AstraZeneca PLC ADR (AZN): Price and Financial Metrics

AZN Price/Volume Stats

| Current price | $78.13 | 52-week high | $80.86 |

| Prev. close | $78.52 | 52-week low | $60.47 |

| Day low | $78.08 | Volume | 5,878,519 |

| Day high | $79.45 | Avg. volume | 5,328,704 |

| 50-day MA | $78.49 | Dividend yield | 2.44% |

| 200-day MA | $69.79 | Market Cap | 242.24B |

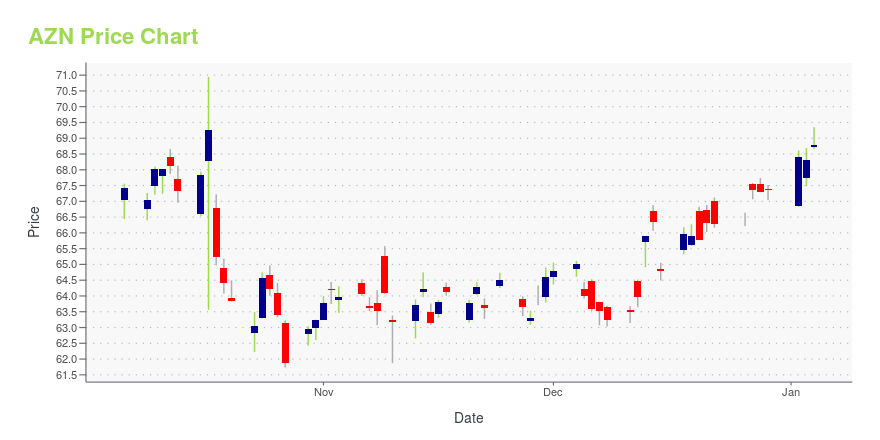

AZN Stock Price Chart Interactive Chart >

AstraZeneca PLC ADR (AZN) Company Bio

AstraZeneca plc engages in the discovery, development, and commercialization of prescription medicines for the treatment of cardiovascular, metabolic, respiratory, inflammation, autoimmune, oncology, infection, and neuroscience diseases worldwide. The company was founded in 1992 and is based in London, the United Kingdom.

Latest AZN News From Around the Web

Below are the latest news stories about ASTRAZENECA PLC that investors may wish to consider to help them evaluate AZN as an investment opportunity.

Buy AstraZeneca Stock. It Looks Much Better Going Into 2024.The Big Pharma mainstay is set to deliver double-digit earnings growth, driven by a diverse portfolio of blockbusters and promising newcomers. |

Why Is Cytokinetics (CYTK) Stock Up 70% Today?With Cytokinetics hitting a homerun with its heart failure drug, CYTK stock skyrocketed in part due to takeover interest. |

Astrazeneca (AZN) Surpasses Market Returns: Some Facts Worth KnowingIn the most recent trading session, Astrazeneca (AZN) closed at $67.35, indicating a +1.28% shift from the previous trading day. |

Recent M&A Bodes Well For Targeted Cancer Therapy Player Fusion Pharmaceuticals, Analyst Say AstraZeneca Is Favorably PositionedWith recent merger and acquisition deals in the targeted radiopharmaceutical therapy (TRT) space, on Tuesday, Oppenheimer noted that Fusion Pharmaceuticals Inc (NASDAQ: FUSN) is potentially the sole remaining clinical-stage player with a robust supply chain. In September, Oppenheimer initiated coverage on Fusion Pharmaceuticals, citing the company's pipeline as among the best in the space with alpha-emitter-based targeted radionuclide therapies. Most recently, Bristol Myers Squibb & Co (NYSE: BM |

AstraZeneca (AZN) Set to Acquire Gracell for $1.2 BillionAstraZeneca (AZN) is set to acquire clinical-stage biopharmaceutical company, Gracell, for a total deal value of up to $1.2 billion. |

AZN Price Returns

| 1-mo | -1.20% |

| 3-mo | 3.94% |

| 6-mo | 18.19% |

| 1-year | 17.13% |

| 3-year | 45.28% |

| 5-year | 102.98% |

| YTD | 17.75% |

| 2023 | 1.40% |

| 2022 | 19.10% |

| 2021 | 19.66% |

| 2020 | 3.06% |

| 2019 | 35.58% |

AZN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AZN

Here are a few links from around the web to help you further your research on Astrazeneca Plc's stock as an investment opportunity:Astrazeneca Plc (AZN) Stock Price | Nasdaq

Astrazeneca Plc (AZN) Stock Quote, History and News - Yahoo Finance

Astrazeneca Plc (AZN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...