Barings BDC, Inc. (BBDC): Price and Financial Metrics

BBDC Price/Volume Stats

| Current price | $9.58 | 52-week high | $10.85 |

| Prev. close | $9.70 | 52-week low | $7.66 |

| Day low | $9.56 | Volume | 209,700 |

| Day high | $9.75 | Avg. volume | 497,987 |

| 50-day MA | $9.13 | Dividend yield | 10.72% |

| 200-day MA | $0.00 | Market Cap | 1.01B |

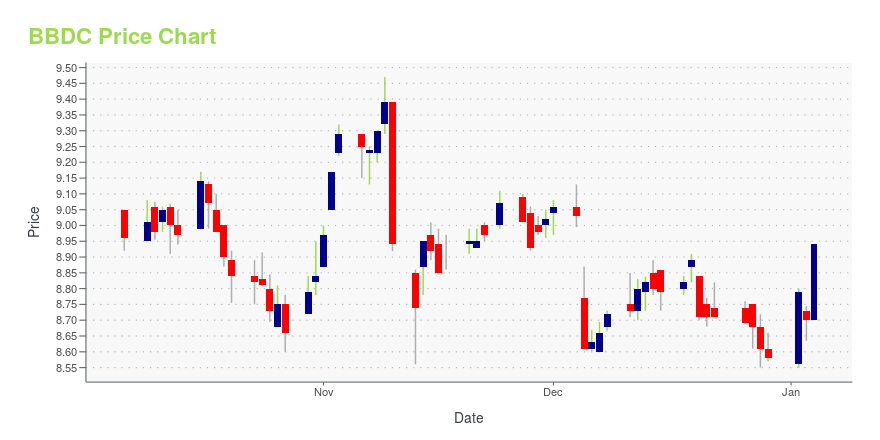

BBDC Stock Price Chart Interactive Chart >

Barings BDC, Inc. (BBDC) Company Bio

Barings BDC, Inc. (NYSE: BBDC) is a publicly traded, externally managed investment company that has elected to be treated as a business development company under the Investment Company Act of 1940. Barings BDC seeks to invest primarily in senior secured loans to private U.S. middle-market companies that operate across a wide range of industries. It specializes in mezzanine, leveraged buyouts, management buyouts, ESOPs, change of control transactions, acquisition financings, growth financing, and recapitalizations in lower middle market, mature, and later stage companies. Barings BDC's investment activities are managed by its investment adviser, Barings LLC, a leading global asset manager based in Charlotte, NC with over $335 billion of AUM firm-wide. For more information, visit www.baringsbdc.com.

BBDC Price Returns

| 1-mo | 5.74% |

| 3-mo | 14.31% |

| 6-mo | 3.56% |

| 1-year | 7.66% |

| 3-year | 39.74% |

| 5-year | 101.41% |

| YTD | 6.81% |

| 2024 | 23.86% |

| 2023 | 18.53% |

| 2022 | -18.59% |

| 2021 | 29.31% |

| 2020 | -3.48% |

BBDC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BBDC

Want to do more research on Barings BDC Inc's stock and its price? Try the links below:Barings BDC Inc (BBDC) Stock Price | Nasdaq

Barings BDC Inc (BBDC) Stock Quote, History and News - Yahoo Finance

Barings BDC Inc (BBDC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...