Braskem SA ADR (BAK): Price and Financial Metrics

BAK Price/Volume Stats

| Current price | $6.44 | 52-week high | $10.98 |

| Prev. close | $6.32 | 52-week low | $6.11 |

| Day low | $6.30 | Volume | 764,047 |

| Day high | $6.49 | Avg. volume | 874,873 |

| 50-day MA | $6.92 | Dividend yield | N/A |

| 200-day MA | $7.81 | Market Cap | 2.91B |

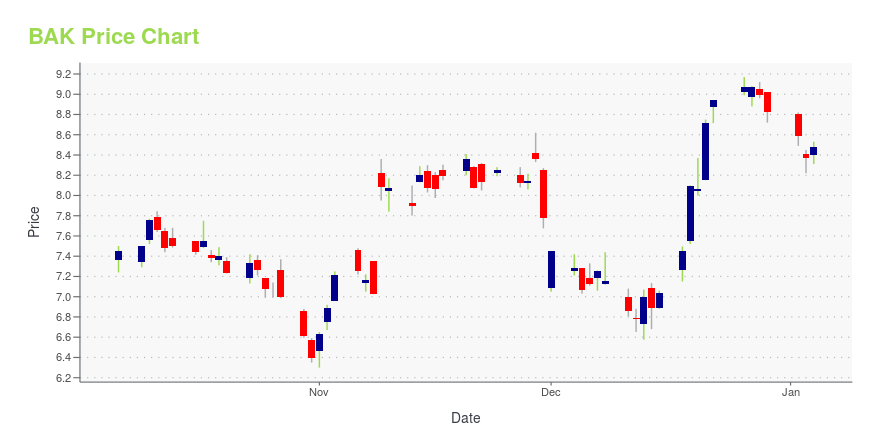

BAK Stock Price Chart Interactive Chart >

Braskem SA ADR (BAK) Company Bio

Braskem S.A., together with its subsidiaries, produces and sells thermoplastic resins. Braskem's business operations consist of four production segments and one distribution segment: Basic Petrochemicals Unit, Polyolefins, Vinyls, United States and Europe, and Chemical distribution. The company is also engaged in the import and export of chemicals, petrochemicals and fuels, the production, supply and sale of utilities such as steam, water, compressed air, industrial gases, as well as the provision of industrial services and the production, supply and sale of electric energy for its own use and use by other companies. The company was founded in 1972 and is based in Camacari, Brazil.

Latest BAK News From Around the Web

Below are the latest news stories about BRASKEM SA that investors may wish to consider to help them evaluate BAK as an investment opportunity.

Petrobras (PBR) Considers Increasing Stake in Braskem to Aid SalePetrobras (PBR) is considering increasing its share in the petrochemical company Braskem, with the objective of streamlining a potential sale to international investors. |

Braskem’s Credit Rating Cut to Junk by Fitch Over Environmental Risks(Bloomberg) -- Latin America’s largest petrochemical firm Braskem SA was stripped of its investment-grade status at Fitch Ratings, in the latest blow to a company that’s under increasing pressure as the collapse of a salt mine it operates in Brazil’s Northeast risks engulfing part of a town. Most Read from BloombergRange Rovers Become Thief-Magnets, Causing Prices to TumbleOwner of the Philippines’ Largest Malls Says China Feud May Hurt BusinessesCiti Shuts Muni Business That Once Was Envy of Ri |

UPDATE 2-Brazil senators to probe petrochemical Braskem's sinking ground havocBrazil's Congress committed on Wednesday to a federal investigation into petrochemical company Braskem over the sinking soil in the city of Maceio, which has forced about 60,000 people to be moved since 2018. The launch of an official investigation in Brazil's Congress follows a Sunday breach of one of Braskem's more than thirty salt mines under Maceio, a coastal city with nearly 1 million people in Brazil's northeast region. |

Brazil senators to probe petrochemical Braskem's sinking ground havocBrazil's Congress committed on Wednesday to a federal investigation into petrochemical company Braskem over the sinking soil in the city of Maceio, which has forced about 60,000 people to be moved since 2018. The launch of an official investigation in Brazil's Congress follows a breach on Sunday of one of Braskem's more than thirty salt mines under Maceio, a coastal city with nearly 1 million people in Brazil's northeast region. |

Moody's downgrades Brazil's Braskem on potential extra damages provisionsMoody's cut Brazilian petrochemical Braskem's rating to Ba2 from Ba1 on Tuesday, citing the risk of additional provisions related to troubled operations in the city of Maceio at a moment of high financial leverage. Moody's also downgraded Braskem's rating outlook to negative from stable. Braskem has spent about 9.2 billion reais ($1.85 billion), with over 5 billion reais provisioned, on socio-environmental agreements related to that operation. |

BAK Price Returns

| 1-mo | -1.23% |

| 3-mo | -27.96% |

| 6-mo | -15.49% |

| 1-year | -37.29% |

| 3-year | -65.97% |

| 5-year | -57.66% |

| YTD | -26.98% |

| 2023 | -4.13% |

| 2022 | -54.85% |

| 2021 | 167.18% |

| 2020 | -39.12% |

| 2019 | -33.43% |

Continue Researching BAK

Want to see what other sources are saying about Braskem Sa's financials and stock price? Try the links below:Braskem Sa (BAK) Stock Price | Nasdaq

Braskem Sa (BAK) Stock Quote, History and News - Yahoo Finance

Braskem Sa (BAK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...