Blue Bird Corporation (BLBD): Price and Financial Metrics

BLBD Price/Volume Stats

| Current price | $51.87 | 52-week high | $59.40 |

| Prev. close | $49.79 | 52-week low | $17.59 |

| Day low | $50.44 | Volume | 356,342 |

| Day high | $52.73 | Avg. volume | 560,795 |

| 50-day MA | $53.08 | Dividend yield | N/A |

| 200-day MA | $34.44 | Market Cap | 1.68B |

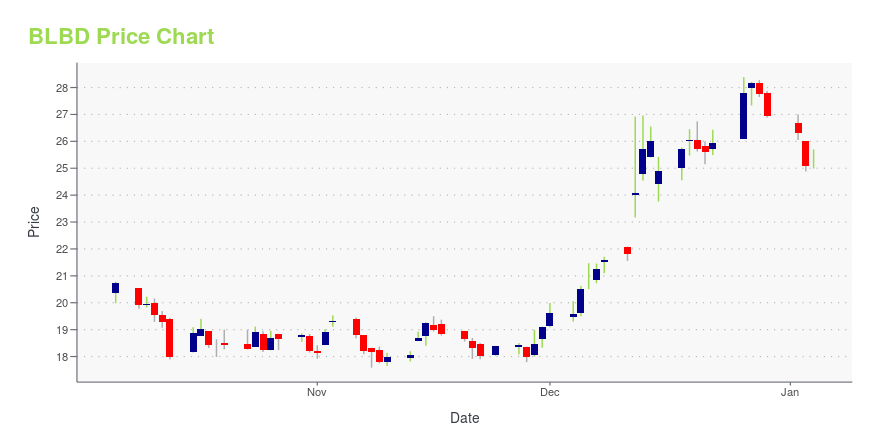

BLBD Stock Price Chart Interactive Chart >

Blue Bird Corporation (BLBD) Company Bio

Blue Bird Corporation designs, engineers, manufactures, and sells school buses and aftermarket parts in the United States and internationally. The company was founded in 2013 and is based in Fort Valley, Georgia.

Latest BLBD News From Around the Web

Below are the latest news stories about BLUE BIRD CORP that investors may wish to consider to help them evaluate BLBD as an investment opportunity.

Blue Bird Corp CEO Phil Horlock Sells 40,000 SharesOn December 26, 2023, Phil Horlock, the CEO of Blue Bird Corp (NASDAQ:BLBD), sold 40,000 shares of the company's stock, according to a recent SEC Filing. |

Peabody Energy, Janus International, and More Stocks See Action From Activist InvestorsActivists file with the SEC on Liquidia, Janus International Group, Peabody Energy, Disc Medicine, and Blue Bird. |

Auto Roundup: GM's Cruise Layoff Update, BLBD's Quarterly Release & MoreWhile General Motors' Cruise trims its workforce by 24%, Blue Bird (BLBD) delivers a comprehensive beat for the fiscal fourth quarter of 2023 and raises fiscal 2024 forecasts. |

Further Upside For Blue Bird Corporation (NASDAQ:BLBD) Shares Could Introduce Price Risks After 32% BounceBlue Bird Corporation ( NASDAQ:BLBD ) shareholders have had their patience rewarded with a 32% share price jump in the... |

Insider Sell: CEO Phil Horlock Sells 30,000 Shares of Blue Bird Corp (BLBD)Blue Bird Corp (NASDAQ:BLBD), a leading manufacturer of school buses, has recently witnessed a significant insider sell by its CEO, Phil Horlock. |

BLBD Price Returns

| 1-mo | -3.53% |

| 3-mo | 52.69% |

| 6-mo | 85.18% |

| 1-year | 153.40% |

| 3-year | 108.98% |

| 5-year | 149.02% |

| YTD | 92.40% |

| 2023 | 151.73% |

| 2022 | -31.52% |

| 2021 | -14.35% |

| 2020 | -20.33% |

| 2019 | 26.00% |

Continue Researching BLBD

Want to see what other sources are saying about Blue Bird Corp's financials and stock price? Try the links below:Blue Bird Corp (BLBD) Stock Price | Nasdaq

Blue Bird Corp (BLBD) Stock Quote, History and News - Yahoo Finance

Blue Bird Corp (BLBD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...