Box, Inc. (BOX): Price and Financial Metrics

BOX Price/Volume Stats

| Current price | $33.26 | 52-week high | $38.80 |

| Prev. close | $32.82 | 52-week low | $24.63 |

| Day low | $32.90 | Volume | 1,312,100 |

| Day high | $33.32 | Avg. volume | 1,973,754 |

| 50-day MA | $33.64 | Dividend yield | N/A |

| 200-day MA | $32.68 | Market Cap | 4.78B |

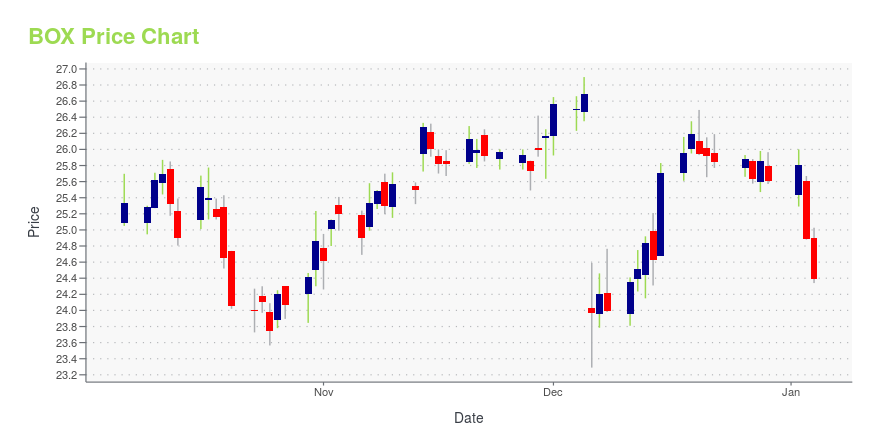

BOX Stock Price Chart Interactive Chart >

Box, Inc. (BOX) Company Bio

Box Inc. provides a cloud-based enterprise content collaboration platform that enables organizations of various sizes to access, store, share, and manage their content/information. The company was founded in 2005 and is based in Los Altos, California.

BOX Price Returns

| 1-mo | -13.72% |

| 3-mo | 11.57% |

| 6-mo | 5.62% |

| 1-year | N/A |

| 3-year | 26.75% |

| 5-year | N/A |

| YTD | 5.25% |

| 2024 | 23.39% |

| 2023 | -17.73% |

| 2022 | 18.86% |

| 2021 | 45.10% |

| 2020 | 7.57% |

Continue Researching BOX

Here are a few links from around the web to help you further your research on Box Inc's stock as an investment opportunity:Box Inc (BOX) Stock Price | Nasdaq

Box Inc (BOX) Stock Quote, History and News - Yahoo Finance

Box Inc (BOX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...