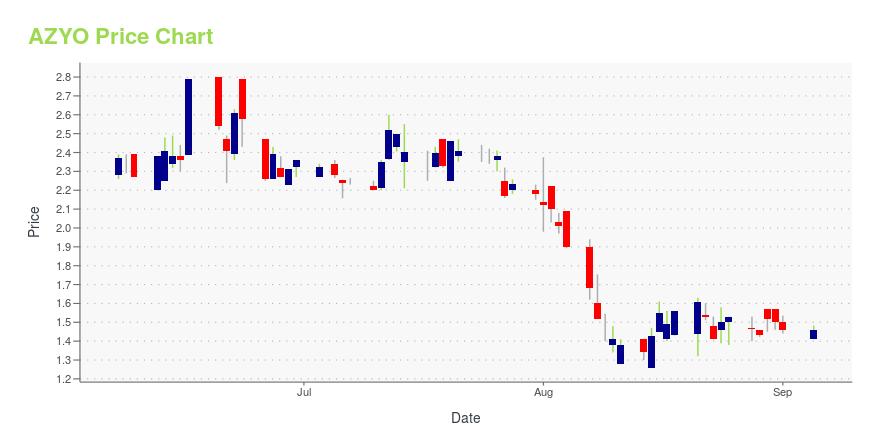

Aziyo Biologics Inc. (AZYO): Price and Financial Metrics

AZYO Price/Volume Stats

| Current price | $1.49 | 52-week high | $9.01 |

| Prev. close | $1.46 | 52-week low | $1.10 |

| Day low | $1.40 | Volume | 8,100 |

| Day high | $1.54 | Avg. volume | 127,527 |

| 50-day MA | $1.94 | Dividend yield | N/A |

| 200-day MA | $3.01 | Market Cap | 24.21M |

AZYO Stock Price Chart Interactive Chart >

Aziyo Biologics Inc. (AZYO) Company Bio

Aziyo Biologics, Inc. operates as a biotechnology company which focuses on regenerative medicine in areas such as cardiology, orthopedics and other medical specialties. It offers cardiac device envelope, vascular surgery, cardiothoracic repair, orthopedics and spine, sports medicine, dermal, and wound care. The company was founded on August 6, 2015 and is headquartered in Silver Spring, MD.

Latest AZYO News From Around the Web

Below are the latest news stories about AZIYO BIOLOGICS INC that investors may wish to consider to help them evaluate AZYO as an investment opportunity.

Aziyo Biologics Announces Publication of a CanGaroo® Case Study Demonstrating Bioenvelope Benefits for Reoperative ProceduresCase provides first histologic evidence that CanGaroo can catalyze development of new healthy tissue layer within an existing cardiac implantable electronic device (CIED) pocket SILVER SPRING, Md., Aug. 30, 2023 (GLOBE NEWSWIRE) -- Aziyo Biologics, Inc. (Nasdaq: AZYO) (“Aziyo”), a company that develops and commercializes biologic products to improve compatibility between medical devices and the patients who need them, today announced the publication of a case report highlighting results that dem |

Aziyo Biologics, Inc. (NASDAQ:AZYO) Q2 2023 Earnings Call TranscriptAziyo Biologics, Inc. (NASDAQ:AZYO) Q2 2023 Earnings Call Transcript August 20, 2023 Operator: Good day, ladies and gentlemen. Welcome to the Aziyo Biologics’ Second Quarter 2023 Financial Results Conference Call. [Operator Instructions] Please be advised that today’s conference call is being recorded. I would now like to hand the conference over to Matt Steinberg of […] |

Q2 2023 Aziyo Biologics Inc Earnings CallQ2 2023 Aziyo Biologics Inc Earnings Call |

Aziyo Biologics Reports Second Quarter 2023 Financial Results - Transformation Continues to Drug-Eluting Biomatrix CompanyNegotiating multiple LOIs to divest Orthopedic business CanGaroo® RM 510(k) resubmission to the FDA remains on track SimpliDerm® quarterly net sales up 32% year-over-year Successful transfer of Cardiovascular product distribution to LeMaitre Vascular SILVER SPRING, Md., Aug. 14, 2023 (GLOBE NEWSWIRE) -- Aziyo Biologics, Inc. (Nasdaq: AZYO) (“Aziyo”), a company that develops and commercializes biologic products to improve compatibility between medical devices and the patients who need them, today |

Aziyo Biologics to Report Second Quarter 2023 Financial Results on Monday, August 14, 2023SILVER SPRING, Md., July 31, 2023 (GLOBE NEWSWIRE) -- Aziyo Biologics, Inc. (Nasdaq: AZYO) (“Aziyo”), a company that develops and commercializes biologic products to improve compatibility between medical devices and the patients who need them, today announced that it will release its second quarter 2023 financial results after market close on Monday, August 14, 2023. Members of the Company’s management team will host a conference call and webcast starting at 4:30 p.m. Eastern Time / 1:30 p.m. Pa |

AZYO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -31.34% |

| 3-year | -82.57% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -32.54% |

| 2021 | -53.78% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...