Buenaventura Mining Company Inc. (BVN): Price and Financial Metrics

BVN Price/Volume Stats

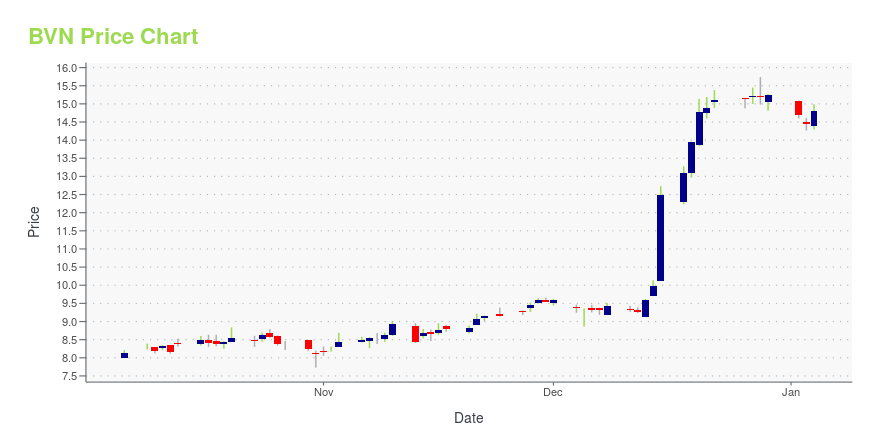

| Current price | $15.92 | 52-week high | $18.84 |

| Prev. close | $15.78 | 52-week low | $7.22 |

| Day low | $15.50 | Volume | 2,148,379 |

| Day high | $16.25 | Avg. volume | 1,439,334 |

| 50-day MA | $17.07 | Dividend yield | 0.44% |

| 200-day MA | $14.45 | Market Cap | 4.04B |

BVN Stock Price Chart Interactive Chart >

Buenaventura Mining Company Inc. (BVN) Company Bio

Buenaventura is engaged in the mining, processing, development and exploration of gold and silver and other metals via wholly owned mines, as well as through its participation in joint exploration projects in Peru. The company was founded in 1953 and is based in Lima, Peru.

Latest BVN News From Around the Web

Below are the latest news stories about BUENAVENTURA MINING CO INC that investors may wish to consider to help them evaluate BVN as an investment opportunity.

Buenaventura Announces Sale of Contacto Corredores De SegurosLIMA, Peru, November 03, 2023--Compañia de Minas Buenaventura S.A.A. ("Buenaventura" or the "Company") (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious metals mining company, today announced that it has reached a definitive agreement to sell 100% of Contacto Corredores De Seguros S.A. ("Contacto"), the Company’s risk and insurance brokerage, to Howden Holdco Perú S.A.C., a subsidiary of Howden Broking Group Limited, for US$ 33.7 million dollars in cash, as well a |

Compañía de Minas Buenaventura S.A.A. (NYSE:BVN) Q3 2023 Earnings Call TranscriptCompañía de Minas Buenaventura S.A.A. (NYSE:BVN) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good day, ladies and gentlemen. And welcome to the Compania de Minas Buenaventura Third Quarter 2023 Earnings Results Conference Call. At this time, all participants are in a listen-only mode, and please note that this call is being recorded. At […] |

Buenaventura Announces Third Quarter and Nine-month 2023 ResultsLIMA, Peru, October 31, 2023--Compañia de Minas Buenaventura S.A.A. ("Buenaventura" or "the Company") (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious metals mining company, today announced results for the third quarter (3Q23) and nine-month period ended September 30, 2023 (9M23). All figures have been prepared in accordance with IFRS (International Financial Reporting Standards) on a non-GAAP basis and are stated in U.S. dollars (US$). |

Buenaventura Announces Third Quarter 2023 Results for Production and Volume Sold per MetalLIMA, Peru, October 19, 2023--Compañia de Minas Buenaventura S.A.A. ("Buenaventura" or "the Company") (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious metals mining company, today announced 3Q23 results for production and volume sold. |

Buenaventura Cordially Invites You to Its Third Quarter 2023 Earnings Conference CallLIMA, Peru, October 16, 2023--Compañía de Minas Buenaventura S.A.A. (NYSE: BVN; Lima Stock Exchange: BUE.LM) today announces that it will hold its Third Quarter 2023 earnings conference call on: |

BVN Price Returns

| 1-mo | -5.07% |

| 3-mo | -8.40% |

| 6-mo | 5.41% |

| 1-year | 113.49% |

| 3-year | 85.16% |

| 5-year | 1.35% |

| YTD | 4.93% |

| 2023 | 106.39% |

| 2022 | 2.44% |

| 2021 | -39.95% |

| 2020 | -19.27% |

| 2019 | -6.41% |

BVN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BVN

Want to see what other sources are saying about Buenaventura Mining Co Inc's financials and stock price? Try the links below:Buenaventura Mining Co Inc (BVN) Stock Price | Nasdaq

Buenaventura Mining Co Inc (BVN) Stock Quote, History and News - Yahoo Finance

Buenaventura Mining Co Inc (BVN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...