Booking Holdings Inc. (BKNG): Price and Financial Metrics

BKNG Price/Volume Stats

| Current price | $3,700.99 | 52-week high | $4,144.32 |

| Prev. close | $3,659.88 | 52-week low | $2,733.04 |

| Day low | $3,659.15 | Volume | 233,990 |

| Day high | $3,714.24 | Avg. volume | 249,533 |

| 50-day MA | $3,878.66 | Dividend yield | 0.89% |

| 200-day MA | $3,517.57 | Market Cap | 125.57B |

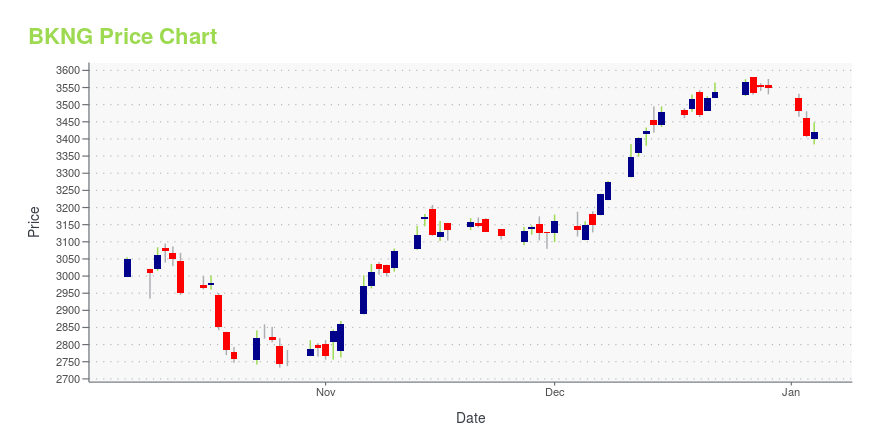

BKNG Stock Price Chart Interactive Chart >

Booking Holdings Inc. (BKNG) Company Bio

Booking Holdings (Formerly Priceline Group) is a provider of online travel and travel related reservation and search services. The Company, through its online travel agent services, connects consumers wishing to make travel reservations with providers of travel services across the world. The company was founded in 1997 and is based in Norwalk, Connecticut.

Latest BKNG News From Around the Web

Below are the latest news stories about BOOKING HOLDINGS INC that investors may wish to consider to help them evaluate BKNG as an investment opportunity.

Travel and Leisure Titans: 3 Stocks Set to Soar in 2024These travel and leisure stocks are high-quality businesses with robust shareholder return programs that will support more gains in 2024. |

Stocks, sectors that reached record highs in 20232023 — and the month of December — has been a year for record gains across various sectors and stocks, such as homebuilders and tech companies. Yahoo Finance's Jared Blikre highlights several stocks and industries that have reached new highs year-to-date. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

Here’s Why Booking Holdings (BKNG) Rose in Q3ClearBridge Investments, an investment management company, released its “ClearBridge Sustainability Leaders Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. The strategy underperformed its benchmark, the Russell 3000 Index, in the quarter. The strategy gained two out of 10 sectors in which it invested during the quarter, on an absolute […] |

13 Most Profitable Robinhood StocksIn this article, we discuss the 13 most profitable Robinhood stocks. If you want to read about some more Robinhood stocks, go directly to 5 Most Profitable Robinhood Stocks. The stock picking habits of retail investors who use platforms like Reddit to strategize and stock trading applications like Robinhood Markets, Inc. (NASDAQ:HOOD) to carry out […] |

25 Countries That Welcome Americans With Open ArmsIn this article, we will take a look at the 25 countries that welcome Americans with open arms. If you want to skip our discussion on the global perception of Americans, you can go directly to the 5 Countries That Welcome Americans With Open Arms. With a considerable number of Americans eager to travel abroad, […] |

BKNG Price Returns

| 1-mo | -7.07% |

| 3-mo | 5.35% |

| 6-mo | 5.67% |

| 1-year | 25.82% |

| 3-year | 65.57% |

| 5-year | 89.08% |

| YTD | 4.84% |

| 2023 | 76.02% |

| 2022 | -16.00% |

| 2021 | 7.72% |

| 2020 | 8.45% |

| 2019 | 19.24% |

BKNG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BKNG

Want to do more research on Booking Holdings Inc's stock and its price? Try the links below:Booking Holdings Inc (BKNG) Stock Price | Nasdaq

Booking Holdings Inc (BKNG) Stock Quote, History and News - Yahoo Finance

Booking Holdings Inc (BKNG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...