BigCommerce Holdings Inc. (BIGC): Price and Financial Metrics

BIGC Price/Volume Stats

| Current price | $8.35 | 52-week high | $12.75 |

| Prev. close | $8.30 | 52-week low | $5.62 |

| Day low | $8.23 | Volume | 422,149 |

| Day high | $8.50 | Avg. volume | 692,257 |

| 50-day MA | $7.97 | Dividend yield | N/A |

| 200-day MA | $8.10 | Market Cap | 645.25M |

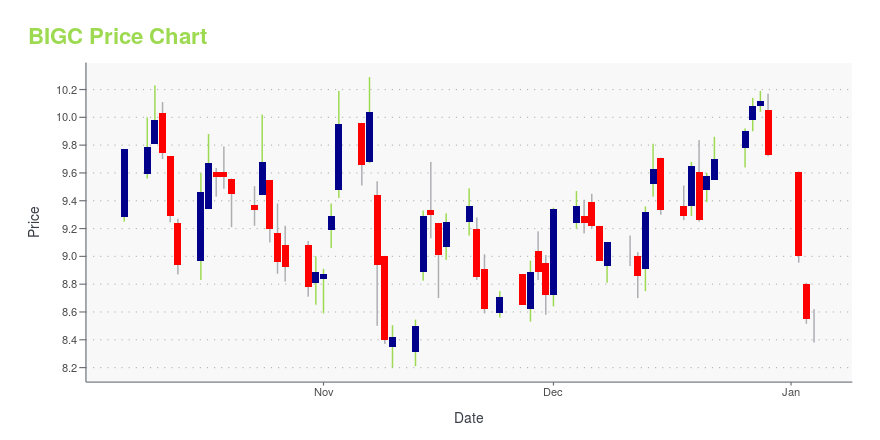

BIGC Stock Price Chart Interactive Chart >

BigCommerce Holdings Inc. (BIGC) Company Bio

BigCommerce Holdings, Inc. provides technology services. Its software-as-a-service platform powers its customers branded e-commerce stores and their cross-channel connectionsto online marketplaces, social networks, and offline point-of-sale (POS) systems. The company was founded in 2009 and is headquartered in Austin, TX.

Latest BIGC News From Around the Web

Below are the latest news stories about BIGCOMMERCE HOLDINGS INC that investors may wish to consider to help them evaluate BIGC as an investment opportunity.

BigCommerce Named a Leader in IDC MarketScape: Worldwide B2B Digital Commerce Applications for MidMarket GrowthAUSTIN, Texas, December 18, 2023--BigCommerce is also recognized as a Major Player in Enterprise B2B Digital Commerce Applications by IDC MarketScape |

Coldwater Creek Transforms its Ecommerce with BigCommerce and a Future-Proof Technology StackAUSTIN, Texas, December 13, 2023--BigCommerce (Nasdaq: BIGC), a leading Open SaaS ecommerce platform for fast-growing and established B2C and B2B brands, today announced Coldwater Creek, a leading specialty retailer of women’s apparel, has launched a new ecommerce site with a modernized tech stack on the BigCommerce platform. |

Waterfront Brands Selects BigCommerce to Optimize New Boat Lift Warehouse Online Store For GrowthAUSTIN, Texas, December 11, 2023--Leading waterfront equipment manufacturer adds fourth brand to the BigCommerce platform, citing ease-of-use and flexibility |

Is There An Opportunity With BigCommerce Holdings, Inc.'s (NASDAQ:BIGC) 33% Undervaluation?Key Insights BigCommerce Holdings' estimated fair value is US$13.81 based on 2 Stage Free Cash Flow to Equity Current... |

Implied Volatility Surging for BigCommerce (BIGC) Stock OptionsInvestors need to pay close attention to BigCommerce (BIGC) stock based on the movements in the options market lately. |

BIGC Price Returns

| 1-mo | 9.87% |

| 3-mo | 41.53% |

| 6-mo | 1.21% |

| 1-year | -16.08% |

| 3-year | -87.71% |

| 5-year | N/A |

| YTD | -14.18% |

| 2023 | 11.33% |

| 2022 | -75.29% |

| 2021 | -44.86% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...