BIMI International Medical Inc. (BIMI): Price and Financial Metrics

BIMI Price/Volume Stats

| Current price | $1.23 | 52-week high | $4.13 |

| Prev. close | $1.29 | 52-week low | $1.01 |

| Day low | $1.20 | Volume | 41,394 |

| Day high | $1.33 | Avg. volume | 67,624 |

| 50-day MA | $1.33 | Dividend yield | N/A |

| 200-day MA | $1.86 | Market Cap | 14.20M |

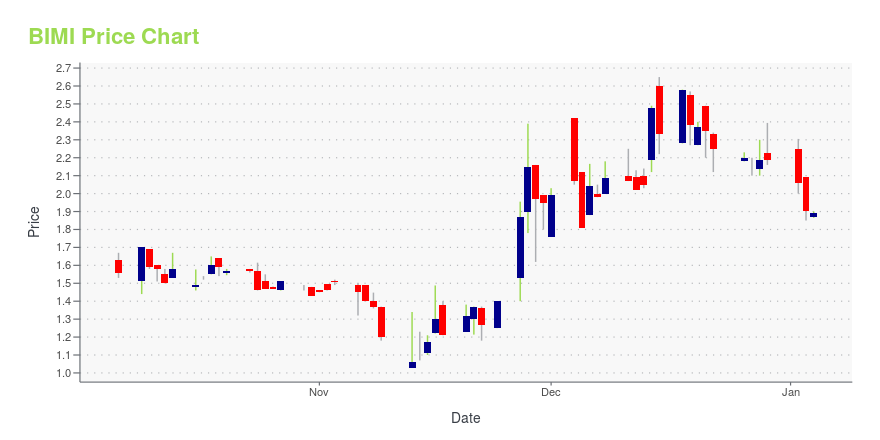

BIMI Stock Price Chart Interactive Chart >

BIMI International Medical Inc. (BIMI) Company Bio

BIMI International Medical, Inc. engages in the provision of healthcare products. It deals with the retail and wholesale of medical devices, pharmaceuticals, and other relates services. It intends to establish a chain of hospitals specializing in obstetrics and gynecology. The company was founded on October 31, 2000 and is headquartered in Chongqing, China.

Latest BIMI News From Around the Web

Below are the latest news stories about BIMI INTERNATIONAL MEDICAL INC that investors may wish to consider to help them evaluate BIMI as an investment opportunity.

BIMI Stock Earnings: BIMI Intl Medical Reported Results for Q3 2023BIMI Intl Medical just reported results for the third quarter of 2023. |

BIMI International Medical Inc. Announces Third Quarter 2023 Financial ResultsNEW YORK, Dec. 19, 2023 (GLOBE NEWSWIRE) -- BIMI International Medical Inc. (the “Company”), a leading medical solutions provider, today announced its financial results for the three months and nine months ended September 30, 2023. Revenues for the three months ended September 30, 2023 and 2022 were $2,523,193 and $4,932,479, respectively. Revenues for the nine months ended September 30, 2023 and 2022 were $11,278,496 and $10,476,224, respectively. The revenues of the Zhongshan, Qiangsheng, Eura |

BIMI Announces Buyback of WarrantsNEW YORK, NY, Nov. 28, 2023 (GLOBE NEWSWIRE) -- BIMI International Medical Inc. (NASDAQ: BIMI, "BIMI"), a healthcare products and services provider, today announced its entry into material definitive agreements with certain of its warrant holders, pursuant to which BIMI agreed to buy back an aggregate of 7,066,913 warrants to purchase shares of common stock of the Company from these warrant holders. BIMI agreed to pay $0.30 for each share of common stock underlying the warrant, or an aggregate p |

BIMI Receives Nasdaq Notification of Non-Compliance with Listing Rule 5250(c)(1)NEW YORK, Nov. 27, 2023 (GLOBE NEWSWIRE) -- BIMI International Medical Inc. (the “Company”) today announced that on November 21, 2023, the Company received a notification letter from The Nasdaq Stock Market LLC (“Nasdaq”) stating that, because the Company has not yet filed its Quarterly Report on Form 10-Q for the period ended September 30, 2023 (the “Third Quarter Form 10-Q”), the Company is no longer in compliance with Nasdaq Listing Rule 5250(c)(1). Nasdaq Listing Rule 5250(c)(1) requires lis |

BIMI International Medical Inc. Announces Second Quarter 2023 Financial ResultsNEW YORK, Nov. 27, 2023 (GLOBE NEWSWIRE) -- BIMI International Medical Inc. (the “Company”), a leading medical solutions provider, today announced its financial results for the three months ended June 30, 2023. The Company reported a significant increase in gross margin underlining the ongoing success of its business strategy and operational effectiveness. Revenues for the six months ended June 30, 2023 and 2022 were $8,755,303 and $5,543,745, respectively. Compared with the same period in 2022, |

BIMI Price Returns

| 1-mo | -7.10% |

| 3-mo | 0.00% |

| 6-mo | -58.45% |

| 1-year | -60.83% |

| 3-year | -97.68% |

| 5-year | -99.00% |

| YTD | -43.84% |

| 2023 | 78.05% |

| 2022 | -95.18% |

| 2021 | -69.46% |

| 2020 | -47.65% |

| 2019 | -79.72% |

Continue Researching BIMI

Want to do more research on BOQI International Medical Inc's stock and its price? Try the links below:BOQI International Medical Inc (BIMI) Stock Price | Nasdaq

BOQI International Medical Inc (BIMI) Stock Quote, History and News - Yahoo Finance

BOQI International Medical Inc (BIMI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...