Bandwidth Inc. - (BAND): Price and Financial Metrics

BAND Price/Volume Stats

| Current price | $22.49 | 52-week high | $25.02 |

| Prev. close | $21.77 | 52-week low | $9.34 |

| Day low | $22.06 | Volume | 399,700 |

| Day high | $22.66 | Avg. volume | 334,631 |

| 50-day MA | $19.17 | Dividend yield | N/A |

| 200-day MA | $15.93 | Market Cap | 607.41M |

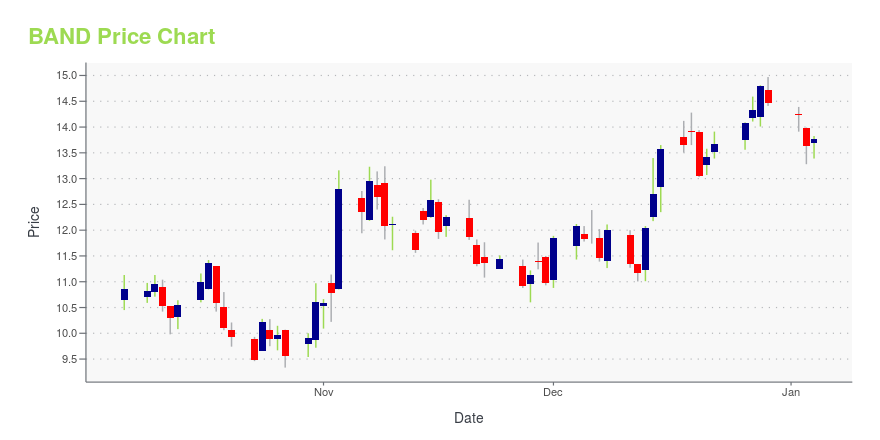

BAND Stock Price Chart Interactive Chart >

Bandwidth Inc. - (BAND) Company Bio

Bandwidth Inc. operates as a cloud-based, software-powered communications platform-as-a-service (CPaaS) provider in the United States. The company operates through two segments, CPaaS and Other. Its platform enables enterprises to create, scale, and operate voice or text communications services across mobile application or connected device or enterprises. The company also offers SIP trunking, data resale, and hosted voice over Internet protocol services. It serves large enterprises, small and medium-sized businesses, technology companies, and other business. Bandwidth Inc. was founded in 2000 and is headquartered in Raleigh, North Carolina.

Latest BAND News From Around the Web

Below are the latest news stories about BANDWIDTH INC that investors may wish to consider to help them evaluate BAND as an investment opportunity.

Canaccord Says These 3 Communications Software Stocks Are Down but Not Out, Forecasting up to 160% Upside2023 will go down as a vintage year for the stock market but not all have enjoyed the spoils. For instance, it has been a difficult ride for many companies operating in the communications software space. This is acknowledged by Canaccord analyst Michael Walkley, who notes that it has been a challenging year for the majority of companies under his coverage in the communications software group. It has been particularly hard for smaller cap stocks with debt and especially net debt. But as every sav |

At US$13.65, Is It Time To Put Bandwidth Inc. (NASDAQ:BAND) On Your Watch List?Bandwidth Inc. ( NASDAQ:BAND ), is not the largest company out there, but it led the NASDAQGS gainers with a relatively... |

Zacks Industry Outlook Highlights Anterix, Bandwidth and DZSAnterix, Bandwidth and DZS are part of the Zacks Industry Outlook article. |

3 Communication Stocks Likely to Gain Despite Industry GloomThe infrastructure upgrade for digital transformation, fiber densification and 5G rollout should help the Zacks Communication - Infrastructure industry thrive despite near-term headwinds. ATEX, BAND and DZSI are well poised to benefit from the continued transition to cloud networks. |

Bandwidth Inc. (NASDAQ:BAND) Q3 2023 Earnings Call TranscriptBandwidth Inc. (NASDAQ:BAND) Q3 2023 Earnings Call Transcript November 2, 2023 Bandwidth Inc. beats earnings expectations. Reported EPS is $0.23, expectations were $0.2. Operator: Good afternoon, and welcome to the Bandwidth Inc. Third Quarter 2023 Earnings Conference Call. All participants will be in listen-only mode. [Operator Instructions]. After today’s presentation there will be an opportunity […] |

BAND Price Returns

| 1-mo | 44.26% |

| 3-mo | 24.67% |

| 6-mo | 54.36% |

| 1-year | 63.33% |

| 3-year | -82.69% |

| 5-year | -72.01% |

| YTD | 55.43% |

| 2023 | -36.95% |

| 2022 | -68.02% |

| 2021 | -53.30% |

| 2020 | 139.92% |

| 2019 | 57.18% |

Continue Researching BAND

Want to do more research on Bandwidth Inc's stock and its price? Try the links below:Bandwidth Inc (BAND) Stock Price | Nasdaq

Bandwidth Inc (BAND) Stock Quote, History and News - Yahoo Finance

Bandwidth Inc (BAND) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...