Baudax Bio, Inc. (BXRX): Price and Financial Metrics

BXRX Price/Volume Stats

| Current price | $0.02 | 52-week high | $3.47 |

| Prev. close | $0.02 | 52-week low | $0.01 |

| Day low | $0.02 | Volume | 310,800 |

| Day high | $0.02 | Avg. volume | 281,029 |

| 50-day MA | $0.03 | Dividend yield | N/A |

| 200-day MA | $0.32 | Market Cap | 1.14M |

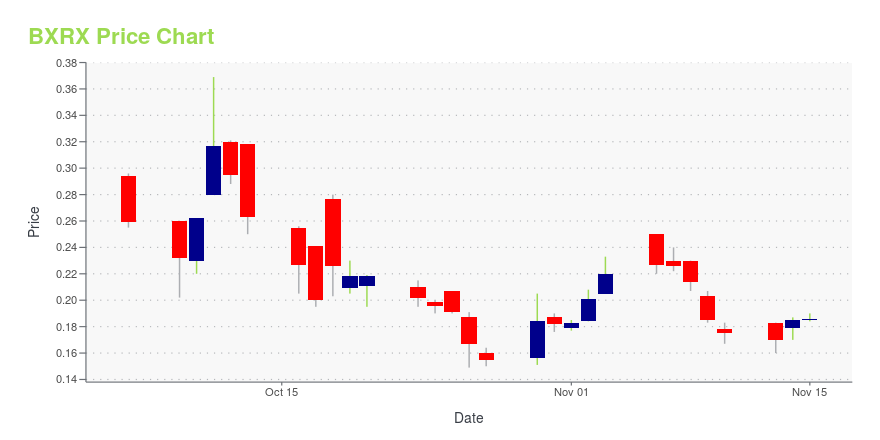

BXRX Stock Price Chart Interactive Chart >

Baudax Bio, Inc. (BXRX) Company Bio

Baudax Bio, Inc., a pharmaceutical company, develops and commercializes products for hospital and other acute care settings. Its lead product candidate is intravenous form of meloxicam, a non-opioid that has completed Phase III clinical trials for the management of moderate to severe pain; and is in the Phase IIIb clinical trials in colorectal surgery and orthopedic surgery patients to assess opioid consumption, pain intensity, and length of hospital stay with associated pharmacoeconomic parameters. The company's early-stage product candidates includes RP1000, an intermediate-acting neuromuscular blocking agent (NMBA) that is in phase I clinical trial; and RP2000, an ultrashort-acting NMBA, which is in pre-clinical trial; and a reversal agent, as well as Dex-IN, a proprietary intranasal formulation of dexmedetomidine. The company was incorporated in 2019 and is based in Malvern, Pennsylvania.

Latest BXRX News From Around the Web

Below are the latest news stories about BAUDAX BIO INC that investors may wish to consider to help them evaluate BXRX as an investment opportunity.

Baudax Bio Announces Corporate UpdateCompany Poised to Initiate TI-168 Clinical Development Following Recent Shareholder Approval of Corporate Actions Related to TeraImmune Acquisition Phase 1/2a Clinical Study of TI-168 In Hemophilia A with FVIII Inhibitors Projected to Begin Q1 2024 MALVERN, Pa., Oct. 18, 2023 (GLOBE NEWSWIRE) -- Baudax Bio, Inc. (the “Company” or “Baudax Bio”) (NASDAQ: BXRX), a biotechnology company focused on developing T cell receptor (“TCR”) therapies utilizing human regulatory T cells (“Tregs”), as well as a |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time for a dive into the biggest pre-market stock movers as we check out all of the latest news traders need to know about on Friday! |

Why Is Baudax Bio (BXRX) Stock Up 75% Today?Although Baudax Bio saw significant interest because of its orphan drug designation, BXRX stock must climb a wall of worry. |

Baudax Bio Announces Orphan Drug Designation Granted by U.S. FDA for TI-168 for the Treatment of Hemophilia A with InhibitorsMALVERN, Pa., Sept. 28, 2023 (GLOBE NEWSWIRE) -- Baudax Bio, Inc. (the “Company” or “Baudax Bio”) (NASDAQ: BXRX), a biotechnology company focused on developing T cell receptor (“TCR”) therapies utilizing human regulatory T cells (“Tregs”), as well as a portfolio of clinical stage Neuromuscular Blocking Agents (“NMBs”) and an associated reversal agent, today announced that U.S. Food and Drug Administration (FDA) has granted orphan drug designation to its lead clinical candidate TI-168 for the tre |

Baudax Bio to Participate in the H.C. Wainwright Global Investment ConferenceMALVERN, Pa., Sept. 07, 2023 (GLOBE NEWSWIRE) -- Baudax Bio, Inc. (the “Company” or “Baudax Bio”) (NASDAQ: BXRX), a biotechnology company focused on developing T cell receptor (“TCR”) therapies utilizing human regulatory T cells (“Tregs”), as well as a portfolio of clinical stage Neuromuscular Blocking Agents (“NMBs”) and an associated reversal agent, today announced that that the Company’s management will be participating in the 25th Annual H.C. Wainwright Global Investment Conference, to be he |

BXRX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -20.63% |

| 1-year | -97.06% |

| 3-year | -100.00% |

| 5-year | N/A |

| YTD | -9.09% |

| 2023 | -99.31% |

| 2022 | -98.96% |

| 2021 | -78.30% |

| 2020 | -85.40% |

| 2019 | N/A |

Loading social stream, please wait...