Bausch Health Companies Inc. (BHC): Price and Financial Metrics

BHC Price/Volume Stats

| Current price | $5.99 | 52-week high | $11.46 |

| Prev. close | $5.88 | 52-week low | $3.96 |

| Day low | $5.69 | Volume | 5,184,100 |

| Day high | $6.04 | Avg. volume | 3,272,761 |

| 50-day MA | $6.74 | Dividend yield | N/A |

| 200-day MA | $7.78 | Market Cap | 2.16B |

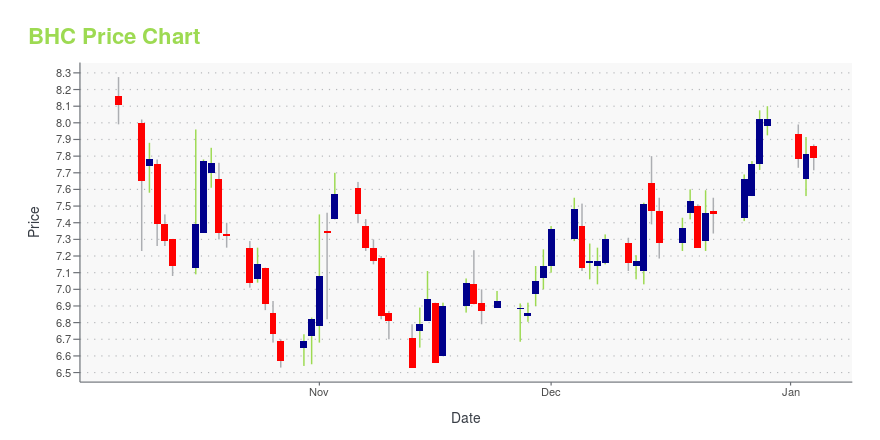

BHC Stock Price Chart Interactive Chart >

Bausch Health Companies Inc. (BHC) Company Bio

Bausch Health Cos. Inc. (formerly) Valeant Pharmaceuticals is engaged in developing, manufacturing, and marketing a range of branded, generic and branded generic pharmaceuticals, over-the-counter products, and medical devices, including contact lenses, intraocular lenses, ophthalmic surgical equipment, and aesthetics devices. The company was founded in 1983 and is based in Laval, Canada.

Latest BHC News From Around the Web

Below are the latest news stories about BAUSCH HEALTH COMPANIES INC that investors may wish to consider to help them evaluate BHC as an investment opportunity.

Bausch Health (BHC) Ulcerative Colitis Drug Meets Primary GoalBausch's (BHC) amiselimod achieves the primary and key secondary endpoints, including clinical and endoscopic measures, in the double-blind period of a phase II study. |

Bausch Health Announces Positive Topline Results From Global Phase 2 Study Evaluating Amiselimod (an S1P antagonist) to Treat Ulcerative ColitisTrial Meets Both Primary and Key Secondary Endpoints LAVAL, QC / ACCESSWIRE / December 21, 2023 / Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC) ("Bausch Health" or the "Company") today announced positive topline results from the Company's Phase ... |

Are Medical Stocks Lagging Bausch Health (BHC) This Year?Here is how Bausch Health (BHC) and Connect Biopharma Holdings Limited Sponsored ADR (CNTB) have performed compared to their sector so far this year. |

DUOBRII(TM) Lotion to Treat Moderate to Severe Plaque Psoriasis Now Available Through Quebec’s Public Drug PlanLAVAL, QC / ACCESSWIRE / December 18, 2023 / Bausch Health, Canada, part of Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC), ("Bausch Health" or the "Company") today announced that DUOBRII™ (0.01% w/w halobetasol propionate and 0.045% w/w tazarotene), ... |

Implied Volatility Surging for On Bausch Health Companies (BHC) Stock OptionsInvestors need to pay close attention to Bausch Health Companies (BHC) stock based on the movements in the options market lately. |

BHC Price Returns

| 1-mo | -11.78% |

| 3-mo | -31.23% |

| 6-mo | -26.77% |

| 1-year | -36.00% |

| 3-year | -78.68% |

| 5-year | -74.84% |

| YTD | -25.31% |

| 2023 | 27.71% |

| 2022 | -77.25% |

| 2021 | 32.74% |

| 2020 | -30.48% |

| 2019 | 61.99% |

Continue Researching BHC

Want to do more research on Bausch Health Companies Inc's stock and its price? Try the links below:Bausch Health Companies Inc (BHC) Stock Price | Nasdaq

Bausch Health Companies Inc (BHC) Stock Quote, History and News - Yahoo Finance

Bausch Health Companies Inc (BHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...