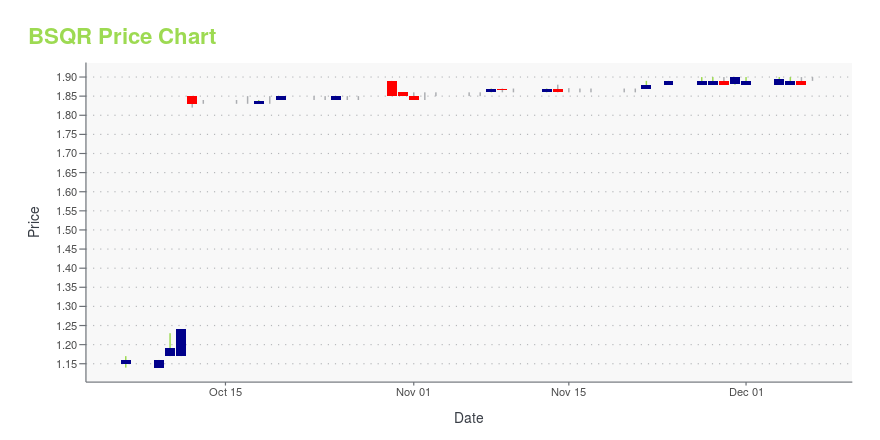

BSQUARE Corporation (BSQR): Price and Financial Metrics

BSQR Price/Volume Stats

| Current price | $1.89 | 52-week high | $1.90 |

| Prev. close | $1.88 | 52-week low | $1.05 |

| Day low | $1.89 | Volume | 23,100 |

| Day high | $1.90 | Avg. volume | 71,022 |

| 50-day MA | $1.72 | Dividend yield | N/A |

| 200-day MA | $1.32 | Market Cap | 37.56M |

BSQR Stock Price Chart Interactive Chart >

Latest BSQR News From Around the Web

Below are the latest news stories about BSQUARE CORP that investors may wish to consider to help them evaluate BSQR as an investment opportunity.

KONTRON AND BSQUARE ANNOUNCE SUCCESSFUL COMPLETION OF TENDER OFFERKontron AG ("Kontron"), a global leader in IoT Technology, and Bsquare Corporation (Nasdaq: BSQR) ("Bsquare"), an expert in developing and deploying software technologies for the makers and operators of connected devices, today jointly announced the successful completion of the previously commenced tender offer (the "Offer") by Kontron Merger Sub., Inc. ("Merger Sub"), a wholly owned, indirect subsidiary of Kontron, to acquire all of the outstanding shares of common stock of Bsquare (the "Shares |

KONTRON AND BSQUARE URGE SHAREHOLDERS TO TENDER AS SOON AS POSSIBLEKontron America, Incorporated ("Kontron"), a global leader in IoT Technology, and Bsquare Corporation (Nasdaq: BSQR) ("Bsquare"), an expert in developing and deploying software technologies for the makers and operators of connected devices, today jointly encouraged shareholders of Bsquare to tender their shares of common stock of Bsquare ("Shares"). |

KONTRON AND BSQUARE ANNOUNCE EXTENSION OF TENDER OFFER FOR ALL OUTSTANDING SHARES OF BSQUAREKontron America, Incorporated ("Kontron"), a global leader in IoT Technology, and Bsquare Corporation (Nasdaq: BSQR) ("Bsquare"), an expert in developing and deploying software technologies for the makers and operators of connected devices, today jointly announced that Kontron Merger Sub., Inc. ("Merger Sub"), a wholly owned subsidiary of Kontron, has extended the expiration of its tender offer (the "Offer") to acquire all of the outstanding shares of common stock of Bsquare ("Shares"), for $1.9 |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayPre-market stock movers are a hot topic among traders on Thursday and we're offering all of the latest coverage this morning! |

KONTRON TO ACQUIRE BSQUARE FOR $1.90 PER SHAREKontron America, Incorporated ("Kontron"), a global leader in IoT Technology, and Bsquare Corporation (Nasdaq: BSQR) ("Bsquare"), an expert in developing and deploying software technologies for the makers and operators of connected devices, today jointly announced the execution of a definitive merger agreement by which Kontron will acquire Bsquare. Under the terms of the agreement, Kontron will commence a tender offer for all outstanding shares of Bsquare for $1.90 per share of common stock in a |

BSQR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 57.49% |

| 3-year | -34.38% |

| 5-year | 60.17% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -33.85% |

| 2021 | 12.50% |

| 2020 | 9.35% |

| 2019 | -10.32% |

Continue Researching BSQR

Want to see what other sources are saying about Bsquare Corp's financials and stock price? Try the links below:Bsquare Corp (BSQR) Stock Price | Nasdaq

Bsquare Corp (BSQR) Stock Quote, History and News - Yahoo Finance

Bsquare Corp (BSQR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...