Bright Scholar Education Holdings Limited American Depositary Shares, each representing one Class A Ordinary Share (BEDU): Price and Financial Metrics

BEDU Price/Volume Stats

| Current price | $1.99 | 52-week high | $3.23 |

| Prev. close | $2.11 | 52-week low | $0.81 |

| Day low | $1.99 | Volume | 3,496 |

| Day high | $2.11 | Avg. volume | 9,285 |

| 50-day MA | $2.06 | Dividend yield | N/A |

| 200-day MA | $1.67 | Market Cap | 59.15M |

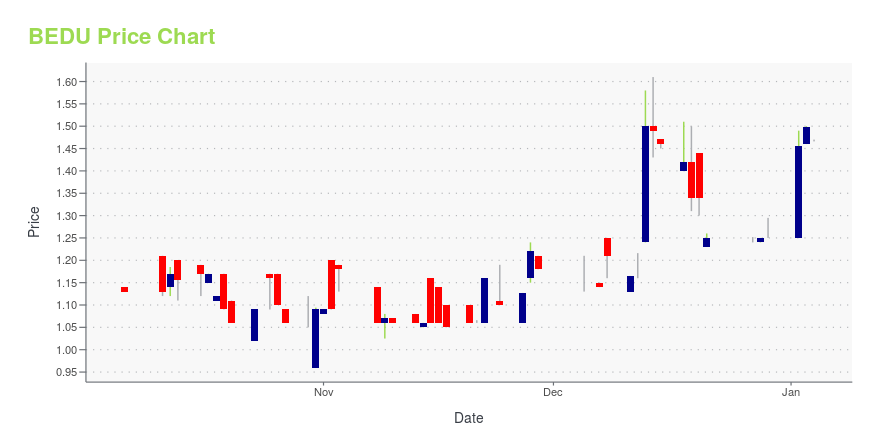

BEDU Stock Price Chart Interactive Chart >

Bright Scholar Education Holdings Limited American Depositary Shares, each representing one Class A Ordinary Share (BEDU) Company Bio

Bright Scholar Education Holdings Ltd. provides education services. The company offers K-12 international and bilingual education, training, education technology, and graduate education services. It operates 6 international schools, 11 bilingual schools, and 34 kindergartens in seven provinces; and 16 learning centers in Beijing, Shanghai, Shenzhen, and Foshan, China. The company was founded in 1994 and is based in Foshan, China.

Latest BEDU News From Around the Web

Below are the latest news stories about BRIGHT SCHOLAR EDUCATION HOLDINGS LTD that investors may wish to consider to help them evaluate BEDU as an investment opportunity.

Bright Scholar Announces Results of 2024 Annual General MeetingBright Scholar Education Holdings Limited ("Bright Scholar" or the "Company") (NYSE: BEDU), a global premier education service company, today announced that it held its 2024 annual general meeting of shareholders on December 19, 2023. At the meeting, the shareholders resolved by ordinary resolutions to ratify the appointment of (1) Deloitte Touche Tohmatsu Certified Public Accountants LLP as the independent registered public accounting firm of the Company for the fiscal year ended August 31, 202 |

Bright Scholar Announces Unaudited Financial Results for the Fourth Fiscal Quarter and Fiscal Year 2023Bright Scholar Education Holdings Limited ("Bright Scholar," the "Company," "we" or "our") (NYSE: BEDU), a global premier education service company, today announced its unaudited financial results for the fourth fiscal quarter and fiscal year ended August 31, 2023. |

Bright Scholar to Hold 2024 Annual General Meeting on December 19, 2023Bright Scholar Education Holdings Limited ("Bright Scholar" or the "Company") (NYSE: BEDU), a global premier education service company, today announced that it would hold its 2024 annual general meeting of shareholders at No.1, Country Garden Road, Beijiao Town, Shunde District, Foshan, Guangdong 528300, The People's Republic of China on December 19, 2023 at 10:00 a.m. (local time). The proposal to be submitted for shareholders' approval at the annual general meeting is the ratification of the a |

Bright Scholar Announces Unaudited Financial Results for the Third Fiscal Quarter of Fiscal 2023Bright Scholar Education Holdings Limited ("Bright Scholar," the "Company," "we" or "our") (NYSE: BEDU), a global premier education service company, today announced its unaudited financial results for the third fiscal quarter of fiscal 2023 ended May 31, 2023. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for another dive into the biggest pre-market stock movers as we check out the shares worth watching on Tuesday! |

BEDU Price Returns

| 1-mo | -0.50% |

| 3-mo | 2.84% |

| 6-mo | 40.14% |

| 1-year | 80.91% |

| 3-year | -84.87% |

| 5-year | -94.43% |

| YTD | 59.20% |

| 2023 | -48.22% |

| 2022 | -47.97% |

| 2021 | -79.24% |

| 2020 | -33.85% |

| 2019 | -3.27% |

Continue Researching BEDU

Want to do more research on Bright Scholar Education Holdings Ltd's stock and its price? Try the links below:Bright Scholar Education Holdings Ltd (BEDU) Stock Price | Nasdaq

Bright Scholar Education Holdings Ltd (BEDU) Stock Quote, History and News - Yahoo Finance

Bright Scholar Education Holdings Ltd (BEDU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...