Bio-Path Holdings, Inc. (BPTH): Price and Financial Metrics

BPTH Price/Volume Stats

| Current price | $1.77 | 52-week high | $23.00 |

| Prev. close | $1.77 | 52-week low | $1.59 |

| Day low | $1.73 | Volume | 13,175 |

| Day high | $1.82 | Avg. volume | 1,124,602 |

| 50-day MA | $2.08 | Dividend yield | N/A |

| 200-day MA | $6.43 | Market Cap | 3.68M |

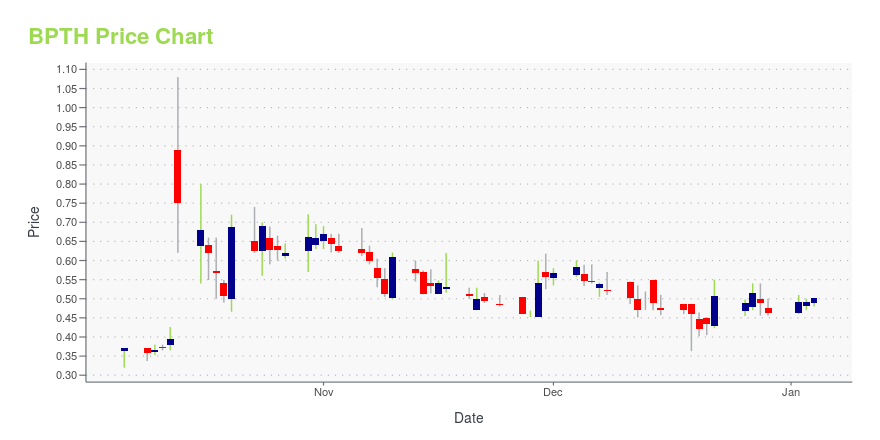

BPTH Stock Price Chart Interactive Chart >

Bio-Path Holdings, Inc. (BPTH) Company Bio

Bio-Path Holdings, Inc. focuses on developing therapeutic products utilizing its proprietary liposomal delivery technology to systemically distribute nucleic acid drugs throughout the human body with a simple intravenous transfusion. The company was founded in 2007 and is based in Bellaire, Texas.

Latest BPTH News From Around the Web

Below are the latest news stories about BIO-PATH HOLDINGS INC that investors may wish to consider to help them evaluate BPTH as an investment opportunity.

Bio-Path Holdings Successfully Completes First Dose Cohort of Phase 1/1b Clinical Trial of BP1002 in Refractory/Relapsed Acute Myeloid LeukemiaBP1002 Offers Unique Opportunity for Venetoclax-Resistant Patients by Utilizing RNAi to Limit Cells’ Ability to Produce Bcl-2 ProteinHOUSTON, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Bio-Path Holdings, Inc., (NASDAQ: BPTH) a biotechnology company leveraging its proprietary DNAbilize® antisense RNAi nanoparticle technology to develop a portfolio of targeted nucleic acid cancer drugs, today announced completion of the first dose cohort of the dose escalation portion of its Phase 1/1b clinical trial of BP |

Bio-Path Holdings, Inc. (NASDAQ:BPTH) Q3 2023 Earnings Call TranscriptBio-Path Holdings, Inc. (NASDAQ:BPTH) Q3 2023 Earnings Call Transcript November 15, 2023 Operator: Good morning, ladies and gentlemen. Welcome to the Bio-Path Holdings Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. [Operator Instructions] Following the formal remarks, we will open the call up for your questions. Please […] |

Bio-Path Holdings Reports Third Quarter 2023 Financial ResultsConference Call to be Held Today at 8:30 A.M. ETHOUSTON, Nov. 15, 2023 (GLOBE NEWSWIRE) -- Bio-Path Holdings, Inc., (NASDAQ:BPTH), a biotechnology company leveraging its proprietary DNAbilize® liposomal delivery and antisense technology to develop a portfolio of targeted nucleic acid cancer drugs, today announced its financial results for the third quarter ended September 30, 2023 and provided an update on recent corporate developments. “The third quarter marked a particularly progressive time a |

Bio-Path Holdings to Announce Third Quarter 2023 Financial Results on November 15, 2023HOUSTON, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Bio-Path Holdings, Inc., (NASDAQ: BPTH) a biotechnology company leveraging its proprietary DNAbilize® antisense RNAi nanoparticle technology to develop a portfolio of targeted nucleic acid cancer drugs, today announced that it will host a live conference call and audio webcast on Wednesday, November 15, 2023 at 8:30 a.m. ET to report financial results for the third quarter ended September 30, 2023 and to provide a business overview. To access the live c |

Bio-Path Holdings to Host Virtual Key Opinion Leader Event to Discuss Prexigebersen and Advances in the Treatment Landscape for Acute Myeloid LeukemiaConference call to be held on Monday, October 30, 2023 at 9:00 a.m. ETHOUSTON, Oct. 24, 2023 (GLOBE NEWSWIRE) -- Bio-Path Holdings, Inc., (NASDAQ: BPTH) a biotechnology company leveraging its proprietary DNAbilize® antisense RNAi nanoparticle technology to develop a portfolio of targeted nucleic acid cancer drugs, today announced it will host a virtual key opinion leader event to highlight the prexigebersen program and discuss advances in the treatment landscape for acute myeloid leukemia (AML). |

BPTH Price Returns

| 1-mo | -9.69% |

| 3-mo | -33.96% |

| 6-mo | -81.17% |

| 1-year | -91.65% |

| 3-year | -98.61% |

| 5-year | -99.36% |

| YTD | -80.89% |

| 2023 | -69.34% |

| 2022 | -59.95% |

| 2021 | 7.71% |

| 2020 | -56.20% |

| 2019 | 128.29% |

Loading social stream, please wait...