Bassett Furniture Industries, Incorporated (BSET): Price and Financial Metrics

BSET Price/Volume Stats

| Current price | $13.45 | 52-week high | $17.89 |

| Prev. close | $13.31 | 52-week low | $13.02 |

| Day low | $13.34 | Volume | 6,857 |

| Day high | $13.49 | Avg. volume | 19,672 |

| 50-day MA | $14.01 | Dividend yield | 5.39% |

| 200-day MA | $15.00 | Market Cap | 118.75M |

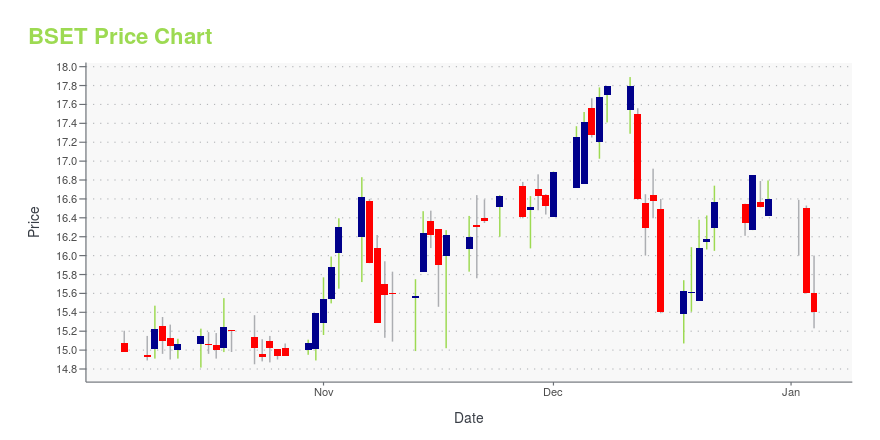

BSET Stock Price Chart Interactive Chart >

Bassett Furniture Industries, Incorporated (BSET) Company Bio

Bassett Furniture manufactures, imports, and retails home furnishings in the United States. The company was founded in 1902 and is based in Bassett, Virginia.

Latest BSET News From Around the Web

Below are the latest news stories about BASSETT FURNITURE INDUSTRIES INC that investors may wish to consider to help them evaluate BSET as an investment opportunity.

25 Highest Quality Furniture Brands in the WorldIn this article, we will take a look at the 25 highest quality furniture brands in the world. If you want to skip our detailed analysis, you can go directly to the 5 Highest Quality Furniture Brands in the World. According to a report by Grandview Research, the global furniture market was valued at $677.09 billion […] |

Bassett Announces Regular Fourth Quarter DividendBASSETT, Va., Oct. 05, 2023 (GLOBE NEWSWIRE) -- Bassett Furniture Industries, Inc. (Nasdaq: BSET) announced today that its Board of Directors has declared a regular quarterly dividend of $0.18 per share of common stock, payable on November 24, 2023, to shareholders of record at the close of business on November 10, 2023. About Bassett Furniture Industries, Inc.Bassett Furniture Industries, Inc. (NASDAQ:BSET), is a leading manufacturer and marketer of high quality home furnishings. With 89 compan |

Modine and Bassett Furniture have been highlighted as Zacks Bull and Bear of the DayModine and Bassett Furniture have been highlighted as Zacks Bull and Bear of the Day. |

Bear of the Day: Bassett Furniture (BSET)Earnings are plunging this year. |

New Strong Sell Stocks for September 29thBSET, DRCT and D have been added to the Zacks Rank #5 (Strong Sell) List on September 29, 2023. |

BSET Price Returns

| 1-mo | -5.81% |

| 3-mo | 3.83% |

| 6-mo | -14.87% |

| 1-year | -17.06% |

| 3-year | -29.74% |

| 5-year | 39.59% |

| YTD | -16.98% |

| 2023 | -0.38% |

| 2022 | 15.61% |

| 2021 | -14.53% |

| 2020 | 27.24% |

| 2019 | -14.06% |

BSET Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BSET

Want to see what other sources are saying about Bassett Furniture Industries Inc's financials and stock price? Try the links below:Bassett Furniture Industries Inc (BSET) Stock Price | Nasdaq

Bassett Furniture Industries Inc (BSET) Stock Quote, History and News - Yahoo Finance

Bassett Furniture Industries Inc (BSET) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...