BioSig Technologies, Inc. (BSGM): Price and Financial Metrics

BSGM Price/Volume Stats

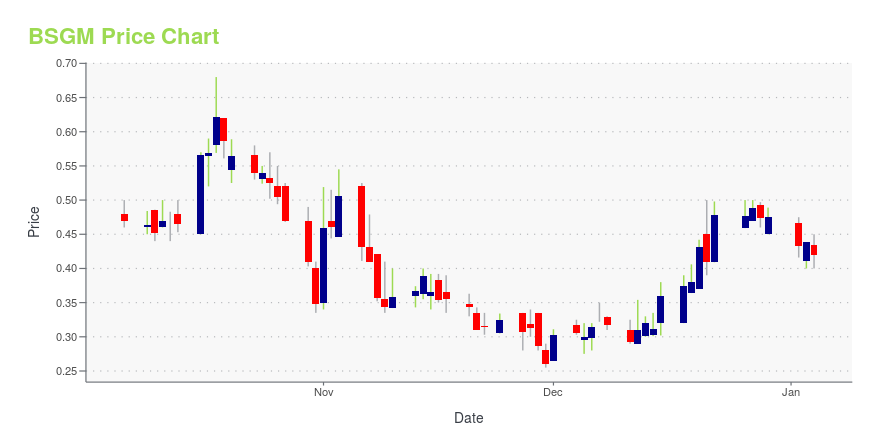

| Current price | $0.41 | 52-week high | $10.00 |

| Prev. close | $0.45 | 52-week low | $0.20 |

| Day low | $0.35 | Volume | 46,667 |

| Day high | $0.45 | Avg. volume | 615,698 |

| 50-day MA | $0.93 | Dividend yield | N/A |

| 200-day MA | $2.05 | Market Cap | 5.82M |

BSGM Stock Price Chart Interactive Chart >

BioSig Technologies, Inc. (BSGM) Company Bio

BioSig Technologies, Inc., a medical device company, engages in developing and commercializing a proprietary biomedical signal processing technology platform to extract information from physiologic signals. The company's proprietary product include precise uninterrupted real-time evaluation of electrograms electrophysiology system, a computerized system intended for acquiring, digitizing, amplifying, filtering, measuring and calculating, displaying, recording, and storing of electrocardiographic and intracardiac signals for patients undergoing electrophysiology procedures in an electrophysiology laboratory under the supervision of licensed healthcare practitioners who are responsible for interpreting the data. It also focuses on enhancing intracardiac signal acquisition and diagnostic information for the procedures of atrial fibrillation and ventricular tachycardia. The company has a research agreement with University of Minnesota to develop novel therapies to treat sympathetic nervous system diseases. BioSig Technologies, Inc. was founded in 2009 and is headquartered in Westport, Connecticut.

Latest BSGM News From Around the Web

Below are the latest news stories about BIOSIG TECHNOLOGIES INC that investors may wish to consider to help them evaluate BSGM as an investment opportunity.

Shareholders May Not Be So Generous With BioSig Technologies, Inc.'s (NASDAQ:BSGM) CEO Compensation And Here's WhyKey Insights BioSig Technologies to hold its Annual General Meeting on 18th of December CEO Ken Londoner's total... |

BioSig Issues Letter to Shareholders Detailing Technology Innovations and Strategic Focus for 2024Westport, CT, Dec. 06, 2023 (GLOBE NEWSWIRE) -- BioSig Technologies, Inc. (Nasdaq: BSGM) (“BioSig” or the “Company”), a medical technology company delivering unprecedented accuracy and precision to intracardiac signal visualization, today issued its 2023 letter to shareholders to recap recent achievements and offer insights about the year ahead. In the letter, Kenneth Londoner, Chairman & CEO of BioSig, states “BioSig’s capacity for innovation is stronger than ever, and to our knowledge, our opp |

BioSig Announces $2.5 Million Registered Direct Offering Priced At-the-Market Under Nasdaq RulesWestport, CT, Nov. 13, 2023 (GLOBE NEWSWIRE) -- BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”) a medical technology company committed to delivering unprecedented accuracy and precision to intracardiac signal visualization, today announced the closing of its previously announced registered direct offering priced at-the-market under Nasdaq rules of 6,996,922 shares of its common stock, Series A warrants to purchase up to 6,996,922 shares of common stock and Series B warrants |

BioSig Appoints Global MedTech Leader Fred Hrkac as New Executive VP32-year career in medical device and electrophysiology business expansion for industry bellwethers; led multiple company exits including a $1B sale in 2018 Part of leadership team that grew Johnson & Johnson’s original cardiology/electrophysiology business from $22M to $500M in 7 yearsWestport, CT, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Westport, CT, November 7, 2023 (GLOBE NEWSWIRE) -- BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”), a medical technology company committed to del |

BioSig’s New PURE EP™ Subscription Model Adopted by Mayo Clinic-Phoenix for World-Class Cardiac CarePURE EP™ subscriber community now includes two of top three U.S. health systems in cardiology: Mayo Clinic-Phoenix and Cleveland ClinicWestport, CT, Nov. 02, 2023 (GLOBE NEWSWIRE) -- BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”), a medical technology company committed to delivering unprecedented accuracy and precision to intracardiac signal visualization, announced today that Mayo Clinic-Phoenix—an existing user of the PURE EP™ Platform—has upgraded to the Platform’s subsc |

BSGM Price Returns

| 1-mo | 11.41% |

| 3-mo | -70.07% |

| 6-mo | -81.19% |

| 1-year | -95.45% |

| 3-year | -98.78% |

| 5-year | -99.50% |

| YTD | -91.37% |

| 2023 | 13.10% |

| 2022 | -81.17% |

| 2021 | -42.82% |

| 2020 | -34.12% |

| 2019 | 38.64% |

Loading social stream, please wait...