Bank Of Montreal (BMO): Price and Financial Metrics

BMO Price/Volume Stats

| Current price | $87.33 | 52-week high | $100.12 |

| Prev. close | $86.98 | 52-week low | $73.98 |

| Day low | $86.89 | Volume | 5,031,900 |

| Day high | $87.50 | Avg. volume | 818,630 |

| 50-day MA | $87.29 | Dividend yield | 5.11% |

| 200-day MA | $89.44 | Market Cap | 63.69B |

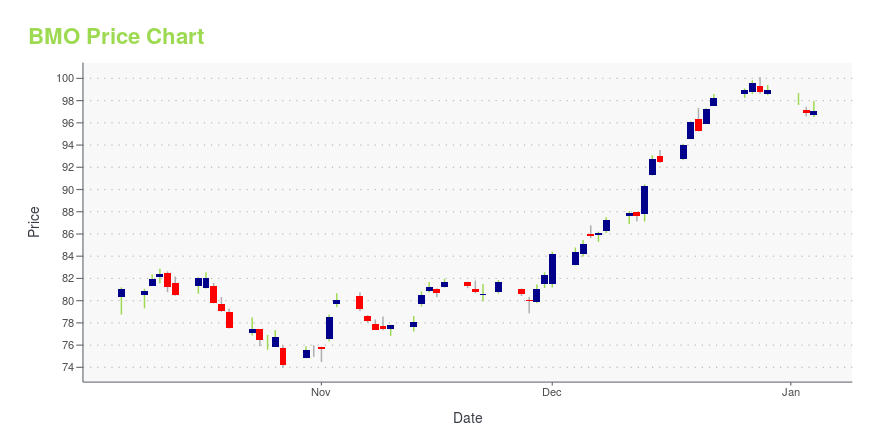

BMO Stock Price Chart Interactive Chart >

Bank Of Montreal (BMO) Company Bio

The Bank of Montreal (BMO; French: Banque de Montréal) is a Canadian multinational investment bank and financial services company. (Source:Wikipedia)

Latest BMO News From Around the Web

Below are the latest news stories about BANK OF MONTREAL that investors may wish to consider to help them evaluate BMO as an investment opportunity.

Chile’s SQM Reaches Lithium Mining Accord With Codelco(Bloomberg) -- SQM, the world’s second-largest lithium producer, reached a framework agreement to hand over a majority stake in its prized Chilean brine assets to state-owned Codelco in exchange for extending operations for three more decades. Most Read from BloombergThe Late-Night Email to Tim Cook That Set the Apple Watch Saga in MotionChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerBridgewater CEO’s Past Office Romance Led to Favoritism ClaimsL’Oreal Heir Francoise Bettencour |

3 Canadian Bank Stocks for Value and Dividend IncomeInvestors may not realize that Canadian banks tend to trade for lower valuations than their U.S. counterparts, and many also have higher dividend yields. |

Bank of Montreal Reworks Loan Deal for Warburg’s Everise Stake(Bloomberg) -- A group of banks led by Bank of Montreal had to rework a debt sale that financed Warburg Pincus’ purchase of a stake in health-care services outsourcing firm Everise after failing to garner enough demand from institutional lenders, according to people with knowledge of the matter.Most Read from BloombergChina Is Softening Stance on Gaming After $80 Billion RoutEthiopia Fails to Pay Coupon, Becoming Latest African DefaulterBank of Russia Governor Says She Is Bracing for More Sancti |

Modest Growth Puts Canada Economy on Track for Soft Landing(Bloomberg) -- The Canadian economy is on track to avoid back-to-back quarterly contractions, with early data pointing to a slight rebound toward the end of the year, suggesting a possibility of a soft landing.Most Read from BloombergManchester United Saga Ends With $1.3 Billion Ratcliffe DealTrump Tells Appeals Panel He Should Have ‘Absolute Immunity’US Accuses Iran of Indian Ocean Attack as Shipping Threat GrowsQuantum Computing Is Finally Here. But What Is It?Nigeria Seeks Control of Banks Li |

Canadian Consumers Slow Spending as Interest Rates Bite(Bloomberg) -- Canadian consumers likely slowed down their spending in November after splurging the previous month, as high interest rates restrict household budgets.Most Read from BloombergHyperloop One to Shut Down After Failing to Reinvent TransitHarvard Financial Pain Grows as Blavatnik Joins Donor RevoltVilified Zero-Day Options Blamed by Traders for S&P DeclineGiuliani Files for Bankruptcy After $148 Million Defamation LossUS Inflation Report to Show Fed’s Battle Is Now All But CompleteRec |

BMO Price Returns

| 1-mo | 4.84% |

| 3-mo | -3.94% |

| 6-mo | -8.15% |

| 1-year | -2.53% |

| 3-year | -1.90% |

| 5-year | 40.25% |

| YTD | -10.66% |

| 2023 | 14.64% |

| 2022 | -12.39% |

| 2021 | 45.54% |

| 2020 | 3.34% |

| 2019 | 23.51% |

BMO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BMO

Want to see what other sources are saying about Bank Of Montreal's financials and stock price? Try the links below:Bank Of Montreal (BMO) Stock Price | Nasdaq

Bank Of Montreal (BMO) Stock Quote, History and News - Yahoo Finance

Bank Of Montreal (BMO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...