Barnes Group, Inc. (B): Price and Financial Metrics

B Price/Volume Stats

| Current price | $41.10 | 52-week high | $45.24 |

| Prev. close | $42.11 | 52-week low | $18.79 |

| Day low | $38.03 | Volume | 1,215,012 |

| Day high | $42.81 | Avg. volume | 324,636 |

| 50-day MA | $40.33 | Dividend yield | 1.47% |

| 200-day MA | $34.36 | Market Cap | 2.08B |

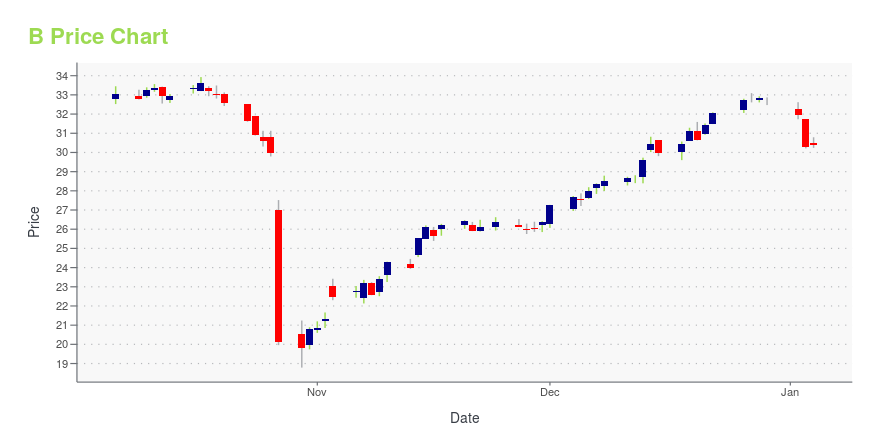

B Stock Price Chart Interactive Chart >

Barnes Group, Inc. (B) Company Bio

Barnes Group operates as an industrial and aerospace manufacturer and service provider serving a range of end markets and customers worldwide. The company operates in two segments, Industrial and Aerospace. The company was founded in 1857 and is based in Bristol, Connecticut.

Latest B News From Around the Web

Below are the latest news stories about BARNES GROUP INC that investors may wish to consider to help them evaluate B as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

The 3 Best Value Stocks Targeting at Least 25% UpsideWith growth stocks leading the market rebound this year, now is a great time to consider the best value stocks to buy for 2024. |

Apple’s Market Maneuvers: Is AAPL Stock a Smart Buy at $193?A ban on the Apple Watch could hit AAPL stock hard as the wearable is the tech stock's second biggest money-maker. |

At US$32.86, Is Barnes Group Inc. (NYSE:B) Worth Looking At Closely?Barnes Group Inc. ( NYSE:B ), might not be a large cap stock, but it received a lot of attention from a substantial... |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

B Price Returns

| 1-mo | -1.84% |

| 3-mo | 19.70% |

| 6-mo | 27.45% |

| 1-year | -1.27% |

| 3-year | -13.34% |

| 5-year | -14.68% |

| YTD | 27.02% |

| 2023 | -18.68% |

| 2022 | -10.81% |

| 2021 | -6.88% |

| 2020 | -16.97% |

| 2019 | 16.92% |

B Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching B

Want to see what other sources are saying about Barnes Group Inc's financials and stock price? Try the links below:Barnes Group Inc (B) Stock Price | Nasdaq

Barnes Group Inc (B) Stock Quote, History and News - Yahoo Finance

Barnes Group Inc (B) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...