Blue Hat Interactive Entertainment Technology (BHAT): Price and Financial Metrics

BHAT Price/Volume Stats

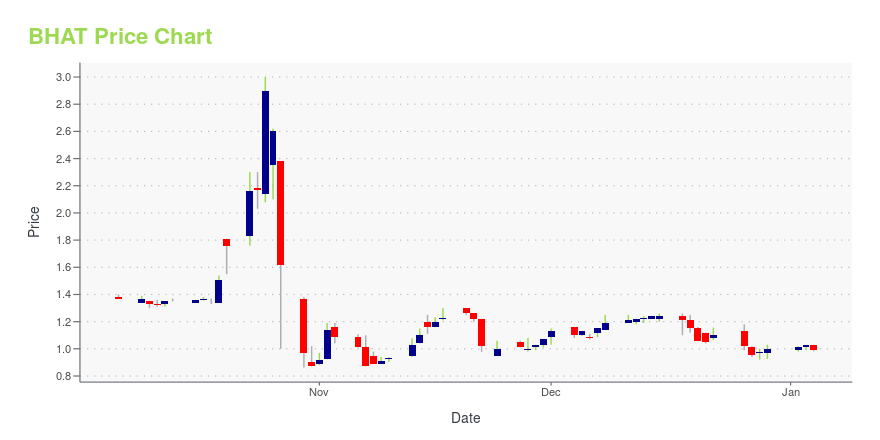

| Current price | $1.20 | 52-week high | $3.00 |

| Prev. close | $1.23 | 52-week low | $0.70 |

| Day low | $1.10 | Volume | 137,245 |

| Day high | $1.20 | Avg. volume | 99,264 |

| 50-day MA | $1.09 | Dividend yield | N/A |

| 200-day MA | $1.20 | Market Cap | 17.52M |

BHAT Stock Price Chart Interactive Chart >

Blue Hat Interactive Entertainment Technology (BHAT) Company Bio

Blue Hat Interactive Entertainment Technology is a holding company, which engages in the production, development, and operation of augmented reality (AR) interactive entertainment games and toys. It offers the following AR interactive product lines: AR Racer, AR Need a Spanking, AR 3D Magic Box, and AR Picture Book. AR Racer is a car-racing mobile game with a small physical toy car that is placed onto the user’s mobile device screen. AR Need a Spanking is a combat game with a ladybug shaped electronic toy. AR 3D Magic Box uses AR recognition technology to allow children to draw shapes or objects onto a physical card while the mobile game captures the drawings and animates them in a set background. AR Picture Book provides an educational and interactive experience that allows stories to come to life. The company was founded on June 13, 2018 and is headquartered in Xiamen, China.

Latest BHAT News From Around the Web

Below are the latest news stories about BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY that investors may wish to consider to help them evaluate BHAT as an investment opportunity.

Fujian Blue Hat Interactive Entertainment Technology First Half 2023 Earnings: US$0.36 loss per share (vs US$1.02 loss in 1H 2022)Fujian Blue Hat Interactive Entertainment Technology ( NASDAQ:BHAT ) First Half 2023 Results Key Financial Results... |

Blue Hat Announces Financial Results for the First Half of 2023, Highlighted by 5,657.93% Increase in Revenues to $46.30 millionXIAMEN, China, Dec. 22, 2023 (GLOBE NEWSWIRE) -- Blue Hat Interactive Entertainment Technology (“Blue Hat” or the “Company”) (NASDAQ: BHAT), primarily a company of commodity trading in China, today announced its unaudited financial results for the six months ended June 30, 2023 (“First Half of 2023”). First Half of 2023 Financial Highlights First Half of 2023 total revenues of US$46.30 million, compared to US$0.80 million in the prior-year period, due to that increased commodity trading.First Ha |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayWe're starting off Wednesday with a breakdown of the biggest pre-market stock movers investors will want to keep track of today! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start off Thursday with a breakdown of the biggest pre-market stock movers investors will want to watch this morning. |

BHAT Enters Gold Purchasing AgreementOctober 26th, 2023, a wholly owned subsidiary of Blue Hat Interactive Entertainment Technology Ltd. (Nasdaq: BHAT), a Nasdaq listed company, signed a framework agreement with Macau Rongxin Precious Metals Technology Ltd., to purchase 1000 kilograms of gold. |

BHAT Price Returns

| 1-mo | 14.29% |

| 3-mo | 16.50% |

| 6-mo | 10.09% |

| 1-year | 41.29% |

| 3-year | -89.66% |

| 5-year | N/A |

| YTD | 20.00% |

| 2023 | 162.95% |

| 2022 | -91.21% |

| 2021 | -51.39% |

| 2020 | -55.73% |

| 2019 | N/A |

Loading social stream, please wait...