Bausch + Lomb Corporation (BLCO): Price and Financial Metrics

BLCO Price/Volume Stats

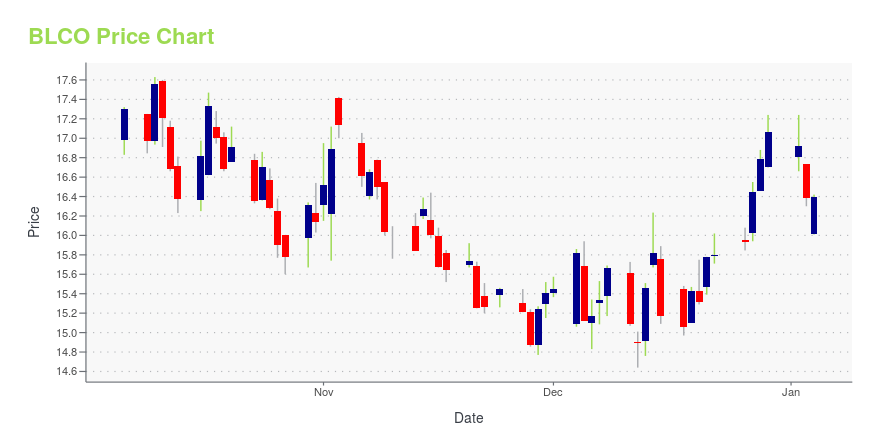

| Current price | $15.81 | 52-week high | $20.30 |

| Prev. close | $15.53 | 52-week low | $13.16 |

| Day low | $15.36 | Volume | 416,800 |

| Day high | $15.81 | Avg. volume | 496,082 |

| 50-day MA | $15.33 | Dividend yield | N/A |

| 200-day MA | $15.54 | Market Cap | 5.56B |

BLCO Stock Price Chart Interactive Chart >

Bausch + Lomb Corporation (BLCO) Company Bio

Bausch + Lomb Corporation operates as an eye health company in Canada and internationally. It operates through three segments: Vision Care/Consumer Health Care, Ophthalmic Pharmaceuticals, and Surgical. The Vision Care/Consumer Health Care segment provides contact lens that cover the spectrum of wearing modalities, including daily disposable and frequently replaced contact lenses; and contact lens care products, over-the-counter eye drops, eye vitamins, and mineral supplements that address various conditions comprising eye allergies, conjunctivitis, and dry eye. The Ophthalmic Pharmaceuticals segment offers proprietary and generic pharmaceutical products for post-operative treatments and treatments for various eye conditions, such as glaucoma, eye inflammation, ocular hypertension, dry eyes, and retinal diseases; and and contact lenses for therapeutic use. The Surgical segment provides medical device equipment, consumables, and instrumental tools and technologies for the treatment of corneal, cataracts, and vitreous and retinal eye conditions. The company was founded in 1853 and is headquartered in Vaughan, Canada.

Latest BLCO News From Around the Web

Below are the latest news stories about BAUSCH & LOMB CORP that investors may wish to consider to help them evaluate BLCO as an investment opportunity.

Bausch + Lomb CEO Brent Saunders Pays $35.35 Million for Cher’s Former Miami Beach HomeBausch + Lomb CEO Brent Saunders has purchased Cher’s former waterfront home in Miami Beach, Fla., for $35.35 million. The La Gorce Island home, which Cher owned in the 1990s, hit the market three months ago for $42.5 million. Saunders, who is also the former CEO of the Botox maker Allergan, said he bought the property with his wife, Daniela Botero Correa. |

Is Bausch + Lomb Corporation (NYSE:BLCO) Trading At A 39% Discount?Key Insights Using the 2 Stage Free Cash Flow to Equity, Bausch + Lomb fair value estimate is US$25.50 Current share... |

Bausch + Lomb Reports More Than 76 Million Units of Contact Lenses, Lens Care and Eye Care Materials Collected Through ONE By ONE and Biotrue® Eye Care Recycling ProgramsVAUGHAN, Ontario, November 15, 2023--Bausch + Lomb Corporation (NYSE/TSX: BLCO), a leading global eye health company dedicated to helping people see better to live better, today announced its exclusive ONE by ONE and Biotrue Eye Care Recycling programs have collected a total of 76,645,000 million units, or 464,100 pounds, of used contact lenses, eye care and lens care materials in the United States, which is equivalent to the weight of 140 hippos1. |

Bausch & Lomb Corp (BLCO) Reports Q3 2023 Earnings and Raises Full-Year GuidanceRevenue Grows 7% to $1.007 Billion, Despite Net Loss of $84 Million |

Bausch + Lomb Announces Third-Quarter 2023 Results and Raises Full-Year 2023 GuidanceVAUGHAN, Ontario, November 01, 2023--Bausch + Lomb Corporation (NYSE/TSX: BLCO), a leading global eye health company dedicated to helping people see better to live better, today announced its third-quarter 2023 financial results. |

BLCO Price Returns

| 1-mo | 7.04% |

| 3-mo | 6.90% |

| 6-mo | 10.02% |

| 1-year | -18.25% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -7.33% |

| 2023 | 9.99% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...