Bumble Inc. (BMBL): Price and Financial Metrics

BMBL Price/Volume Stats

| Current price | $9.13 | 52-week high | $18.91 |

| Prev. close | $9.17 | 52-week low | $8.65 |

| Day low | $8.95 | Volume | 2,610,085 |

| Day high | $9.39 | Avg. volume | 2,859,971 |

| 50-day MA | $10.47 | Dividend yield | N/A |

| 200-day MA | $12.25 | Market Cap | 1.15B |

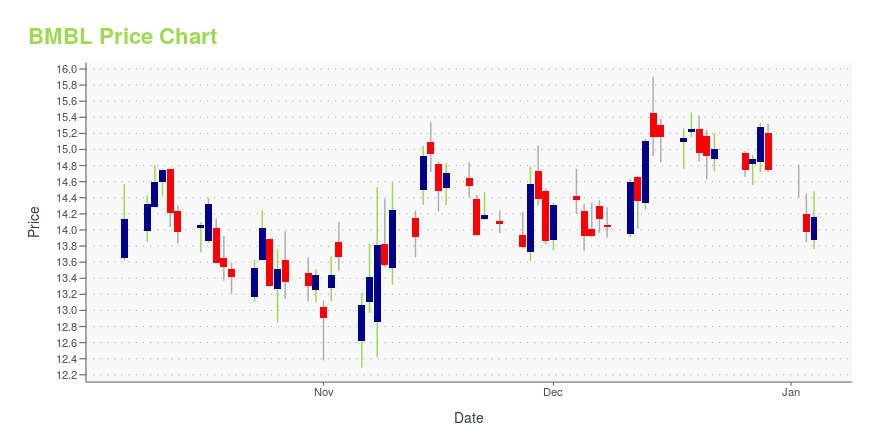

BMBL Stock Price Chart Interactive Chart >

Bumble Inc. (BMBL) Company Bio

Bumble Inc. operates online dating and social networking platforms. It provides subscription and credit-based dating products servicing North America, Europe, and various other countries. Its platforms enable people to connect and build relationships across various areas of life, including love, friendships, careers, and beyond. The company was incorporated in 2020 and is based in Austin, Texas.

Latest BMBL News From Around the Web

Below are the latest news stories about BUMBLE INC that investors may wish to consider to help them evaluate BMBL as an investment opportunity.

Finance leaders at OpenAI, Bumble, and Alphabet’s Wing on how they got doors to open throughout their careers“To be an effective CFO, you have to be a lifelong learner," Shannon Nash, CFO at Wing said. |

Should You Follow Christian Leone Into These Tech and Consumer Stocks?In this article, we will discuss should you follow Christian Leone into these tech and consumer stocks? If you want to skip our detailed analysis of Leone’s history, investment philosophy performance, you can go directly to Should You Follow Christian Leone Into These 5 Tech and Consumer Stocks?. Rising interest rates, regional banking crisis, concerns over […] |

Bumble, Peabody Energy, and More Stocks See Action From Activist InvestorsHedge fund firm Elliott Management sold nearly 3.2 million shares of coal company Peabody Energy to trim its stake to 13.7%. |

Biogen upgraded, Take-Two downgraded: Wall Street's top analyst callsBiogen upgraded, Take-Two downgraded: Wall Street's top analyst calls |

Bumble For Friends Adds "Plans" and AI-powered Conversation Starters to Make it Easier to Connect with FriendsAUSTIN, Texas, December 04, 2023--Friendship app Bumble For Friends is adding two product features: Plans and AI-powered conversation starters. |

BMBL Price Returns

| 1-mo | -10.14% |

| 3-mo | -12.96% |

| 6-mo | -35.70% |

| 1-year | -49.19% |

| 3-year | -81.47% |

| 5-year | N/A |

| YTD | -38.06% |

| 2023 | -29.98% |

| 2022 | -37.83% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...