stories about AXT INC that investors may wish to consider to help them evaluate AXTI as an investment opportunity.

7 Heavily De-Risked Tech Stocks Worth Another LookWith the Technology Select Sector SPDR Fund (NYSEARCA:XLK) running well above the equities benchmark index this year, it’s clear that the innovation space is humming strongly, which subsequently yields a case for de-risked tech stocks. |

The past three years for AXT (NASDAQ:AXTI) investors has not been profitableAs an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So consider... |

AXT, Inc. (NASDAQ:AXTI) Q3 2023 Earnings Call TranscriptAXT, Inc. (NASDAQ:AXTI) Q3 2023 Earnings Call Transcript November 2, 2023 AXT, Inc. misses on earnings expectations. Reported EPS is $-0.14 EPS, expectations were $-0.13. Operator: Good afternoon, everyone, and welcome to AXT’s Third Quarter 2023 Financial Conference Call. Leading the call today is Dr. Morris Young, Chief Executive Officer; and Gary Fischer, Chief Financial […] |

Q3 2023 AXT Inc Earnings CallQ3 2023 AXT Inc Earnings Call |

AXT Inc (AXTI) Reports Q3 2023 Financial ResultsRevenue Declines Year-Over-Year, Net Loss Reported |

AXTI Price Returns

| 1-mo | -10.71% |

| 3-mo | 9.43% |

| 6-mo | 26.21% |

| 1-year | 11.30% |

| 3-year | -65.02% |

| 5-year | -23.89% |

| YTD | 35.42% |

| 2023 | -45.21% |

| 2022 | -50.28% |

| 2021 | -7.94% |

| 2020 | 120.00% |

| 2019 | 0.00% |

Continue Researching AXTI

Want to see what other sources are saying about Axt Inc's financials and stock price? Try the links below:Axt Inc (AXTI) Stock Price | Nasdaq

Axt Inc (AXTI) Stock Quote, History and News - Yahoo Finance

Axt Inc (AXTI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...