Brookfield Renewable Corporation (BEPC): Price and Financial Metrics

BEPC Price/Volume Stats

| Current price | $28.46 | 52-week high | $32.83 |

| Prev. close | $28.10 | 52-week low | $21.35 |

| Day low | $28.13 | Volume | 556,144 |

| Day high | $28.53 | Avg. volume | 988,208 |

| 50-day MA | $30.15 | Dividend yield | 4.95% |

| 200-day MA | $26.92 | Market Cap | 5.11B |

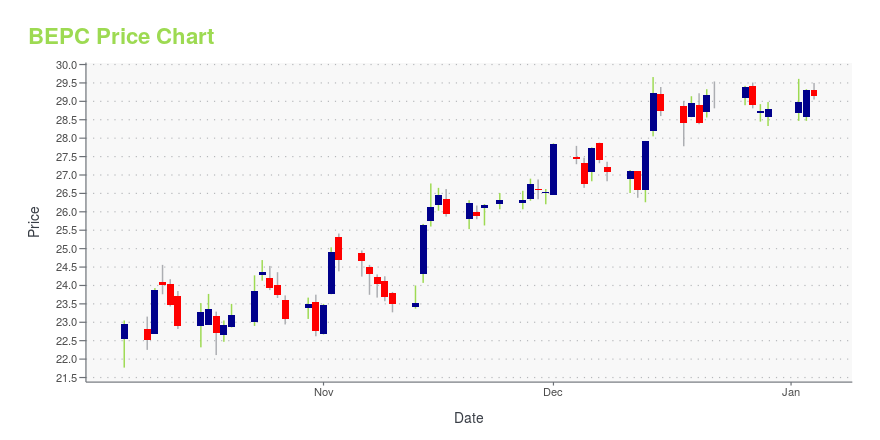

BEPC Stock Price Chart Interactive Chart >

Brookfield Renewable Corporation (BEPC) Company Bio

Brookfield Renewable Corporation operates renewable power assets in the United States, Brazil, and Colombia. It operates hydroelectric, wind, and solar power plants with an installed capacity of approximately 19,000 megawatts, as well as 18,000 megawatt of development pipeline. The company was founded in 2019 and is headquartered in New York, New York.

Latest BEPC News From Around the Web

Below are the latest news stories about BROOKFIELD RENEWABLE CORP that investors may wish to consider to help them evaluate BEPC as an investment opportunity.

Canada Growth Fund Announces Strategic Investment in Entropy Inc. and Carbon Credit Offtake CommitmentBROOKFIELD, NEWS, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) and Canada Growth Fund Inc. ("CGF") and Advantage Energy Ltd. (TSX: AAV) ("Advantage") today announce that CGF has entered into a strategic investment agreement with Entropy Inc. ("Entropy" or the "Company"), a Calgary-based developer of technologically-advanced carbon capture and sequestration ("CCS") projects with the potential to significantly reduce emissions in Canada and worldwide. CG |

Applied Digital Announces Long-Term Supply Agreement with TerraForm PowerDALLAS, Dec. 19, 2023 (GLOBE NEWSWIRE) -- Applied Digital Corporation (Nasdaq: APLD) ("Applied Digital " or the "Company"), a designer, builder, and operator of next-generation digital infrastructure designed for High-Performance Computing (“HPC”) applications, today announced TerraForm Power, owned by Brookfield, has entered into a long term Retail Electric Service Agreement with the Company for its 200-megawatt (“MW”) next-generation datacenter in Garden City, Texas. The Garden City facility d |

Brookfield Renewable Announces Renewal of Normal Course Issuer BidsAll amounts in US dollars unless otherwise indicated BROOKFIELD, News, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Brookfield Renewable today announced that the Toronto Stock Exchange (the “TSX”) has accepted notices filed by Brookfield Renewable Partners L.P. (TSX: BEP.UN; NYSE: BEP) (“BEP”) of its intention to renew its normal course issuer bids for its limited partnership units (“LP Units”) and Class A preferred limited partnership units (“Preferred Units”);Brookfield Renewable Corporation (TSX: BEPC; |

Brookfield Acknowledges Result of the Origin Energy Shareholder VoteSYDNEY, Australia, and TORONTO, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Brookfield Asset Management (NYSE: BAM, TSX: BAM), together with its listed affiliate Brookfield Renewable Partners (NYSE: BEP, BEPC; TSX BEP.UN, BEPC), acknowledges the announcement today by Origin Energy Limited (“Origin”) (ASX: ORG) of the result of Origin’s shareholder vote in respect of the previously announced Scheme of Arrangement with Brookfield, its institutional investors, and EIG. Origin’s shareholders voted 69% in favo |

If You Can Only Buy One Solar Stock in December, It Better Be One of These 3 NamesSolar stocks, like other companies leading the transition into clean energy, still have a lot of gas left in the tank to surge higher. |

BEPC Price Returns

| 1-mo | -2.40% |

| 3-mo | 23.49% |

| 6-mo | 4.41% |

| 1-year | -4.95% |

| 3-year | -24.28% |

| 5-year | N/A |

| YTD | 1.47% |

| 2023 | 9.52% |

| 2022 | -22.49% |

| 2021 | -34.95% |

| 2020 | N/A |

| 2019 | N/A |

BEPC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...