Bankwell Financial Group, Inc. (BWFG): Price and Financial Metrics

BWFG Price/Volume Stats

| Current price | $27.16 | 52-week high | $30.83 |

| Prev. close | $26.37 | 52-week low | $22.47 |

| Day low | $26.42 | Volume | 7,400 |

| Day high | $27.16 | Avg. volume | 12,829 |

| 50-day MA | $24.68 | Dividend yield | 3.05% |

| 200-day MA | $25.79 | Market Cap | 214.51M |

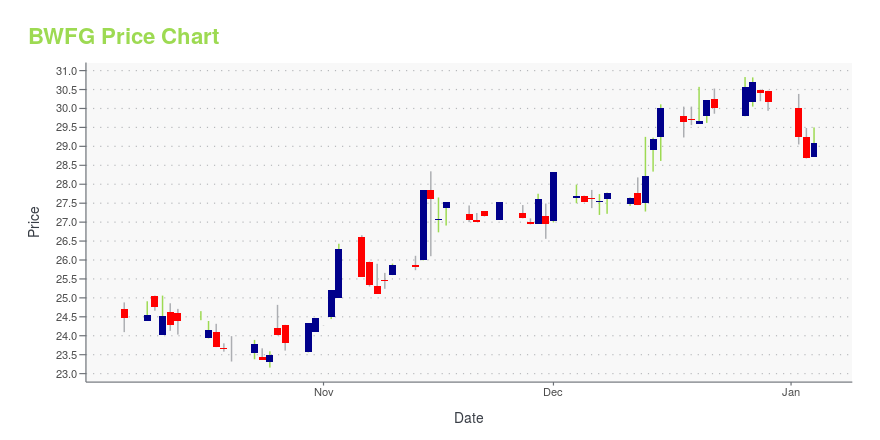

BWFG Stock Price Chart Interactive Chart >

Bankwell Financial Group, Inc. (BWFG) Company Bio

Bankwell Financial Group, Inc. provides a range of banking services to commercial and consumer customers in Connecticut. The company was founded in 2002 and is headquartered in New Canaan, Connecticut.

Latest BWFG News From Around the Web

Below are the latest news stories about BANKWELL FINANCIAL GROUP INC that investors may wish to consider to help them evaluate BWFG as an investment opportunity.

Bankwell Financial Group (NASDAQ:BWFG) shareholders have earned a 18% CAGR over the last three yearsBy buying an index fund, investors can approximate the average market return. But if you pick the right individual... |

Bankwell Financial Group (NASDAQ:BWFG) Is Paying Out A Dividend Of $0.20The board of Bankwell Financial Group, Inc. ( NASDAQ:BWFG ) has announced that it will pay a dividend of $0.20 per... |

Bankwell Financial Group, Inc.'s (NASDAQ:BWFG) largest shareholders are individual investors with 37% ownership, institutions own 36%Key Insights Significant control over Bankwell Financial Group by individual investors implies that the general public... |

Bankwell Financial Group Reports Operating Results for the Third Quarter and Declares Fourth Quarter DividendNEW CANAAN, Conn., October 25, 2023--Bankwell Financial Group, Inc. (NASDAQ: BWFG) reported GAAP net income of $9.8 million, or $1.25 per share for the third quarter of 2023, versus $9.2 million, or $1.18 per share, for the same period in 2022. |

SEIDMAN LAWRENCE B Acquires Significant Stake in Bankwell Financial Group IncOn September 14, 2023, SEIDMAN LAWRENCE B (Trades, Portfolio), a renowned investment firm, made a notable addition to its portfolio by acquiring 723,281 shares in Bankwell Financial Group Inc (NASDAQ:BWFG). This article provides an in-depth analysis of this transaction, the guru's investment strategy, and the traded company's financial health and performance. |

BWFG Price Returns

| 1-mo | 10.36% |

| 3-mo | 14.89% |

| 6-mo | -7.12% |

| 1-year | 2.81% |

| 3-year | 5.89% |

| 5-year | 8.47% |

| YTD | -8.54% |

| 2023 | 5.76% |

| 2022 | -8.20% |

| 2021 | 71.96% |

| 2020 | -29.99% |

| 2019 | 2.33% |

BWFG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BWFG

Here are a few links from around the web to help you further your research on Bankwell Financial Group Inc's stock as an investment opportunity:Bankwell Financial Group Inc (BWFG) Stock Price | Nasdaq

Bankwell Financial Group Inc (BWFG) Stock Quote, History and News - Yahoo Finance

Bankwell Financial Group Inc (BWFG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...