Bakkt Holdings, Inc. (BKKT): Price and Financial Metrics

BKKT Price/Volume Stats

| Current price | $18.84 | 52-week high | $37.21 |

| Prev. close | $18.46 | 52-week low | $6.81 |

| Day low | $18.02 | Volume | 270,846 |

| Day high | $19.49 | Avg. volume | 466,812 |

| 50-day MA | $13.43 | Dividend yield | N/A |

| 200-day MA | $15.58 | Market Cap | 262.08M |

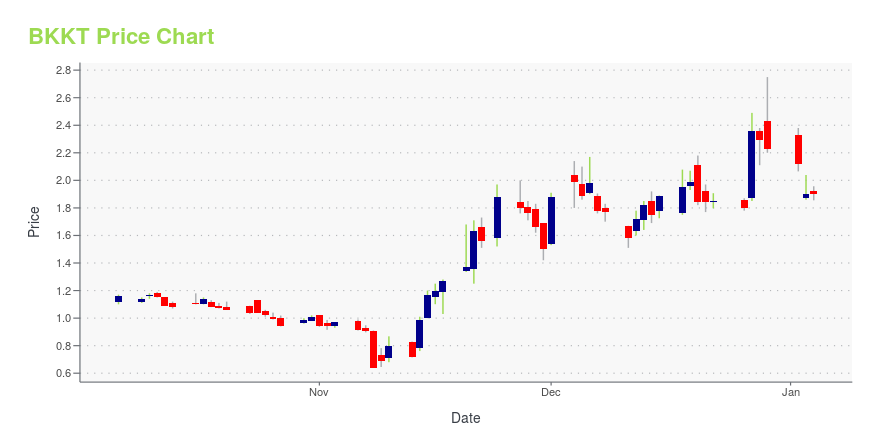

BKKT Stock Price Chart Interactive Chart >

Bakkt Holdings, Inc. (BKKT) Company Bio

Bakkt Holdings, LLC, through its subsidiary, operates as a crypto derivatives provider. It offers custody of bitcoins. The company was founded in 2018 and is headquartered in Atlanta, Georgia. Bakkt Holdings, LLC operates as a subsidiary of Intercontinental Exchange Holdings, Inc.

BKKT Price Returns

| 1-mo | 53.05% |

| 3-mo | 131.73% |

| 6-mo | -27.84% |

| 1-year | -13.54% |

| 3-year | -69.37% |

| 5-year | N/A |

| YTD | -23.94% |

| 2024 | -55.57% |

| 2023 | 87.39% |

| 2022 | -86.02% |

| 2021 | -15.58% |

| 2020 | N/A |

Loading social stream, please wait...