AZEK Co. Inc. (AZEK): Price and Financial Metrics

AZEK Price/Volume Stats

| Current price | $45.25 | 52-week high | $50.78 |

| Prev. close | $42.99 | 52-week low | $25.03 |

| Day low | $44.11 | Volume | 1,532,401 |

| Day high | $46.04 | Avg. volume | 1,702,801 |

| 50-day MA | $44.77 | Dividend yield | N/A |

| 200-day MA | $40.93 | Market Cap | 6.58B |

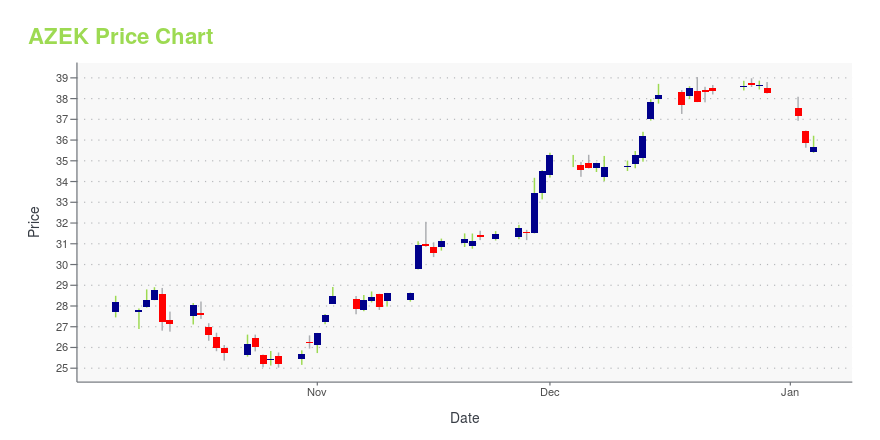

AZEK Stock Price Chart Interactive Chart >

AZEK Co. Inc. (AZEK) Company Bio

The AZEK Co., Inc. is an industry manufacturer of premium building products that replace traditional materials and provide value through lower maintenance, refined aesthetics and reduced total cost. The company operates through two segments: Residential and Commercial. The Residential consumer consumer brands include TimberTech and AZEK Exteriors. The TimberTech offers a premium portfolio of capped polymer and capped composite decking as well as railing, porch, lighting and paver products. The AZEK Exteriors manufactures distinctly unique trim and moulding. The Commercial segment manufactures engineered sheet products and high-quality bathroom partitions and lockers. The company was founded on August 15, 2013 and is headquartered in Chicago, IL.

Latest AZEK News From Around the Web

Below are the latest news stories about AZEK CO INC that investors may wish to consider to help them evaluate AZEK as an investment opportunity.

The AZEK Company Inc.'s (NYSE:AZEK) Business Is Trailing The Industry But Its Shares Aren'tThe AZEK Company Inc.'s ( NYSE:AZEK ) price-to-sales (or "P/S") ratio of 4.1x may look like a poor investment... |

The AZEK Company Announces $100 Million Accelerated Share Repurchase ProgramCHICAGO, December 05, 2023--The AZEK Company Inc. (NYSE: AZEK) ("AZEK" or the "Company"), the industry-leading manufacturer of beautiful, low-maintenance and environmentally sustainable outdoor living products, including TimberTech® decking and railing, Versatex® and AZEK® Trim and StruXure™ pergolas, today announced it has entered into an accelerated share repurchase agreement ("ASR") with Goldman Sachs & Co. LLC ("Goldman Sachs") to repurchase $100 million of the Company’s Class A common stock |

The AZEK Company Inc. (NYSE:AZEK) Q4 2023 Earnings Call TranscriptThe AZEK Company Inc. (NYSE:AZEK) Q4 2023 Earnings Call Transcript November 28, 2023 The AZEK Company Inc. beats earnings expectations. Reported EPS is $0.36, expectations were $0.29. Operator: Welcome to The AZEK Company’s Fourth Quarter Fiscal 2023 Earnings Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there will […] |

AZEK Q4 Earnings & Revenues Top Estimates, Rises Y/YAZEK's Q4 fiscal 2023 results benefit from strong Residential sales growth and margin execution. |

Q4 2023 Azek Company Inc Earnings CallQ4 2023 Azek Company Inc Earnings Call |

AZEK Price Returns

| 1-mo | 8.28% |

| 3-mo | -1.91% |

| 6-mo | 19.90% |

| 1-year | 47.92% |

| 3-year | 25.97% |

| 5-year | N/A |

| YTD | 18.30% |

| 2023 | 88.24% |

| 2022 | -56.06% |

| 2021 | 20.26% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...