Borr Drilling LTD. (BORR): Price and Financial Metrics

BORR Price/Volume Stats

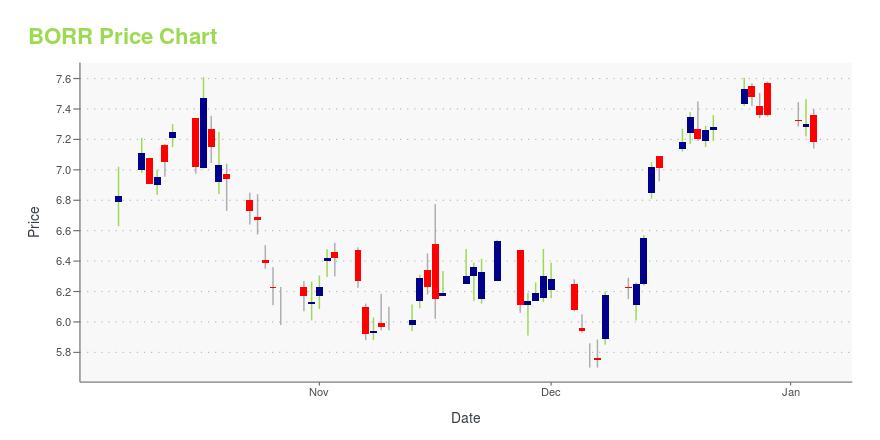

| Current price | $6.70 | 52-week high | $9.01 |

| Prev. close | $6.75 | 52-week low | $5.19 |

| Day low | $6.61 | Volume | 2,860,882 |

| Day high | $6.84 | Avg. volume | 1,997,097 |

| 50-day MA | $6.45 | Dividend yield | 1.48% |

| 200-day MA | $6.39 | Market Cap | 1.02B |

BORR Stock Price Chart Interactive Chart >

Borr Drilling LTD. (BORR) Company Bio

Borr Drilling Ltd. engages in the provision of drilling services to the oil and gas exploration and production industry. The firm will acquire and operate drilling assets. The company was founded in 2016 and is headquartered in Oslo, Norway.

Latest BORR News From Around the Web

Below are the latest news stories about BORR DRILLING LTD that investors may wish to consider to help them evaluate BORR as an investment opportunity.

Borr Drilling Limited -Dividend declaration and key information relating to the cash distribution for the third quarter 2023Borr Drilling Limited (NYSE: BORR) and (OSE: BORR) today announces that the Company's Board of Directors has approved a cash distribution of paid-in capital of US$0.05 per share for the third quarter of 2023. |

BORR, DO major energy gainersMore on Energy Select Sector SPDR ETF |

Borr Drilling Limited - Approval of Share Repurchase ProgramThe board of directors in Borr Drilling Limited (the "Company") has today approved a share repurchase program for the Company's shares, to be purchased in the open market and limited to a total amount of USD 100,000,000. |

7 Stocks You’ll Be Thankful You Bought in November 2023These are the top stocks to own and represent undervalued companies that are likely to witness healthy growth and margin expansion. |

Borr Drilling Limited - Notice of Special General Meeting of ShareholdersBorr Drilling Limited (the "Company") (NYSE: BORR) and (OSE: BORR) advises that the Company will hold a Special General Meeting on December 22, 2023 to approve a reduction of the Company's Share Premium account (referred to as additional paid-in capital in the financial statements of the Company) and to credit the same amount resulting from this reduction to the Company's Contributed Surplus account, which will enable dividend payments to shareholders. |

BORR Price Returns

| 1-mo | 6.69% |

| 3-mo | 23.41% |

| 6-mo | -6.34% |

| 1-year | -16.91% |

| 3-year | 356.43% |

| 5-year | N/A |

| YTD | -6.98% |

| 2023 | 48.09% |

| 2022 | 141.26% |

| 2021 | 26.51% |

| 2020 | -91.00% |

| 2019 | N/A |

BORR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...