Bit Brother Ltd. (BTB): Price and Financial Metrics

BTB Price/Volume Stats

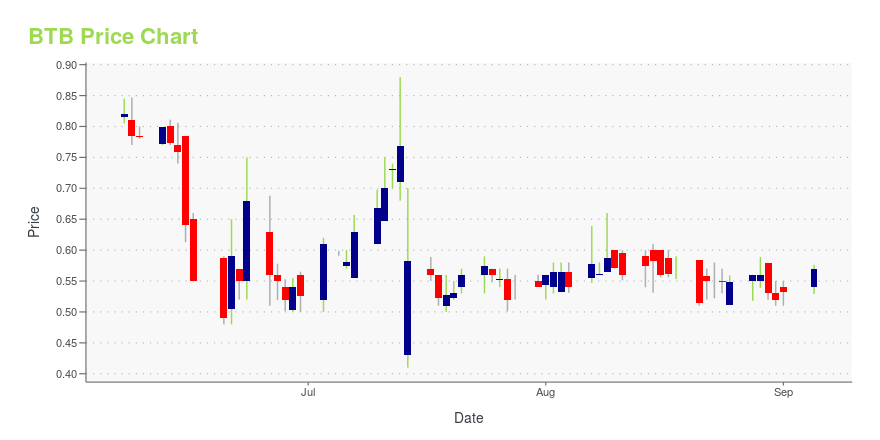

| Current price | $0.60 | 52-week high | $12.00 |

| Prev. close | $0.58 | 52-week low | $0.41 |

| Day low | $0.57 | Volume | 372,400 |

| Day high | $0.61 | Avg. volume | 731,044 |

| 50-day MA | $0.57 | Dividend yield | N/A |

| 200-day MA | $2.28 | Market Cap | N/A |

BTB Stock Price Chart Interactive Chart >

Latest BTB News From Around the Web

Below are the latest news stories about BIT BROTHER LTD that investors may wish to consider to help them evaluate BTB as an investment opportunity.

Bit Brother Ltd. Received Nasdaq Notification Letter Regarding Bid Price DeficiencyBit Brother Limited (the "Company," "we" or "Bit Brother") (NASDAQ: BTB), announced today that on May 16, 2023, the Company received a notification letter from the Nasdaq Listing Qualifications Staff of The NASDAQ Stock Market LLC ("Nasdaq") notifying the Company that the minimum bid price per share for its Class A ordinary shares has been below $1.00 for a period of 30 consecutive business days and the Company therefore no longer meets the minimum bid price requirements set forth in Nasdaq List |

Bit Brother Announces First Fully Loaded Texas Mining Farm and Development of Second Mining FarmBit Brother Limited (the "Company," "we", "BTB" or "Bit Brother") (NASDAQ: BTB) is pleased to announce that the newly purchased 1.5MW mining servers installed in its first Texas mining farm are in full operation and are located at 1968 N Access Rd, Clyde, TX 79510. The total number of installed servers in the first mining farm has reached 1,750 with aggregated computing power of 175,000TH/S, thus reaching its fully loaded capacity of 6MW. We estimate that our servers can generate a total value o |

Bit Brother Generated over 15 Bitcoins from Texas Mining Farm Since Jan 17, 2023Bit Brother Limited (the "Company," "we", "BTB" or "Bit Brother") (NASDAQ: BTB) is pleased to announce that BTB's Texas mining farm has been operating as expected since it started operations on January 17, 2023. As of February 23, 2023, the mining server has mined over 15 bitcoins, generating approximately $370,000 in revenue based on the current bitcoin price. |

BTB to Release Video Conference with Mark Hunter on the Topic of Naked Short SellingBit Brother Limited (the "Company," "we", "BTB" or "Bit Brother") (NASDAQ: BTB) Mr. Ralph Jones, CEO of the subsidiary Bit Brother New York Inc, held a video conference with Mr. Mark Hunter, a former SEC enforcement lawyer, to discuss specific details of countering naked short selling. The Company's Special Task Force will continual to fight back against short sales . |

Bit Brother: Optimizing Tea Chain Business with AIGC and ChatGPT TechnologiesBit Brother Limited (the "Company," "we", "BTB" or "Bit Brother") (NASDAQ: BTB), a tea product and a crypto finance digital technology group, has been exploring the application of AI technology to digital technology and milk tea&coffee business scenarios, such as pre-sales customer communication and consultation, basic product information, including product names, selling points, risk control requirements, application requirements, etc. Subsequently, we plan to increase its investment in AIGC an |

BTB Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 15.36% |

| 3-year | -94.95% |

| 5-year | -99.99% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 23.68% |

| 2021 | -67.07% |

| 2020 | -99.82% |

| 2019 | -25.86% |

Loading social stream, please wait...