Bonso Electronics International, Inc. (BNSO): Price and Financial Metrics

BNSO Price/Volume Stats

| Current price | $1.12 | 52-week high | $12.09 |

| Prev. close | $1.18 | 52-week low | $1.07 |

| Day low | $1.12 | Volume | 22,900 |

| Day high | $1.25 | Avg. volume | 26,621 |

| 50-day MA | $2.57 | Dividend yield | N/A |

| 200-day MA | $3.11 | Market Cap | 5.44M |

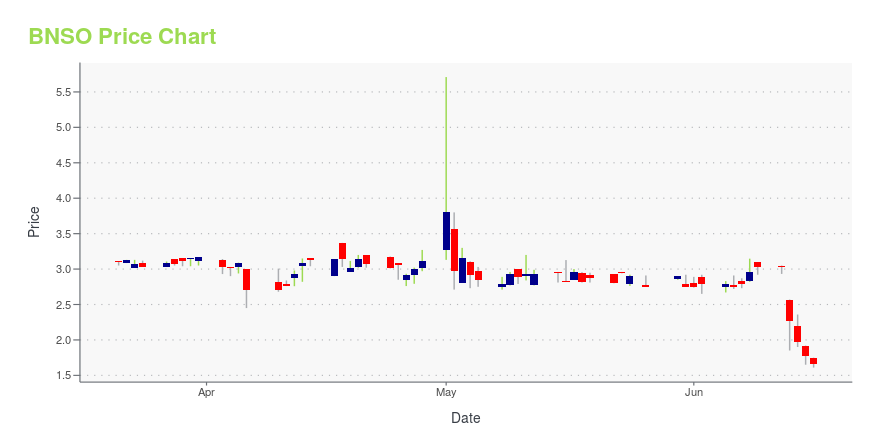

BNSO Stock Price Chart Interactive Chart >

Bonso Electronics International, Inc. (BNSO) Company Bio

Bonso Electronics International Inc. designs, develops, produces, and sells electronic sensor-based and wireless products. The company operates in four segments: Scales, Pet Electronic Products, Rental and Management, and Others. The Scales segment provides sensor-based scales products that include bathroom, kitchen, office, jewelry, laboratory, postal, and industrial scales for consumer, commercial, and industrial applications. The Pet Electronic Products segment develops and produces pet-related electronic products for use in consumer applications. The Rental and Management segment offers leasing of factories and machineries to third parties. The Others segment sells scrap materials. It serves private label original equipment, original brand, and original design manufacturers primarily in the United States, Germany, and the People's Republic of China. The Company also sells its pet electronic products through online platforms. The company was formerly known as Golden Virtue Limited and changed its name to Bonso Electronics International Inc. in September 1988. Bonso Electronics International Inc. was founded in 1988 and is based in Tsim Sha Tsui, Hong Kong.

BNSO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -66.96% |

| 5-year | -61.25% |

| YTD | N/A |

| 2024 | N/A |

| 2023 | 0.00% |

| 2022 | N/A |

| 2021 | 0.00% |

| 2020 | 234.35% |

Continue Researching BNSO

Want to see what other sources are saying about Bonso Electronics International Inc's financials and stock price? Try the links below:Bonso Electronics International Inc (BNSO) Stock Price | Nasdaq

Bonso Electronics International Inc (BNSO) Stock Quote, History and News - Yahoo Finance

Bonso Electronics International Inc (BNSO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...