British American Tobacco PLC ADR (BTI): Price and Financial Metrics

BTI Price/Volume Stats

| Current price | $35.16 | 52-week high | $35.20 |

| Prev. close | $34.73 | 52-week low | $28.25 |

| Day low | $34.92 | Volume | 5,552,974 |

| Day high | $35.20 | Avg. volume | 4,586,950 |

| 50-day MA | $31.69 | Dividend yield | 8.79% |

| 200-day MA | $30.51 | Market Cap | 78.09B |

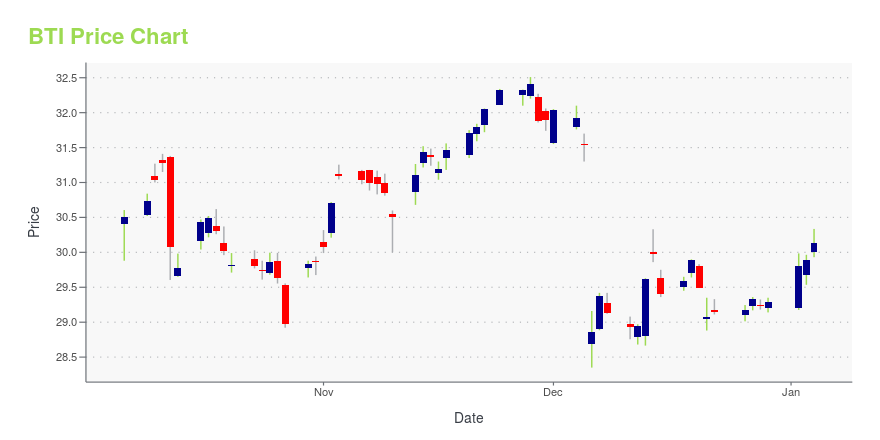

BTI Stock Price Chart Interactive Chart >

British American Tobacco PLC ADR (BTI) Company Bio

British American Tobacco PLC was formed in 1902 with the creation of a joint venture between the American Tobacco Company of the United States and the United Kingdom’s Imperial Tobacco Company. The company manufactures and sells cigarettes and other tobacco products under the brands Dunhill, Kent, Lucky Strike, Pall Mall and Rothmans. The company also offers tobacco alternative products, such as vapor products, e-cigarettes, and tobacco heating products. British American operates 45 cigarette manufacturing facilities in 43 countries around the world. In April of 2019, Jack Bowles became the Chief Executive Officer of British American.

Latest BTI News From Around the Web

Below are the latest news stories about BRITISH AMERICAN TOBACCO PLC that investors may wish to consider to help them evaluate BTI as an investment opportunity.

7 Undervalued Gems That Wall Street Missed Out On in 2023Under a frenzied environment, it’s normal to overpay for certain hot investments – but this framework also drives the case home for undervalued stocks Wall Street overlooked. |

16 Most Promising Dividend Stocks According to AnalystsIn this article, we discuss 16 most promising dividend stocks according to analysts. You can skip our detailed analysis of dividend stocks and their performance over the years, and go directly to read 5 Most Promising Dividend Stocks According to Analysts. This year brought a notable shift in the investment scene, where technology stocks surged […] |

Better Dividend Stock: Pfizer or British American Tobacco?Both blue chip dividend stocks are prized for their rich payouts. |

British American Tobacco (LON:BATS) investors are sitting on a loss of 24% if they invested a year agoPassive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active... |

12 Most Profitable European StocksIn this piece, we will take a look at the 12 most profitable European stocks. If you want to skip our overview of the European economy and the latest trends, then take a look at the 5 Most Profitable European Stocks. The economic impacts of the 2022 Russian invasion of Ukraine coupled with the consequences […] |

BTI Price Returns

| 1-mo | 12.99% |

| 3-mo | 23.04% |

| 6-mo | 24.28% |

| 1-year | 13.97% |

| 3-year | 16.51% |

| 5-year | 40.00% |

| YTD | 25.85% |

| 2023 | -20.05% |

| 2022 | 14.85% |

| 2021 | 7.84% |

| 2020 | -4.68% |

| 2019 | 42.83% |

BTI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BTI

Want to see what other sources are saying about British American Tobacco plc's financials and stock price? Try the links below:British American Tobacco plc (BTI) Stock Price | Nasdaq

British American Tobacco plc (BTI) Stock Quote, History and News - Yahoo Finance

British American Tobacco plc (BTI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...