Bain Capital Specialty Finance, Inc. (BCSF): Price and Financial Metrics

BCSF Price/Volume Stats

| Current price | $16.79 | 52-week high | $16.94 |

| Prev. close | $16.52 | 52-week low | $14.47 |

| Day low | $16.54 | Volume | 244,700 |

| Day high | $16.87 | Avg. volume | 260,251 |

| 50-day MA | $16.51 | Dividend yield | 10.18% |

| 200-day MA | $15.76 | Market Cap | 1.08B |

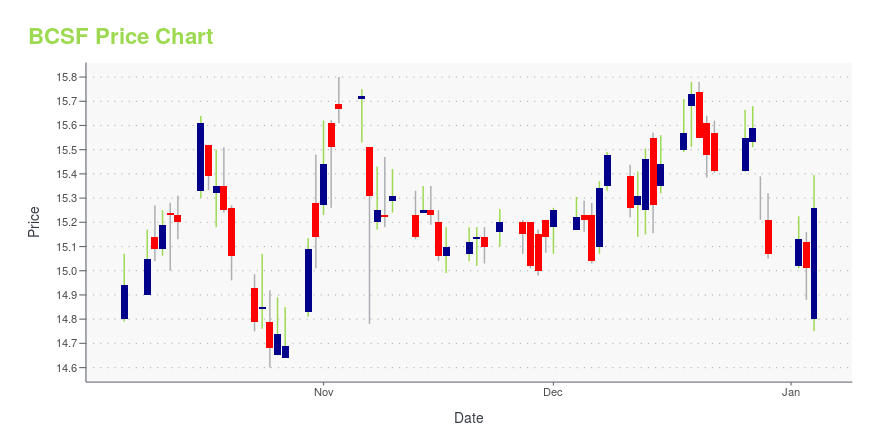

BCSF Stock Price Chart Interactive Chart >

Bain Capital Specialty Finance, Inc. (BCSF) Company Bio

Bain Capital Specialty Finance, Inc. operates as a business development company (BDC) specializing in direct loans to middle-market companies. The fund seeks to invest in senior investments with a first or second lien on collateral, senior first lien, stretch senior, senior second lien, unitranche, mezzanine debt, junior securities, other junior investments, and secondary purchases of assets or portfolios that primarily consist of middle-market corporate debt. It typically invests in companies with EBITDA between $10 million and $150 million.

Latest BCSF News From Around the Web

Below are the latest news stories about BAIN CAPITAL SPECIALTY FINANCE INC that investors may wish to consider to help them evaluate BCSF as an investment opportunity.

Bain Capital Specialty Finance, Inc. (NYSE:BCSF) Q3 2023 Earnings Call TranscriptBain Capital Specialty Finance, Inc. (NYSE:BCSF) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Good day, and welcome to the Bain Capital Specialty Finance Third Quarter Ended September 30, 2023, Earnings Conference Call. All participants will be in a listen-only mode. [Operator Instructions] Please note this event is being recorded. I would now like […] |

Q3 2023 Bain Capital Specialty Finance Inc Earnings CallQ3 2023 Bain Capital Specialty Finance Inc Earnings Call |

Bain Capital Specialty Finance Inc (BCSF) Reports Q3 2023 Earnings, Declares Q4 Dividend of $0. ...BCSF's Q3 2023 financial results show a strong quarter with net investment income per share at $0.55 and net income per share at $0.52 |

Bain Capital Specialty Finance, Inc. Announces September 30, 2023 Financial Results and Declares Fourth Quarter 2023 Dividend of $0.42 per ShareBOSTON, November 06, 2023--Bain Capital Specialty Finance, Inc. (NYSE: BCSF, the "Company", "our" or "we") today announced financial results for the third quarter ended September 30, 2023, and that its Board of Directors has declared a dividend of $0.42 per share for the fourth quarter of 2023. |

Bain to Buy Guidehouse in $5 Billion DealBain Capital said it would acquire Guidehouse, a consulting firm that advises government organizations and businesses, in a deal valuing it at $5.3 billion including debt. The Wall Street Journal reported on Sunday night that the parties were close to a deal. In 2018, Veritas Capital, which invests in businesses at the intersection of government and technology, acquired the U.S. public-sector consulting business of Big Four accounting firm PricewaterhouseCoopers for an undisclosed price and rebranded it as Guidehouse. |

BCSF Price Returns

| 1-mo | 3.32% |

| 3-mo | 4.77% |

| 6-mo | 14.17% |

| 1-year | 27.61% |

| 3-year | 51.48% |

| 5-year | 59.85% |

| YTD | 17.81% |

| 2023 | 41.95% |

| 2022 | -13.31% |

| 2021 | 36.98% |

| 2020 | -29.79% |

| 2019 | 28.19% |

BCSF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BCSF

Here are a few links from around the web to help you further your research on Bain Capital Specialty Finance Inc's stock as an investment opportunity:Bain Capital Specialty Finance Inc (BCSF) Stock Price | Nasdaq

Bain Capital Specialty Finance Inc (BCSF) Stock Quote, History and News - Yahoo Finance

Bain Capital Specialty Finance Inc (BCSF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...