BRP GROUP, INC. (BRP): Price and Financial Metrics

BRP Price/Volume Stats

| Current price | $32.66 | 52-week high | $33.03 |

| Prev. close | $32.51 | 52-week low | $17.33 |

| Day low | $31.94 | Volume | 694,600 |

| Day high | $33.03 | Avg. volume | 379,203 |

| 50-day MA | $28.64 | Dividend yield | N/A |

| 200-day MA | $24.86 | Market Cap | 3.84B |

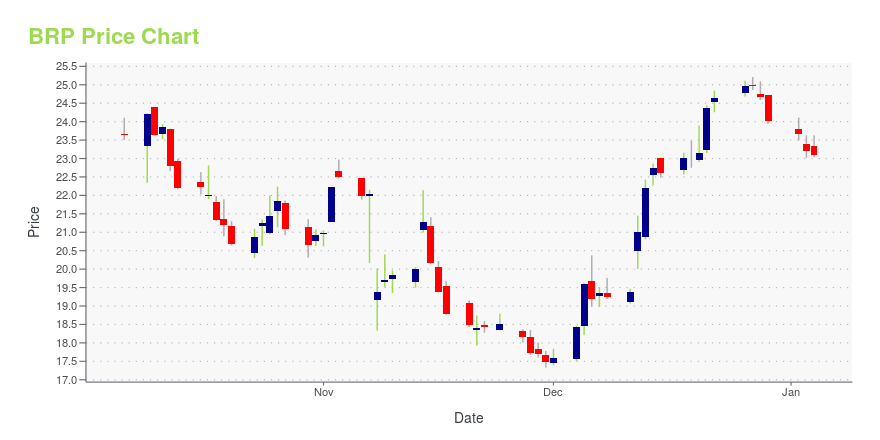

BRP Stock Price Chart Interactive Chart >

BRP GROUP, INC. (BRP) Company Bio

BRP Group, Inc. provides insurance services. It operates through the following four segments: Middle Market, Specialty, Mainstreet, and Medicare. The Middle Market segment provides private risk management, commercial risk management and employee benefits solutions for mid-to-large size businesses and high net worth individuals and families. The Specialty segment is a wholesale co-brokerage platform, which delivers specialty insurers, professionals, individuals and niche industry businesses expanded access to exclusive specialty markets, capabilities and programs requiring complex underwriting and placement. The Mainstreet segment offers personal insurance, commercial insurance and life and health solutions to individuals and businesses in their communities. The Medicare segment offers consultation for government assistance programs and solutions, including traditional Medicare and Medicare Advantage

Latest BRP News From Around the Web

Below are the latest news stories about BRP GROUP INC that investors may wish to consider to help them evaluate BRP as an investment opportunity.

NNGRY or BRP: Which Is the Better Value Stock Right Now?NNGRY vs. BRP: Which Stock Is the Better Value Option? |

NNGRY vs. BRP: Which Stock Is the Better Value Option?NNGRY vs. BRP: Which Stock Is the Better Value Option? |

11 Undervalued Insurance Stocks To Buy NowIn this piece, we will take a look at the 11 undervalued insurance stocks to buy now. If you want to skip our overview of the insurance industry and some recent trends, then take a look at 5 Undervalued Insurance Stocks To Buy Now. The insurance industry is one of the oldest in the world. […] |

BRP Group, Inc. (NASDAQ:BRP) Q3 2023 Earnings Call TranscriptBRP Group, Inc. (NASDAQ:BRP) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Greetings and welcome to BRP Group, Inc. Third Quarter 2023 Earnings Call. At this time, all participants are in a listen-only mode. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce Bonnie Bishop, Executive […] |

Q3 2023 BRP Group Inc Earnings CallQ3 2023 BRP Group Inc Earnings Call |

BRP Price Returns

| 1-mo | N/A |

| 3-mo | 22.32% |

| 6-mo | 33.31% |

| 1-year | 31.32% |

| 3-year | 23.71% |

| 5-year | N/A |

| YTD | 35.97% |

| 2023 | -4.46% |

| 2022 | -30.38% |

| 2021 | 20.49% |

| 2020 | 86.73% |

| 2019 | N/A |

Loading social stream, please wait...