BT Brands, Inc. (BTBD): Price and Financial Metrics

BTBD Price/Volume Stats

| Current price | $1.38 | 52-week high | $3.05 |

| Prev. close | $1.44 | 52-week low | $1.25 |

| Day low | $1.38 | Volume | 872 |

| Day high | $1.38 | Avg. volume | 83,478 |

| 50-day MA | $1.45 | Dividend yield | N/A |

| 200-day MA | $1.83 | Market Cap | 8.62M |

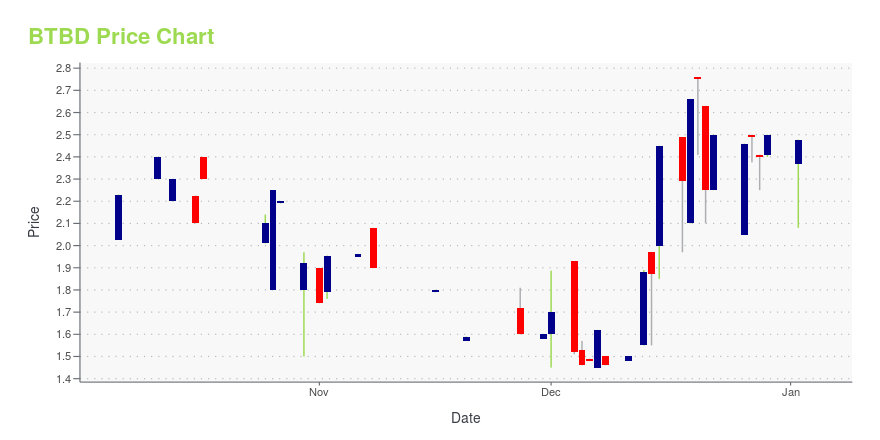

BTBD Stock Price Chart Interactive Chart >

BT Brands, Inc. (BTBD) Company Bio

BT Brands, Inc. owns and operates fast food restaurants in the north central region of United States. The company operates nine Burger Time restaurants located in Minnesota, North Dakota, and South Dakota; and one Dairy Queen franchise restaurant in Ham Lake, Minnesota. Its Burger Time restaurants provide various burgers and other food products, such as chicken sandwiches, pulled pork sandwiches, side dishes, and soft drinks; and Dairy Queen franchise restaurant offers burgers, chicken, sides, ice cream and other desserts, and beverages. The company was founded in 1987 and is based in West Fargo, North Dakota.

Latest BTBD News From Around the Web

Below are the latest news stories about BT BRANDS INC that investors may wish to consider to help them evaluate BTBD as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start off Thursday with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

BT Brands Reports Third Quarter 2023 ResultsWEST FARGO, N.D., November 15, 2023--BT Brands, Inc (Nasdaq: BTBD) Reports Third Quarter Results. Conference Call Today at 4:30 Eastern |

BT Brands Withdraws Its Lawsuit Against Noble Roman and Its DirectorsWEST FARGO, N.D., September 07, 2023--BT Brands, Inc. (NASDAQ: BTND) announced today that it has withdrawn without prejudice its lawsuit in Federal Court for the Southern District of Indiana against Noble Roman’s, ("NROM") and its Directors. BT Brands CEO, Gary Copperud, commented that the purpose of our lawsuit was to achieve a fair vote for Noble Roman shareholders. We were not successful in our effort to get a ruling favorable to NROM shareholders as in its preliminary ruling, the Court allow |

BT Brands Reports Second Quarter 2023 ResultsWEST FARGO, N.D., August 16, 2023--BT Brands, Inc. (Nasdaq: BTBD and BTBDW), today reported its financial results for the thirteen weeks ending July 2, 2023, and for the 26-week period then end. |

BT Brands Brings Lawsuit Against Noble Roman’s and Its DirectorsWEST FARGO, N.D., August 03, 2023--BT Brands, Inc. (NASDAQ: BTBD) ("BT Brands or BT") today announced steps forward in its effort to achieve a fair vote for Noble Roman's shareholders. On August 2, 2023, together with its CEO Gary Copperud, BT Brands brought a lawsuit in Federal Court for the Southern District of Indiana (the "Court") naming Noble Roman’s, Inc. ("NROM" or the "Company") and members of the NROM board of directors as Defendants. The suit alleges that the Company and its directors |

BTBD Price Returns

| 1-mo | -18.82% |

| 3-mo | -13.74% |

| 6-mo | -36.41% |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -44.80% |

| 2023 | 36.75% |

| 2022 | -38.08% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...