Ballard Power Systems, Inc. (BLDP): Price and Financial Metrics

BLDP Price/Volume Stats

| Current price | $2.30 | 52-week high | $5.11 |

| Prev. close | $2.25 | 52-week low | $2.14 |

| Day low | $2.24 | Volume | 1,493,404 |

| Day high | $2.32 | Avg. volume | 2,804,539 |

| 50-day MA | $2.64 | Dividend yield | N/A |

| 200-day MA | $3.10 | Market Cap | 688.60M |

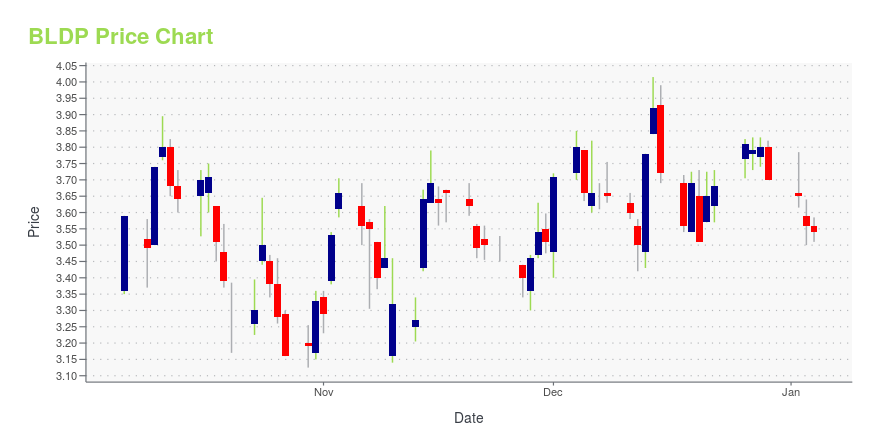

BLDP Stock Price Chart Interactive Chart >

Ballard Power Systems, Inc. (BLDP) Company Bio

Ballard Power Systems Inc. engages in the development and commercialization of proton exchange membrane fuel cells worldwide. The company is primarily involved in the design, development, manufacture, sale, and service of fuel cell stacks, modules, and systems for various applications. The company was founded in 1979 and is based in Burnaby, Canada.

Latest BLDP News From Around the Web

Below are the latest news stories about BALLARD POWER SYSTEMS INC that investors may wish to consider to help them evaluate BLDP as an investment opportunity.

3 High-Stakes Hydrogen Stocks With Million Dollar PotentialHydrogen stocks should be on every growth investors' watch list. |

3 Hydrogen Stocks to Turn $10,000 Into $1 Million: December 2023These millionaire-maker hydrogen stocks are worth considering for multiplying your investment returns. |

Invest in Clean Energy: 3 Essential Hydrogen StocksHydrogen is becoming one of the energy sector's most valuable commodities. |

5 ‘Jackpot’ Stocks to Buy for 2024 for 10X GainsThese stocks to buy have the potential to take your portfolio to the next level thanks to the cutting-edge technology they represent. |

If You Can Only Buy One Hydrogen Stock in December, It Better Be One of These 3 NamesIf you have to pick one hydrogen stock to end the year strong, it better be one of these three names filled with upside. |

BLDP Price Returns

| 1-mo | 0.88% |

| 3-mo | -11.54% |

| 6-mo | -29.88% |

| 1-year | -48.31% |

| 3-year | -85.19% |

| 5-year | -44.44% |

| YTD | -37.84% |

| 2023 | -22.76% |

| 2022 | -61.86% |

| 2021 | -46.32% |

| 2020 | 225.91% |

| 2019 | 200.42% |

Continue Researching BLDP

Here are a few links from around the web to help you further your research on Ballard Power Systems Inc's stock as an investment opportunity:Ballard Power Systems Inc (BLDP) Stock Price | Nasdaq

Ballard Power Systems Inc (BLDP) Stock Quote, History and News - Yahoo Finance

Ballard Power Systems Inc (BLDP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...