Bilibili Inc. ADR (BILI): Price and Financial Metrics

BILI Price/Volume Stats

| Current price | $14.94 | 52-week high | $19.15 |

| Prev. close | $14.61 | 52-week low | $8.80 |

| Day low | $14.72 | Volume | 4,102,284 |

| Day high | $15.30 | Avg. volume | 7,049,655 |

| 50-day MA | $15.54 | Dividend yield | N/A |

| 200-day MA | $12.80 | Market Cap | 6.17B |

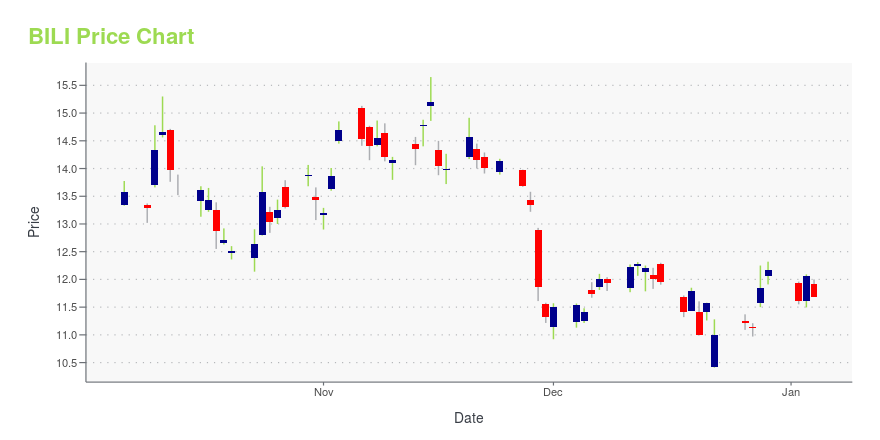

BILI Stock Price Chart Interactive Chart >

Bilibili Inc. ADR (BILI) Company Bio

Bilibili (stylized bilibili), nicknamed B Site (B站, B Zhàn), is a video sharing website based in Shanghai where users can submit, view and add overlaid commentary on videos. Since the mid-2010s, Bilibili began to expand to a broader audience from its original niche market that focused on animation, comics, and games (ACG), and it has become one of the major Chinese over-the-top streaming platforms serving videos on demand such as documentaries, variety shows, and other original programming. (Source:Wikipedia)

Latest BILI News From Around the Web

Below are the latest news stories about BILIBILI INC that investors may wish to consider to help them evaluate BILI as an investment opportunity.

Bilibili's top bullet comment of 2023 is "ah?" as users expressed surprise 13 million times this yearChinese video streaming platform Bilibili's word of 2023 is a single-character question of shock: Ah? The word, written simply as a in pinyin, was used as an interrogative clause 13.2 million times on the platform this year, flooding viewers' screens in Bilibili's famed "bullet comments", which whisk by in horizontal streams atop videos as people watch. The Shanghai-based company called the word, expressed with a question mark, the "most representative bullet comment" of 2023 in a post to its of |

Bilibili Inc. (NASDAQ:BILI) Q3 2023 Earnings Call TranscriptBilibili Inc. (NASDAQ:BILI) Q3 2023 Earnings Call Transcript November 29, 2023 Bilibili Inc. misses on earnings expectations. Reported EPS is $-2.12 EPS, expectations were $-0.24. Operator: Good day, and welcome to the Bilibili Third Quarter 2023 Financial Results and Business Update Conference Call. Today’s conference call is being recorded. At this time, I would like […] |

Company News for Nov 30, 2023Companies in The News Are: FL,BILI,HPE,INTU |

Okta hit with 6 downgrades following Q3 earnings: 4 big analyst cutsBarclays downgraded Bilibili to Underweight from Equalweight and cut its price target to $10.00 from $15.00. Meanwhile, Nomura/Instinet cut its rating to Neutral from Buy. |

Q3 2023 Bilibili Inc Earnings CallQ3 2023 Bilibili Inc Earnings Call |

BILI Price Returns

| 1-mo | -9.18% |

| 3-mo | 13.87% |

| 6-mo | 56.44% |

| 1-year | -7.78% |

| 3-year | -81.94% |

| 5-year | -6.39% |

| YTD | 22.76% |

| 2023 | -48.63% |

| 2022 | -48.94% |

| 2021 | -45.87% |

| 2020 | 360.37% |

| 2019 | 27.62% |

Continue Researching BILI

Here are a few links from around the web to help you further your research on Bilibili Inc's stock as an investment opportunity:Bilibili Inc (BILI) Stock Price | Nasdaq

Bilibili Inc (BILI) Stock Quote, History and News - Yahoo Finance

Bilibili Inc (BILI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...