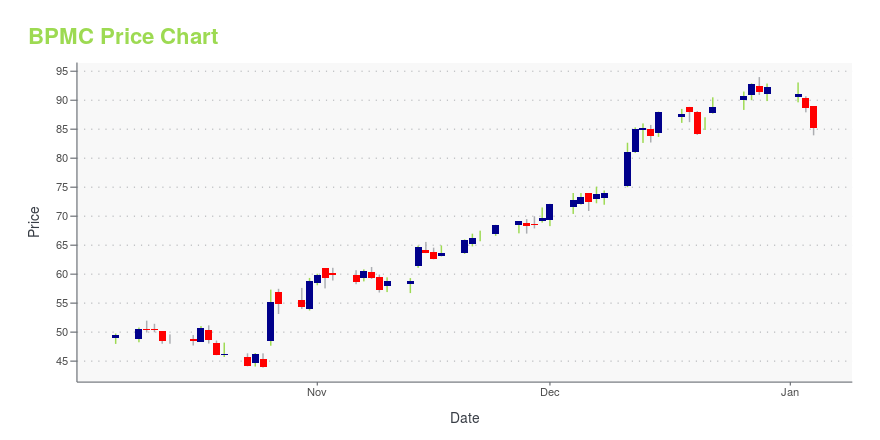

Blueprint Medicines Corporation (BPMC): Price and Financial Metrics

BPMC Price/Volume Stats

| Current price | $112.19 | 52-week high | $121.90 |

| Prev. close | $113.69 | 52-week low | $43.89 |

| Day low | $112.02 | Volume | 435,535 |

| Day high | $116.51 | Avg. volume | 700,902 |

| 50-day MA | $108.61 | Dividend yield | N/A |

| 200-day MA | $87.54 | Market Cap | 7.03B |

BPMC Stock Price Chart Interactive Chart >

Blueprint Medicines Corporation (BPMC) Company Bio

Blueprint Medicines Corporation makes kinase drugs to treat patients with genomically defined diseases. The company was founded in 2008 and is based in Cambridge, Massachusetts.

Latest BPMC News From Around the Web

Below are the latest news stories about BLUEPRINT MEDICINES CORP that investors may wish to consider to help them evaluate BPMC as an investment opportunity.

Blueprint Medicines to Present at 42nd Annual J.P. Morgan Healthcare ConferenceBlueprint Medicines Corporation (Nasdaq: BPMC) today announced that Kate Haviland, Chief Executive Officer, will present a corporate overview and 2024 outlook at the 42nd Annual J.P. Morgan Healthcare Conference on Monday, January 8, 2024, at 10:30 a.m. PT (1:30 p.m. ET). |

Blueprint Medicines Corporation's (NASDAQ:BPMC) 38% Price Boost Is Out Of Tune With RevenuesBlueprint Medicines Corporation ( NASDAQ:BPMC ) shares have continued their recent momentum with a 38% gain in the last... |

Insider Sell: Director Jeffrey Albers Sells 5,000 Shares of Blueprint Medicines Corp (BPMC)Blueprint Medicines Corp (NASDAQ:BPMC) has recently witnessed a notable insider sell by Director Jeffrey Albers, who disposed of 5,000 shares of the company's stock. |

Chart Of The Day: Does Blueprint Medicines Have A Blueprint For Success?Blueprint Medicines Corporation, a precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally. |

Blueprint Medicines' AYVAKYT® (avapritinib) Receives European Commission Approval as the First and Only Treatment for Indolent Systemic MastocytosisBlueprint Medicines Corporation (Nasdaq: BPMC) today announced the European Commission has approved AYVAKYT® (avapritinib) for the treatment of adult patients with indolent systemic mastocytosis (ISM) with moderate to severe symptoms inadequately controlled on symptomatic treatment. AYVAKYT is the first and only approved therapy for people living with ISM in Europe. |

BPMC Price Returns

| 1-mo | 7.96% |

| 3-mo | 20.63% |

| 6-mo | 37.56% |

| 1-year | 87.80% |

| 3-year | 37.32% |

| 5-year | 12.21% |

| YTD | 21.63% |

| 2023 | 110.55% |

| 2022 | -59.10% |

| 2021 | -4.49% |

| 2020 | 40.00% |

| 2019 | 48.60% |

Continue Researching BPMC

Want to see what other sources are saying about Blueprint Medicines Corp's financials and stock price? Try the links below:Blueprint Medicines Corp (BPMC) Stock Price | Nasdaq

Blueprint Medicines Corp (BPMC) Stock Quote, History and News - Yahoo Finance

Blueprint Medicines Corp (BPMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...