Burford Capital Limited (BUR): Price and Financial Metrics

BUR Price/Volume Stats

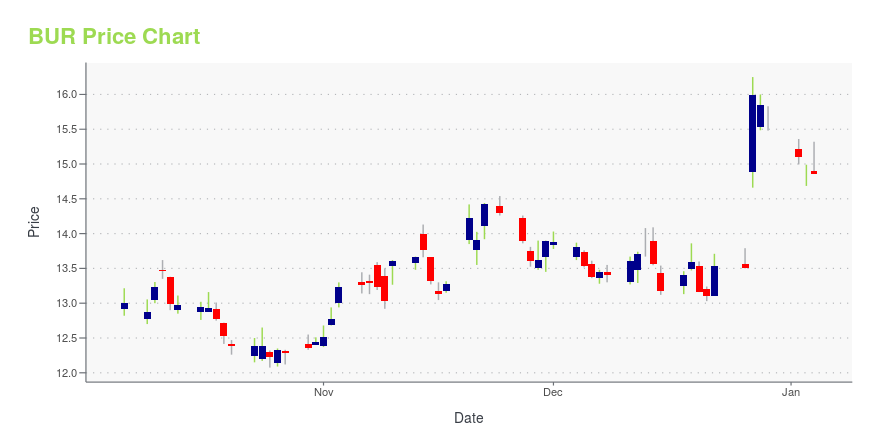

| Current price | $14.04 | 52-week high | $17.70 |

| Prev. close | $13.52 | 52-week low | $12.07 |

| Day low | $13.62 | Volume | 626,600 |

| Day high | $14.05 | Avg. volume | 1,162,280 |

| 50-day MA | $13.70 | Dividend yield | 0.9% |

| 200-day MA | $14.25 | Market Cap | 3.08B |

BUR Stock Price Chart Interactive Chart >

Burford Capital Limited (BUR) Company Bio

Burford Capital Ltd. offers financing for corporate litigation, arbitration and other disputes.

Latest BUR News From Around the Web

Below are the latest news stories about BURFORD CAPITAL LTD that investors may wish to consider to help them evaluate BUR as an investment opportunity.

Argentina May Sell Bond to Pay $16 Billion YPF Lawsuit Award(Bloomberg) -- Argentina’s President Javier Milei is considering issuing a perpetual bond to pay a $16 billion lawsuit award stemming from the nationalization of state-run energy company YPF. Most Read from BloombergThe Late-Night Email to Tim Cook That Set the Apple Watch Saga in MotionChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerApple Resumes Sale of Watches After Appeals Court Lifts US BanTesla Plans Revamp of Smash Hit Model Y From China PlantGhost Ships at Reawakened Nor |

Here's Why You Should Retain Rithm Capital (RITM) Stock for NowRithm Capital's (RITM) asset management business expansion has tremendous growth potential ahead. |

Houlihan Lokey (HLI) Ups Private Capital Mark With Triago BuyoutHoulihan Lokey (HLI) expects the Triago Management acquisition to close in the first half of 2024. |

Best Momentum Stock to Buy for December 4thJAKK, PAY and BUR made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on December 4, 2023. |

New Strong Buy Stocks for December 4thBROS, JAKK, PAY, BUR and RYI have been added to the Zacks Rank #1 (Strong Buy) List on December 4, 2023. |

BUR Price Returns

| 1-mo | 8.00% |

| 3-mo | -8.36% |

| 6-mo | -6.91% |

| 1-year | 7.85% |

| 3-year | 34.59% |

| 5-year | N/A |

| YTD | -9.59% |

| 2023 | 93.26% |

| 2022 | -22.82% |

| 2021 | 9.20% |

| 2020 | N/A |

| 2019 | N/A |

BUR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...