Brown & Brown Inc. (BRO): Price and Financial Metrics

BRO Price/Volume Stats

| Current price | $99.17 | 52-week high | $99.26 |

| Prev. close | $97.43 | 52-week low | $66.73 |

| Day low | $97.61 | Volume | 960,200 |

| Day high | $99.26 | Avg. volume | 1,264,603 |

| 50-day MA | $91.20 | Dividend yield | 0.53% |

| 200-day MA | $81.11 | Market Cap | 28.29B |

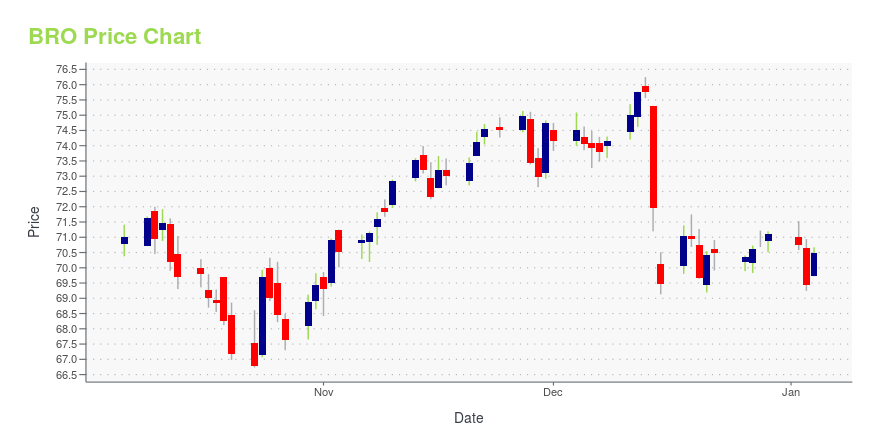

BRO Stock Price Chart Interactive Chart >

Brown & Brown Inc. (BRO) Company Bio

Brown & Brown, Inc. (Brown & Brown Insurance) is a leading insurance brokerage firm, delivering risk management solutions to individuals and businesses since 1939. Headquartered in Daytona Beach, Florida, Brown & Brown has 450+ locations worldwide. (Source:Wikipedia)

Latest BRO News From Around the Web

Below are the latest news stories about BROWN & BROWN INC that investors may wish to consider to help them evaluate BRO as an investment opportunity.

Is Bay Commercial Bank (BCML) Stock Outpacing Its Finance Peers This Year?Here is how Bay Commercial Bank (BCML) and Brown & Brown (BRO) have performed compared to their sector so far this year. |

Brown & Brown (BRO) Expands in Florida With Caton-Hosey BuyoutBrown & Brown (BRO) signs an agreement to acquire Caton-Hosey, boosting its presence in Florida. |

15 Best Motorhome Insurance Companies Heading into 2024In this article, we will look into the 15 best motorhome insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Motorhome Insurance Companies Heading into 2024. North America RV Insurance: A Market Analysis North America is the biggest shareholder in the global RV […] |

Why You Should Add RenaissanceRe (RNR) Stock to Your PortfolioAn improvement in the top line led by higher premiums and net investment income poises RenaissanceRe (RNR) well for growth. |

Brown & Brown, Inc. enters into agreement to acquire Caton-Hosey InsuranceDAYTONA BEACH, Fla., Dec. 26, 2023 (GLOBE NEWSWIRE) -- J. Scott Penny, chief acquisitions officer of Brown & Brown, Inc. (NYSE:BRO), and Rex Caton and John Hosey, the owners of Caton-Hosey Insurance (“Caton Hosey”), today announced that Brown & Brown has entered into an agreement to acquire the assets of Caton Hosey. The transaction is expected to close in early January 2024, subject to certain closing conditions. Caton-Hosey shares roots with Brown & Brown in the Florida insurance market reachi |

BRO Price Returns

| 1-mo | 9.48% |

| 3-mo | 21.93% |

| 6-mo | 29.41% |

| 1-year | 41.50% |

| 3-year | 84.81% |

| 5-year | 182.83% |

| YTD | 39.91% |

| 2023 | 25.73% |

| 2022 | -18.39% |

| 2021 | 49.31% |

| 2020 | 21.06% |

| 2019 | 44.67% |

BRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BRO

Here are a few links from around the web to help you further your research on Brown & Brown Inc's stock as an investment opportunity:Brown & Brown Inc (BRO) Stock Price | Nasdaq

Brown & Brown Inc (BRO) Stock Quote, History and News - Yahoo Finance

Brown & Brown Inc (BRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...